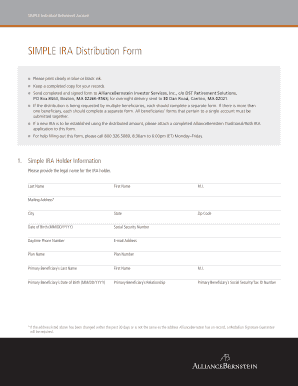

SIMPLE IRA Distribution Form AllianceBernstein

What is the SIMPLE IRA Distribution Form AllianceBernstein

The SIMPLE IRA Distribution Form AllianceBernstein is a specialized document used by individuals to request distributions from their SIMPLE IRA accounts. This form is essential for account holders who wish to withdraw funds from their retirement savings. It ensures that the distribution process is compliant with federal regulations and the specific guidelines set forth by AllianceBernstein. By completing this form, individuals can specify the amount they wish to withdraw and the type of distribution they are requesting, whether it be a full or partial withdrawal.

How to use the SIMPLE IRA Distribution Form AllianceBernstein

Using the SIMPLE IRA Distribution Form AllianceBernstein involves several straightforward steps. First, ensure you have the correct version of the form, which can typically be obtained from AllianceBernstein's official website or customer service. Next, fill out the required fields accurately, including your personal information, account details, and the distribution amount. After completing the form, review it for any errors before submitting it to ensure a smooth processing experience. It is advisable to keep a copy of the completed form for your records.

Steps to complete the SIMPLE IRA Distribution Form AllianceBernstein

Completing the SIMPLE IRA Distribution Form AllianceBernstein requires careful attention to detail. Follow these steps for accurate completion:

- Obtain the latest version of the form from AllianceBernstein.

- Fill in your name, address, and account number at the top of the form.

- Specify the type of distribution you are requesting, such as a one-time withdrawal or a series of payments.

- Indicate the amount you wish to withdraw from your SIMPLE IRA.

- Sign and date the form to confirm your request.

- Submit the form according to the instructions provided, either online, by mail, or in-person.

Legal use of the SIMPLE IRA Distribution Form AllianceBernstein

The SIMPLE IRA Distribution Form AllianceBernstein is legally binding when completed correctly. To ensure its legal validity, it must comply with the Employee Retirement Income Security Act (ERISA) and other relevant federal regulations. Proper execution includes obtaining necessary signatures and providing accurate information. Additionally, using a secure electronic signature solution can enhance the form's legal standing, ensuring that it meets the requirements set forth by the ESIGN Act and UETA.

Key elements of the SIMPLE IRA Distribution Form AllianceBernstein

Key elements of the SIMPLE IRA Distribution Form AllianceBernstein include:

- Personal Information: Name, address, and account number of the individual requesting the distribution.

- Distribution Type: Options for one-time withdrawals or periodic distributions.

- Amount Requested: The specific dollar amount the account holder wishes to withdraw.

- Signature: The account holder's signature and date, confirming the request.

Form Submission Methods

The SIMPLE IRA Distribution Form AllianceBernstein can be submitted through various methods to accommodate the preferences of account holders. These methods include:

- Online Submission: Many users prefer to submit the form electronically via AllianceBernstein's secure online platform.

- Mail: The completed form can be printed and mailed to the designated address provided by AllianceBernstein.

- In-Person: Individuals may also choose to deliver the form in person at an AllianceBernstein office.

Quick guide on how to complete simple ira distribution form alliancebernstein

Effortlessly prepare SIMPLE IRA Distribution Form AllianceBernstein on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage SIMPLE IRA Distribution Form AllianceBernstein on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to edit and electronically sign SIMPLE IRA Distribution Form AllianceBernstein with ease

- Locate SIMPLE IRA Distribution Form AllianceBernstein and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you prefer to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign SIMPLE IRA Distribution Form AllianceBernstein to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the simple ira distribution form alliancebernstein

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a SIMPLE IRA Distribution Form AllianceBernstein?

The SIMPLE IRA Distribution Form AllianceBernstein is a document used to request distributions from a SIMPLE IRA plan administered by AllianceBernstein. It outlines the necessary information required to process withdrawal requests efficiently and ensures compliance with IRS regulations.

-

How do I complete the SIMPLE IRA Distribution Form AllianceBernstein?

Completing the SIMPLE IRA Distribution Form AllianceBernstein involves filling in your personal information, the amount you wish to withdraw, and the reason for the distribution. Ensure all sections are filled accurately to avoid delays in processing your request.

-

Is there a fee associated with the SIMPLE IRA Distribution Form AllianceBernstein?

Typically, there may be fees associated with processing the SIMPLE IRA Distribution Form AllianceBernstein, depending on the terms of your specific plan with AllianceBernstein. It’s recommended to review your plan documents or contact customer service to understand any potential costs.

-

What are the benefits of using the SIMPLE IRA Distribution Form AllianceBernstein?

Using the SIMPLE IRA Distribution Form AllianceBernstein provides a streamlined process for accessing your retirement funds. It ensures compliance with financial regulations while minimizing errors, making it easier for you to manage your retirement savings.

-

Can I submit the SIMPLE IRA Distribution Form AllianceBernstein online?

Yes, many customers can submit the SIMPLE IRA Distribution Form AllianceBernstein online through the AllianceBernstein client portal. This feature enhances convenience and speeds up the processing time for your distribution request.

-

What information do I need to provide on the SIMPLE IRA Distribution Form AllianceBernstein?

When filling out the SIMPLE IRA Distribution Form AllianceBernstein, you will need to provide your account number, personal identification details, the amount of withdrawal, and any applicable tax information. Ensuring accuracy in this information helps avoid processing delays.

-

How long does it take to process the SIMPLE IRA Distribution Form AllianceBernstein?

Processing times for the SIMPLE IRA Distribution Form AllianceBernstein can vary based on several factors, including the method of submission. Generally, requests are processed within 3-5 business days once all required information is received and verified.

Get more for SIMPLE IRA Distribution Form AllianceBernstein

- In the supreme court of florida case no sc05 form

- California mechanics lien law in construction faqs forms ampamp info

- Multistate fixed rate note form 3200 word fannie mae

- Sample forms louisiana state bar association

- Agreement for sale of commercial real estate form

- Form va 864 1lt

- Section v contract documents city of clearwater form

- Web terms 101 the difference between a url domain website and form

Find out other SIMPLE IRA Distribution Form AllianceBernstein

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors