Ksrevenue Form

What is the ksrevenue?

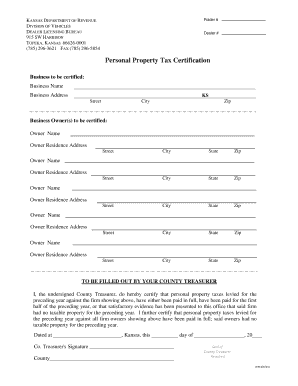

The ksrevenue form is a crucial document used for tax purposes in the state of Kansas. It is primarily utilized by individuals and businesses to report income, deductions, and credits to the Kansas Department of Revenue. Understanding this form is essential for ensuring compliance with state tax laws and regulations. The ksrevenue form helps taxpayers accurately calculate their tax liabilities and claim any eligible refunds. It is vital for both residents and non-residents earning income within Kansas.

How to use the ksrevenue

Using the ksrevenue form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. Next, fill out the form with accurate information regarding your income, deductions, and any applicable credits. It is essential to double-check all entries for accuracy before submission. Finally, submit the completed form to the Kansas Department of Revenue either online, by mail, or in person, depending on your preference and the submission guidelines.

Steps to complete the ksrevenue

Completing the ksrevenue form requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Gather all necessary documentation, including income statements and deduction records.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include any taxable income.

- List any deductions you are eligible for, such as business expenses or education credits.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy, ensuring all figures are correct.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the ksrevenue

The ksrevenue form is legally binding when completed accurately and submitted in accordance with Kansas tax laws. To ensure its legal standing, it is crucial to provide truthful information and maintain compliance with all applicable regulations. The form must be signed and dated by the taxpayer, confirming that the information provided is accurate to the best of their knowledge. Failure to comply with legal requirements can result in penalties or audits by the Kansas Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the ksrevenue form are critical for compliance. Typically, individual taxpayers must file their forms by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines or extensions provided by the Kansas Department of Revenue. Missing the deadline can result in late fees and interest on any unpaid taxes.

Who Issues the Form

The ksrevenue form is issued by the Kansas Department of Revenue, which is responsible for administering state tax laws and regulations. This department provides resources and guidance for taxpayers to ensure compliance and facilitate the filing process. The department also updates the form and its requirements periodically, so it is essential for taxpayers to refer to the official Kansas Department of Revenue website for the most current information.

Quick guide on how to complete ksrevenue

Effortlessly Prepare Ksrevenue on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the right template and securely save it on the web. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without holdups. Manage Ksrevenue on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered task today.

How to Modify and eSign Ksrevenue with Ease

- Obtain Ksrevenue and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose how you wish to send your document, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Modify and eSign Ksrevenue and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ksrevenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ksrevenue, and how does it relate to airSlate SignNow?

ksrevenue is a financial management term that refers to the revenue generated by your business operations. With airSlate SignNow, you can streamline document signing processes, ensuring that your contracts and agreements contribute efficiently to your ksrevenue by minimizing delays and errors.

-

How does airSlate SignNow help improve my ksrevenue?

By using airSlate SignNow, your business can enhance efficiency in document handling, leading to quicker turnaround times on contracts and agreements. This improved efficiency can directly contribute to the growth of your ksrevenue, maximizing profit potential through timely client acquisitions.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers several pricing plans to fit the diverse needs of businesses. Each plan is designed to optimize your operations and potentially enhance your ksrevenue by providing various features that cater to different sizes and types of organizations.

-

Can I integrate airSlate SignNow with other applications to boost my ksrevenue?

Yes, airSlate SignNow offers seamless integrations with various applications, enabling better workflow management. By integrating with your existing systems, you can improve collaboration and efficiency, which can further enhance your ksrevenue.

-

What features does airSlate SignNow provide to enhance my document signing experience?

airSlate SignNow includes features such as customizable templates, in-person signing, and automated notifications. These features not only simplify the signing process but also contribute to improved productivity, thereby boosting your ksrevenue prospects.

-

How secure is the document signing process with airSlate SignNow?

The security of your documents is a top priority for airSlate SignNow, which offers bank-level encryption and compliance with major security standards. Ensuring secure transactions can protect your business's integrity, which is critical for maintaining a healthy ksrevenue.

-

Is there a mobile app for airSlate SignNow that can assist me on the go?

Yes, airSlate SignNow has a user-friendly mobile app that allows you to manage document signing from anywhere. This flexibility enables you to capture opportunities in real-time, contributing positively to your ksrevenue generation efforts.

Get more for Ksrevenue

Find out other Ksrevenue

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online