Rental Property Tax Worksheet Form

What is the Rental Property Tax Worksheet

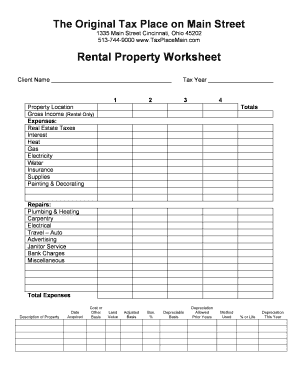

The rental property tax deductions worksheet is a crucial document for property owners in the United States. It assists in calculating eligible tax deductions related to rental properties. This worksheet helps landlords track various expenses, such as repairs, maintenance, and property management fees, that can be deducted from their taxable rental income. By accurately completing this worksheet, property owners can optimize their tax returns and ensure compliance with IRS regulations.

How to Use the Rental Property Tax Worksheet

Using the rental property tax deductions worksheet involves several steps. First, gather all relevant financial documents, including receipts for expenses and records of rental income. Next, fill out the worksheet by entering your total rental income and listing all deductible expenses. Common categories include mortgage interest, property taxes, insurance, and depreciation. Finally, review your entries for accuracy before submitting your tax return to ensure you maximize your deductions.

Steps to Complete the Rental Property Tax Worksheet

Completing the rental property tax deductions worksheet requires careful attention to detail. Start by listing your rental income for the year. Then, categorize and document your expenses, ensuring you have supporting documentation for each item. Calculate the total deductions by summing your expenses and subtracting them from your rental income. This will give you your net rental income or loss, which is essential for your tax filing.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the rental property tax deductions worksheet. It is important to adhere to these guidelines to avoid potential penalties. For instance, the IRS outlines which expenses are deductible and the necessary documentation required to support these deductions. Familiarizing yourself with these guidelines can help ensure that your tax filings are accurate and compliant with federal regulations.

Required Documents

To effectively complete the rental property tax deductions worksheet, certain documents are necessary. These include:

- Receipts for all deductible expenses

- Records of rental income received

- Mortgage interest statements

- Property tax statements

- Insurance premium invoices

Having these documents organized will facilitate the completion of the worksheet and support your claims during tax filing.

Penalties for Non-Compliance

Failure to properly complete the rental property tax deductions worksheet can lead to significant penalties from the IRS. This may include fines for underreporting income or incorrectly claiming deductions. In some cases, non-compliance may result in an audit, which can be time-consuming and stressful. It is essential to ensure that all information is accurate and that you comply with IRS guidelines to avoid these potential consequences.

Quick guide on how to complete rental property tax worksheet

Accomplish Rental Property Tax Worksheet seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Rental Property Tax Worksheet on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign Rental Property Tax Worksheet effortlessly

- Obtain Rental Property Tax Worksheet and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from your preferred device. Edit and electronically sign Rental Property Tax Worksheet and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rental property tax worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a rental property capital gains tax worksheet?

A rental property capital gains tax worksheet is a tool that helps property owners calculate their capital gains taxes when selling a rental property. It provides a structured method for tracking improvements, expenses, and sales proceeds, ensuring accurate reporting. This worksheet is essential for preparing your taxes and understanding the financial implications of your sale.

-

How can airSlate SignNow help with my rental property capital gains tax worksheet?

airSlate SignNow streamlines the process of signing and sending your rental property capital gains tax worksheet. With its user-friendly interface, you can easily prepare, edit, and eSign your documents online, saving you time and effort. This makes managing your tax documents more efficient, especially during tax season.

-

Is there a cost associated with using airSlate SignNow for my rental property capital gains tax worksheet?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Depending on the features you choose, the cost may vary. However, the investment in our platform can save you time and potential errors when processing your rental property capital gains tax worksheet.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides a range of features for managing tax documents, including customizable templates, secure cloud storage, and real-time collaboration. These features are designed to simplify the management of your rental property capital gains tax worksheet. This ensures you have all the tools needed to complete your tax documentation efficiently.

-

Can I integrate airSlate SignNow with other tools for my rental property capital gains tax worksheet?

Yes, airSlate SignNow offers integrations with popular applications such as Google Drive, Dropbox, and various accounting software. This allows you to seamlessly import and export your rental property capital gains tax worksheet to and from these tools. Such integrations enhance your workflow and data management.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your tax-related documents, like the rental property capital gains tax worksheet, provides numerous benefits. It ensures security for all your sensitive information while offering ease of use for document preparation and signing. This can signNowly reduce stress during tax preparation.

-

How secure is airSlate SignNow for my sensitive tax information?

Security is a priority for airSlate SignNow; the platform utilizes advanced encryption protocols to protect your sensitive tax information. This includes documents like your rental property capital gains tax worksheet. You can confidently manage your tax documents knowing they are safe and secure.

Get more for Rental Property Tax Worksheet

Find out other Rental Property Tax Worksheet

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate