4 Point Inspection Form

What is the 4 Point Inspection Form

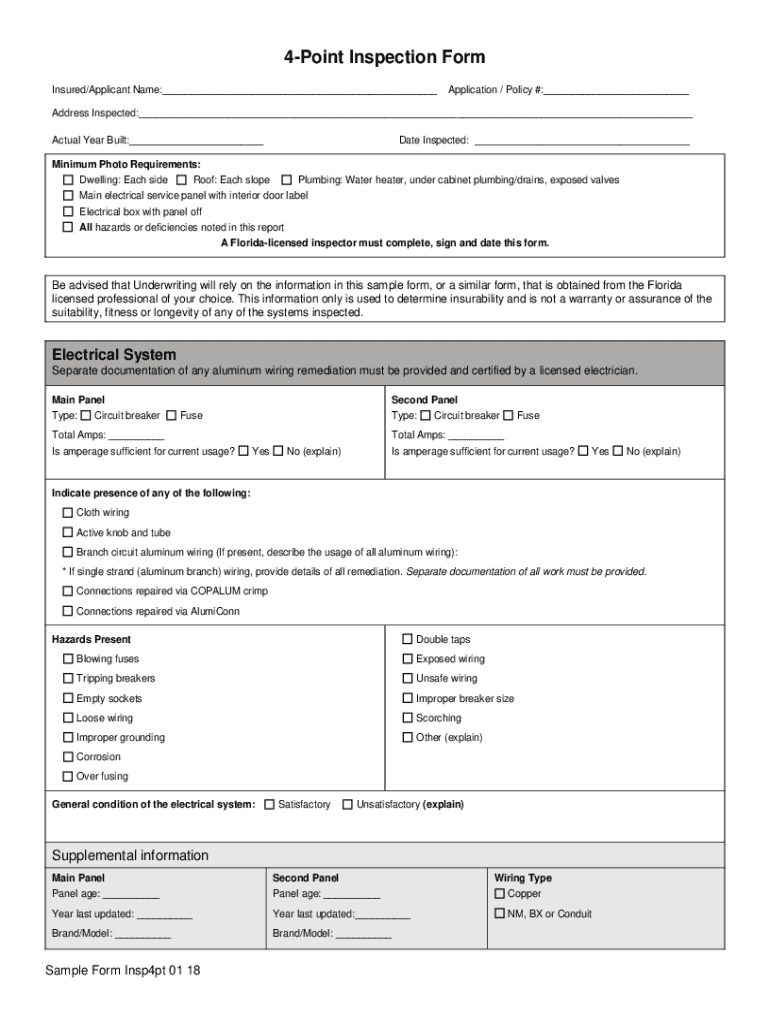

The 4 point inspection form is a crucial document used primarily in the real estate and insurance industries. It assesses the condition of four key components of a home: the roof, electrical system, plumbing system, and HVAC (heating, ventilation, and air conditioning) system. This inspection is often required by insurance companies to determine coverage eligibility and to identify potential risks associated with older homes. By providing a comprehensive overview of these critical systems, the form helps homeowners and insurers make informed decisions regarding property insurance and maintenance needs.

How to use the 4 Point Inspection Form

Using the 4 point inspection form involves several steps to ensure accurate and thorough documentation. First, gather all necessary tools and materials for the inspection, including a camera, notepad, and any relevant building codes or guidelines. Next, systematically evaluate each of the four key components. For the roof, check for signs of damage or wear; for the electrical system, inspect wiring and outlets; for plumbing, look for leaks or corrosion; and for HVAC, assess the functionality and maintenance history. Document your findings clearly on the form, noting any issues that may require further attention or repair.

Steps to complete the 4 Point Inspection Form

Completing the 4 point inspection form requires a structured approach. Begin by filling out the property information section, including the address and owner details. Next, move on to each component section:

- Roof: Describe the age, condition, and materials used.

- Electrical System: Document the age of the system, any upgrades, and the condition of outlets and panels.

- Plumbing System: Note the type of plumbing, any visible leaks, and the condition of fixtures.

- HVAC System: Record the age, maintenance history, and any repairs needed.

Finally, review the completed form for accuracy and ensure all sections are filled out before submitting it to the relevant parties.

Legal use of the 4 Point Inspection Form

The legal use of the 4 point inspection form is vital in ensuring compliance with insurance requirements and real estate transactions. For the form to be legally binding, it must be filled out accurately and signed by a qualified inspector. Many states have specific regulations that govern the use of this form, particularly concerning disclosures and the responsibilities of the inspector. It is essential to understand these regulations to avoid potential liabilities and ensure that the inspection results are accepted by insurance providers and other stakeholders.

Key elements of the 4 Point Inspection Form

The key elements of the 4 point inspection form include detailed sections for each of the four components being inspected. Each section typically requires information about the condition, age, and any repairs made. Additionally, the form often includes a checklist format that allows inspectors to easily mark off items that meet safety standards or require attention. Signature lines for both the inspector and the homeowner may also be present, providing a record of the inspection and acknowledgment of the findings.

State-specific rules for the 4 Point Inspection Form

State-specific rules for the 4 point inspection form vary widely across the United States. Some states may require additional documentation or specific certifications for inspectors conducting these evaluations. It is crucial for homeowners and inspectors to familiarize themselves with their state's regulations to ensure compliance. This may include understanding which properties require a 4 point inspection, the qualifications needed to conduct the inspection, and any reporting requirements that must be met for insurance purposes.

Quick guide on how to complete 4 point inspection template form

Effortlessly prepare 4 Point Inspection Form on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without issues. Manage 4 Point Inspection Form on any platform with the airSlate SignNow Android or iOS applications and simplify any document-focused process today.

The simplest way to modify and eSign 4 Point Inspection Form with ease

- Find 4 Point Inspection Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal force as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign 4 Point Inspection Form while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

How do I fill up the ITR 4 form?

Guidance to File ITR 4Below are mentioned few common guidelines to consider while filing your ITR 4 form:If any schedule is not relevant/applicable to you, just strike it out and write —NA— across itIf any item/particular is not applicable/relevant to you, just write NA against itIndicate nil figures by writing “Nil” across it.Kindly, put a “-” sign prior to any negative figure.All figures shall be rounded off to the nearest one rupee except figures for total income/loss and tax payable. Those shall be rounded off to the nearest multiple of ten.If you are an Employer individual, then you must mark Government if you are a Central/State Government employee. You should tick PSU if you are working in a public sector company of the Central/State Government.Sequence to fill ITR 4 formThe easiest way to fill out your ITR-4 Form is to follow this order:Part AAll the schedulesPart BVerificationModes to file ITR 4 FormYou can submit your ITR-4 Form either online or offline. It is compulsory to file ITR in India electronically (either through Mode 3 or Mode 4) for the following assesses:Those whose earning exceeds Rs. 5 lakhs per yearThose possessing any assets outside the boundary of India (including financial interest in any entity) or signing authority in any account outside India.Those claiming relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR applyOffline:By furnishing a return in a tangible l paper formBy furnishing a bar-coded returnThe Income Tax Department will issue you an acknowledgment as a form of response/reply at the time of submission of your tangible paper return.Online/Electronically:By furnishing the return electronically using digital signature certificate.By sending the data electronically and then submitting the confirmation of the return in Return Form ITR-VIf you submit your ITR-4 Form by electronic means under digital signature, the acknowledgment/response will be sent to your registered email id. You can even download it manually from the official income tax website. For this, you are first required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing.Keep in mind that ITR-4 is an annexure-less form. It means you don’t have to attach any documents when you send it.TaxRaahi is your income tax return filing online companion. Get complete assistance and tax saving tips from experts.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How much do accountants charge for helping you fill out a W-4 form?

A W-4 is a very simple form to instruct your employer to withhold the proper tax. It's written in very plain English and is fairly easy to follow. I honestly do not know of a CPA that will do one of these. If you're having trouble and cannot find a tutorial you like on line see if you can schedule a probing meeting. It should take an accounting student about 10 minutes to walk you through. There is even a worksheet on the back.If you have mitigating factors such as complex investments, partnership income, lies or garnishments, talk to your CPA about those, and then ask their advice regarding the W4 in the context of those issues.

-

At what point does the ATF consider an AR-15 lower receiver a long gun when filling out the form 4473?

The law and ATF are quite clear on how a fire arm type is to be recorded on the form 4473.Section B line 16, handgun, long gun, other.Section D question 27 type of fire arm.Question 16. Type of Firearm(s):Quoting from the instructions for Form 4473"Other" refers to frames, receivers and other firearms that are neither handguns nor long guns (rifles or shotguns), such as firearms having a pistol grip that expel a shotgun shell, or National Firearms Act (NFA) firearms, including silencers. If a frame or receiver can only be made into a long gun (rifle or shotgun), it is still a frame or receiver not a handgun or long gun. However, frames and receivers are still "firearms" by definition, and subject to the same GCA limitations as any other firearms. See Section 921(a)(3)(B). Section 922(b)(1) makes it unlawful for a licensee to sell any firearm other than a shotgun or rifle to any person under the age of 21. Since a frame or receiver for a firearm, to include one that can only be made into a long gun, is a "firearm other than a shotgun or rifle," it cannot be transferred to anyone under the age of 21, nor can these firearms be transferred to anyone who is not a resident of the State where the transfer is to take place. Also, note that multiple sales forms are not required for frames or receivers of any firearms, or pistol grip shotguns, since they are not "pistols or revolvers" under Section 923(g)(3)(A)(Question 27) Question 24-28. Firearm(s) Description:These blocks must be completed with the firearm(s) information. Firearms manufactured after 1968 by Federal firearms licensees should all be marked with a serial number. Should you acquire a firearm that is legally not marked with a serial number (i.e. pre-1968); you may answer question 26 with "NSN" (No Serial Number), "N/A" or "None." If more than four firearms are involved in a transaction, the information required by Section D, questions 24-28, must be provided for the additional firearms on a separate sheet of paper, which must be attached to this ATF Form 4473.Types of firearms include, but are not limited to: pistol, revolver, rifle, shotgun, receiver, frame and other firearms that are neither handguns nor long guns (rifles or shotguns), such as firearms having a pistol grip that expel a shotgun shell (pistol grip firearm) or NFA firearms (machinegun, silencer, short-barreled shotgun, short-barreled rifle, destructive device or "any other weapon").End quote.To enter false information on the form 4473 would be committing a Federal felony. Therefore a stripped receiver must be marked as a receiver. If it is a stripped receiver regardless of manufactures markings, it must be recorded as a “receiver” on the form 4473.To answer the question posted. The ATF would consider an AR 15 receiver a long gun when the receiver is assembled as a long gun when it is transferred. Again a receiver only, is to be recorded as a receiver.

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the 4 point inspection template form

How to create an electronic signature for your 4 Point Inspection Template Form online

How to generate an electronic signature for your 4 Point Inspection Template Form in Chrome

How to make an electronic signature for signing the 4 Point Inspection Template Form in Gmail

How to generate an eSignature for the 4 Point Inspection Template Form right from your smart phone

How to make an electronic signature for the 4 Point Inspection Template Form on iOS devices

How to create an eSignature for the 4 Point Inspection Template Form on Android

People also ask

-

What is a 4 Point Inspection Form and why is it important?

A 4 Point Inspection Form is a crucial document used to evaluate the major systems of a property, including the roof, electrical, plumbing, and HVAC. It helps identify potential issues that could affect the safety and value of the property. Using a 4 Point Inspection Form can also streamline the insurance underwriting process, making it essential for homeowners and real estate professionals.

-

How can airSlate SignNow help me with my 4 Point Inspection Form needs?

airSlate SignNow offers a seamless solution for sending and eSigning your 4 Point Inspection Form. With our intuitive platform, you can easily create, share, and manage your inspection forms electronically. This not only saves time but also enhances the efficiency of your inspection process.

-

Is there a cost associated with using airSlate SignNow for 4 Point Inspection Forms?

Yes, airSlate SignNow provides a cost-effective solution for managing your 4 Point Inspection Forms. We offer various pricing plans to suit different business needs, ensuring that you can choose the right option for your budget. Our plans include access to all features necessary for creating and eSigning documents.

-

What features does airSlate SignNow offer for the 4 Point Inspection Form?

When using airSlate SignNow for your 4 Point Inspection Form, you gain access to features such as customizable templates, secure storage, and advanced eSignature capabilities. Additionally, you can track document status and send reminders, ensuring that your inspection forms are handled efficiently.

-

Can I integrate airSlate SignNow with other software for my 4 Point Inspection Form?

Absolutely! airSlate SignNow offers integration capabilities with various software applications, enhancing your ability to manage your 4 Point Inspection Form. Whether you use CRM systems, cloud storage, or project management tools, our platform can seamlessly connect to streamline your workflow.

-

What are the benefits of using an electronic 4 Point Inspection Form?

Using an electronic 4 Point Inspection Form through airSlate SignNow allows for faster processing and reduced paperwork. It enhances collaboration, as multiple parties can easily access and sign the document from anywhere. Plus, electronic forms are more environmentally friendly and secure than traditional paper forms.

-

How secure is my data when using airSlate SignNow for 4 Point Inspection Forms?

airSlate SignNow prioritizes your data security, employing industry-standard encryption and compliance measures. When you use our platform for your 4 Point Inspection Form, you can trust that your sensitive information is protected from unauthorized access. We take every precaution to ensure your documents are safe.

Get more for 4 Point Inspection Form

- Proclamation certificate template form

- Bulgaria visa application form pdf

- Amerigroup change pcp form

- Neolog nrp form

- Lisa madigans complaint forms

- D claration des douanes us customs and border protection cbp form

- Ultrasound cpt codes form

- Pdf ce course completion certificate re 302 rev 718 california form

Find out other 4 Point Inspection Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors