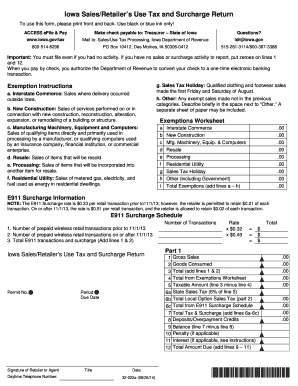

Iowa Sales Retailer's Use Tax and Surcharge Return Form

What is the Iowa Sales Retailer's Use Tax And Surcharge Return

The Iowa Sales Retailer's Use Tax and Surcharge Return is a tax form used by businesses in Iowa to report and pay sales tax and use tax obligations. This form is essential for retailers who sell tangible personal property or taxable services in Iowa. It ensures compliance with state tax laws and helps maintain accurate records of sales transactions. The return includes details about the total sales made, the amount of tax collected, and any applicable surcharges that may apply to specific products or services.

Steps to Complete the Iowa Sales Retailer's Use Tax And Surcharge Return

Completing the Iowa Sales Retailer's Use Tax and Surcharge Return involves several key steps:

- Gather necessary documentation, including sales records and tax rates applicable to your products.

- Calculate the total sales made during the reporting period.

- Determine the amount of sales tax collected from customers.

- Include any applicable surcharges based on the products sold.

- Fill out the return form accurately, ensuring all calculations are correct.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or by mail.

Legal Use of the Iowa Sales Retailer's Use Tax And Surcharge Return

Using the Iowa Sales Retailer's Use Tax and Surcharge Return is legally binding when completed correctly. The form must be filled out in accordance with Iowa tax laws and regulations. Proper execution ensures that the information provided is accurate and that all tax obligations are met. Failure to comply with these legal requirements can result in penalties or fines. It is crucial for businesses to understand their obligations and maintain compliance to avoid any legal issues.

Form Submission Methods

The Iowa Sales Retailer's Use Tax and Surcharge Return can be submitted through various methods, providing flexibility for businesses. The available submission methods include:

- Online submission via the Iowa Department of Revenue’s website, which may offer a streamlined process.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, allowing for immediate assistance if needed.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Iowa Sales Retailer's Use Tax and Surcharge Return is essential for compliance. The deadlines typically align with the reporting period, which can be monthly, quarterly, or annually, depending on the volume of sales. Businesses should mark these important dates on their calendars to ensure timely submission and avoid late fees. It is advisable to check the Iowa Department of Revenue’s website for the most current deadlines and any changes in filing requirements.

Key Elements of the Iowa Sales Retailer's Use Tax And Surcharge Return

When completing the Iowa Sales Retailer's Use Tax and Surcharge Return, several key elements must be included:

- Total sales amount for the reporting period.

- Amount of sales tax collected from customers.

- Applicable surcharges based on specific sales.

- Business identification information, including name and tax ID number.

- Signature of the authorized representative affirming the accuracy of the information provided.

Quick guide on how to complete iowa sales retailers use tax and surcharge return

Prepare Iowa Sales Retailer's Use Tax And Surcharge Return effortlessly on any device

Web-based document management has become increasingly prevalent among companies and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, amend, and electronically sign your documents promptly without any holdups. Handle Iowa Sales Retailer's Use Tax And Surcharge Return on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Iowa Sales Retailer's Use Tax And Surcharge Return with ease

- Find Iowa Sales Retailer's Use Tax And Surcharge Return and click on Get Form to initiate.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or blackout sensitive information with the tools that airSlate SignNow specially offers for this purpose.

- Craft your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate the reprinting of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Iowa Sales Retailer's Use Tax And Surcharge Return and ensure effective communication at any step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iowa sales retailers use tax and surcharge return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Iowa sales and use tax return form?

The Iowa sales and use tax return form is an official document used by businesses in Iowa to report and remit sales and use taxes owed to the state. This form summarizes the sales tax collected from customers and any applicable use tax. Accurate completion of the Iowa sales and use tax return form is essential for compliance with state tax regulations.

-

How can airSlate SignNow assist with the Iowa sales and use tax return form?

airSlate SignNow offers an easy-to-use platform for businesses to digitally complete and eSign the Iowa sales and use tax return form. With our solution, you can streamline the filing process and ensure all necessary documentation is organized and securely stored. This can help reduce errors and save valuable time in managing your tax obligations.

-

What are the pricing options for using airSlate SignNow for tax forms?

AirSlate SignNow provides various pricing plans that cater to businesses of all sizes, allowing users to choose the best option for their needs. Each plan offers features that simplify the completion and eSigning of documents, including the Iowa sales and use tax return form. You can start with a free trial to experience our platform before committing to a subscription.

-

Is airSlate SignNow secure for submitting the Iowa sales and use tax return form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Iowa sales and use tax return form is handled securely. Our platform utilizes encryption and secure cloud storage to protect sensitive information. This gives you peace of mind that your tax forms and data remain confidential and secure.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and financial software, allowing you to efficiently manage your Iowa sales and use tax return form alongside your other financial records. This integration enhances workflow efficiency and reduces the need for duplicate data entry, making your overall tax management more streamlined.

-

Are there features specifically for managing state tax forms like the Iowa sales and use tax return form?

Yes, airSlate SignNow includes features designed to facilitate the management of state tax forms, including the Iowa sales and use tax return form. These features include templates, electronic signatures, and automated reminders, ensuring you never miss a filing deadline. Such tools enhance your efficiency when dealing with various tax obligations.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management provides numerous benefits, including ease of use, reduced filing errors, and time savings. The platform helps you efficiently prepare, eSign, and submit the Iowa sales and use tax return form, ensuring that your business remains compliant with state regulations. Additionally, you can access your documents anytime and from anywhere.

Get more for Iowa Sales Retailer's Use Tax And Surcharge Return

- Motion to contest impending judgment 244 clerk of the court form

- Child support credit affidavit clay county clerk of the circuit court form

- Motion for mediation florida form

- Subpoena for deposition in pinellas county fl form

- Form declaration domicile

- Georgia bar association complaint form

- Divorce papers georgia online fillable 1999 form

- Fulton county 30 day joint compliance worksheet form

Find out other Iowa Sales Retailer's Use Tax And Surcharge Return

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast