Dept Revenue Services Ct Cert 139 Form

What is the Dept Revenue Services Ct Cert 139 Form

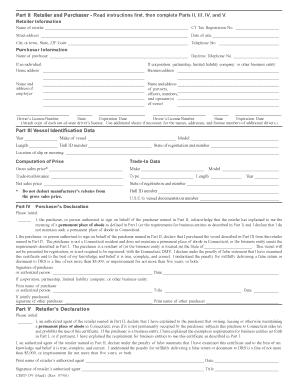

The Dept Revenue Services Ct Cert 139 Form is a crucial document used in Connecticut for tax purposes. It serves as a certification for various tax-related transactions and is often required by businesses and individuals to verify their tax status. This form helps ensure compliance with state tax regulations and facilitates the accurate reporting of income and deductions.

How to use the Dept Revenue Services Ct Cert 139 Form

Using the Dept Revenue Services Ct Cert 139 Form involves several steps. First, individuals or businesses must determine if they need to submit this form based on their tax situation. Once confirmed, they can obtain the form through the Connecticut Department of Revenue Services website or other official channels. After filling out the required information accurately, the form must be submitted to the appropriate tax authority, either electronically or via mail.

Steps to complete the Dept Revenue Services Ct Cert 139 Form

Completing the Dept Revenue Services Ct Cert 139 Form requires careful attention to detail. Follow these steps:

- Download the form from the Connecticut Department of Revenue Services website.

- Fill in your personal or business information, ensuring accuracy.

- Provide any necessary financial details, including income and deductions.

- Review the form for completeness and correctness.

- Sign and date the form as required.

- Submit the completed form to the appropriate authority.

Legal use of the Dept Revenue Services Ct Cert 139 Form

The legal use of the Dept Revenue Services Ct Cert 139 Form is essential for ensuring compliance with Connecticut tax laws. This form must be filled out accurately to avoid potential penalties or legal issues. It is recognized by the state as a valid document for certifying tax-related information, and any discrepancies may lead to audits or fines.

Key elements of the Dept Revenue Services Ct Cert 139 Form

Key elements of the Dept Revenue Services Ct Cert 139 Form include:

- Taxpayer identification information, such as name and address.

- Details regarding the type of certification being requested.

- Financial information relevant to the certification.

- Signature and date fields for validation.

Form Submission Methods (Online / Mail / In-Person)

The Dept Revenue Services Ct Cert 139 Form can be submitted through various methods to accommodate different preferences. Individuals may choose to submit the form online via the Connecticut Department of Revenue Services portal, which offers a streamlined process. Alternatively, the form can be mailed to the designated address or submitted in person at local tax offices. Each method has specific guidelines, so it is important to follow the instructions provided on the form or the official website.

Quick guide on how to complete dept revenue services ct cert 139 form

Effortlessly Prepare Dept Revenue Services Ct Cert 139 Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Handle Dept Revenue Services Ct Cert 139 Form on any platform with the airSlate SignNow apps for Android or iOS, and simplify your document-related tasks today.

How to Edit and eSign Dept Revenue Services Ct Cert 139 Form with Ease

- Locate Dept Revenue Services Ct Cert 139 Form and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive details using tools specifically provided by airSlate SignNow for such purposes.

- Create your eSignature with the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Dept Revenue Services Ct Cert 139 Form and guarantee excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dept revenue services ct cert 139 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Dept Revenue Services Ct Cert 139 Form used for?

The Dept Revenue Services Ct Cert 139 Form is primarily used for signNowing sales tax exemption in the state of Connecticut. Businesses and organizations use this form to document their eligibility for tax-exempt purchases, ensuring compliance with state tax regulations.

-

How can airSlate SignNow assist with the Dept Revenue Services Ct Cert 139 Form?

airSlate SignNow simplifies the signing and submission process for the Dept Revenue Services Ct Cert 139 Form. With its user-friendly interface, you can quickly upload, send, and eSign this form, saving time and ensuring accuracy in your tax documentation.

-

Is there a cost associated with using airSlate SignNow for the Dept Revenue Services Ct Cert 139 Form?

Yes, airSlate SignNow offers various subscription plans that provide access to its features for managing documents like the Dept Revenue Services Ct Cert 139 Form. Pricing is competitive, and the investment can lead to signNow time savings and increased efficiency in document handling.

-

What features does airSlate SignNow offer for the Dept Revenue Services Ct Cert 139 Form?

airSlate SignNow provides features such as eSignature capabilities, document templates, and real-time collaboration for the Dept Revenue Services Ct Cert 139 Form. These tools enhance the signing process, making it more streamlined and accessible for all parties involved.

-

Can I integrate airSlate SignNow with other software for the Dept Revenue Services Ct Cert 139 Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing users to connect with CRMs and other document management systems when working with the Dept Revenue Services Ct Cert 139 Form. This flexibility helps streamline workflows and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the Dept Revenue Services Ct Cert 139 Form?

Using airSlate SignNow for the Dept Revenue Services Ct Cert 139 Form offers numerous benefits, including enhanced document security, compliance assurance, and reduced turnaround times. These advantages contribute to improved productivity and a smoother tax exemption process.

-

How secure is my information when using airSlate SignNow for the Dept Revenue Services Ct Cert 139 Form?

airSlate SignNow prioritizes security and employs encryption protocols to protect your information when processing the Dept Revenue Services Ct Cert 139 Form. This ensures that your sensitive data remains confidential and secure throughout the signing process.

Get more for Dept Revenue Services Ct Cert 139 Form

- Application for replacement of baton training facility certificate form

- Navajo nation limited liability company act navajo business form

- Manager consent form 443610387

- Mail drop 535m insurance unit motor vehicle divisi form

- Rgwlawenfscholarship form

- Laos visa application form

- Form 1120 h

- Irs form 8960 walkthrough net investment income tax

Find out other Dept Revenue Services Ct Cert 139 Form

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later