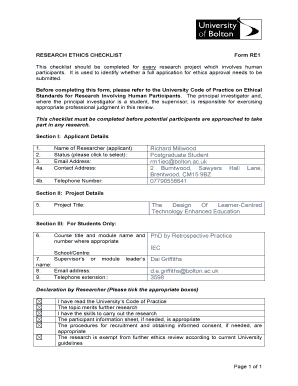

Re1 Form

What is the Re1 Form

The Re1 form is a specific document used primarily for tax-related purposes in the United States. It is often associated with reporting certain financial information to the Internal Revenue Service (IRS). Understanding the Re1 form is essential for individuals and businesses to ensure compliance with federal tax regulations. This form may be required for various situations, including income reporting, tax deductions, or credits.

How to use the Re1 Form

Using the Re1 form involves several key steps to ensure proper completion and submission. First, gather all necessary financial documents that pertain to the information required on the form. Next, accurately fill out each section, ensuring that all figures are correct and reflect your financial situation. After completing the form, review it thoroughly for any errors before submission. It is crucial to follow the specific guidelines provided by the IRS regarding how and when to submit the form.

Steps to complete the Re1 Form

Completing the Re1 form can be straightforward if you follow these steps:

- Gather all relevant financial documents, such as income statements and previous tax returns.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide the necessary financial data as required by the form, ensuring accuracy.

- Double-check all entries for correctness and completeness.

- Sign and date the form before submission.

Legal use of the Re1 Form

The legal use of the Re1 form is governed by IRS regulations. It is essential to ensure that the form is completed accurately and submitted within the specified deadlines to avoid penalties. The information provided on the Re1 form must be truthful and reflect your actual financial situation. Misrepresentation or failure to file the form can lead to legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Re1 form vary depending on the specific circumstances of the taxpayer. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. However, extensions may be available under certain conditions. It is important to stay informed about any changes to deadlines, as they can impact your tax obligations.

Required Documents

To complete the Re1 form, you will need several essential documents. These may include:

- Income statements, such as W-2s or 1099s.

- Previous tax returns for reference.

- Any supporting documentation for deductions or credits claimed.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Re1 form can result in various penalties. These may include monetary fines, interest on unpaid taxes, or even legal action in severe cases. It is crucial to understand the implications of non-compliance and to take the necessary steps to file the form correctly and on time.

Quick guide on how to complete re1 form

Complete Re1 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can locate the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Re1 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

The easiest way to modify and eSign Re1 Form with ease

- Locate Re1 Form and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Re1 Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the re1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an RE1 form in relation to airSlate SignNow?

The RE1 form is a crucial document used in various business processes for regulatory compliance. With airSlate SignNow, you can easily create, send, and eSign RE1 forms, streamlining your workflow. Our platform ensures that your RE1 forms are securely signed and stored, providing peace of mind for your documentation needs.

-

How can airSlate SignNow simplify the completion of an RE1 form?

airSlate SignNow simplifies the process of completing an RE1 form by allowing users to fill out and eSign the form electronically. You can drag and drop fields for easy customization, and recipients can sign from anywhere, facilitating quick turnaround times. This efficiency helps businesses save time and improve their operational workflow.

-

Is there a cost associated with using airSlate SignNow to eSign an RE1 form?

Yes, there is a cost associated with using airSlate SignNow, but it offers a cost-effective solution compared to traditional methods. Our pricing plans are designed to accommodate various business sizes and needs, ensuring you only pay for the features relevant to your usage of RE1 forms. Ask about our free trial, which allows you to experience the service before committing.

-

What features does airSlate SignNow offer for managing RE1 forms?

airSlate SignNow offers several features for managing RE1 forms, including customizable templates, tracking capabilities, and automated reminders for signers. Additionally, integration with other systems enhances the usability of your RE1 forms, making it easier to maintain accuracy and compliance. This robust feature set helps ensure smooth document transactions.

-

Can I integrate airSlate SignNow with other applications while using the RE1 form?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications, such as CRMs and cloud storage services. This integration facilitates the easy sharing and tracking of your RE1 forms across platforms, improving efficiency across your business operations. Explore our integration options to find the best fit for your workflow.

-

What are the benefits of using airSlate SignNow for RE1 forms?

Using airSlate SignNow for your RE1 forms offers numerous benefits, including enhanced security, ease of use, and faster processing times. By digitizing the signing process, you reduce the risk of document loss and ensure compliance. This not only saves time but also improves the overall experience for both senders and signers.

-

How secure is the information on the RE1 form when using airSlate SignNow?

Security is a top priority for airSlate SignNow. We use advanced encryption and secure access protocols to protect the information on your RE1 forms. Additionally, our compliance with industry regulations ensures that your data is handled with utmost care, providing you with peace of mind.

Get more for Re1 Form

- Warranty deed from two individuals to husband and wife wyoming form

- Wyoming corporation form

- Golden transcript 0418 by colorado community media issuu form

- Quitclaim deed by two individuals to llc wyoming form

- Warranty deed from two individuals to llc wyoming form

- Subcontractors notice of right to claim a liencorporation form

- Prime contractors notice individual form

- Quitclaim deed by two individuals to corporation wyoming form

Find out other Re1 Form

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy