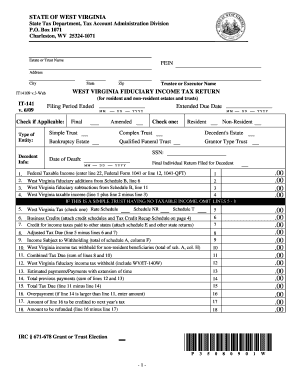

West Virginia It141 Form

What is the West Virginia It141

The West Virginia It141 form is a state tax document used to report income and calculate tax liabilities for residents of West Virginia. This form is particularly important for individuals who earn low income, as it helps determine eligibility for various tax credits and benefits. The It141 is essential for ensuring compliance with state tax laws and for accurately reporting earnings to the West Virginia State Tax Department.

How to obtain the West Virginia It141

To obtain the West Virginia It141 form, individuals can visit the West Virginia State Tax Department's official website, where the form is available for download. Additionally, taxpayers can request a physical copy by contacting the tax department directly. It is advisable to ensure that you have the most recent version of the form to comply with current regulations.

Steps to complete the West Virginia It141

Completing the West Virginia It141 involves several key steps:

- Gather necessary documentation, including income statements and any relevant tax documents.

- Fill out personal information, including name, address, and Social Security number.

- Report total income earned during the tax year, ensuring accuracy in calculations.

- Claim any applicable deductions or credits that may apply to your situation.

- Review the completed form for accuracy before submission.

Legal use of the West Virginia It141

The West Virginia It141 form is legally binding when completed correctly and submitted to the appropriate tax authorities. It must be signed and dated by the taxpayer to validate the information provided. Compliance with state tax laws is crucial, as inaccuracies or omissions can lead to penalties or audits.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines related to the West Virginia It141 form. Typically, the filing deadline aligns with the federal tax deadline, which is usually April fifteenth. However, it is essential to verify any changes or extensions that may apply for a given tax year, as these can vary.

Required Documents

When completing the West Virginia It141, certain documents are required to support the information provided. These may include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation of any other income sources

- Records of deductions, such as education or medical expenses

Eligibility Criteria

Eligibility for using the West Virginia It141 form generally includes being a resident of West Virginia and having a certain income level. Individuals earning low income may qualify for specific credits or benefits, making it essential to review the eligibility criteria outlined by the West Virginia State Tax Department. Understanding these criteria can help taxpayers maximize their potential refunds or minimize their tax liabilities.

Quick guide on how to complete west virginia it141

Complete West Virginia It141 effortlessly on any device

Online document management has become favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle West Virginia It141 on any device with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign West Virginia It141 effortlessly

- Locate West Virginia It141 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form navigation, or errors that require reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign West Virginia It141 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the west virginia it141

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a blank WV low earnings form?

The blank WV low earnings form is a document designed for individuals reporting low income in West Virginia. This form is utilized to assist in determining eligibility for various programs and benefits. By using airSlate SignNow, you can easily eSign and submit this form securely and efficiently.

-

How do I fill out a blank WV low earnings form?

Filling out a blank WV low earnings form involves providing accurate information about your income and financial situation. You can download the form from our platform, fill it in digitally, and use airSlate SignNow to eSign it. This process ensures that the form is completed accurately and submitted without hassle.

-

Is airSlate SignNow secure for submitting the blank WV low earnings form?

Absolutely! airSlate SignNow offers top-notch security features to protect your data when submitting the blank WV low earnings form. Our platform uses encryption and complies with industry standards, ensuring that your personal information remains safe throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for the blank WV low earnings form?

Using airSlate SignNow for the blank WV low earnings form streamlines the process of filling and signing documents. It offers convenience, reducing paper waste and time spent on manual submissions. Additionally, you can track the status of your form with ease, ensuring timely compliance.

-

Can I integrate airSlate SignNow with other tools for the blank WV low earnings form?

Yes, airSlate SignNow seamlessly integrates with various tools and platforms, allowing for efficient handling of the blank WV low earnings form. Whether you use it with Google Drive or other document management systems, our integrations enhance productivity and simplify the workflow.

-

What is the pricing for airSlate SignNow when using the blank WV low earnings form?

airSlate SignNow offers competitive pricing plans designed to meet the needs of businesses and individuals who need to manage documents like the blank WV low earnings form. With various subscription options, you can choose a plan that suits your usage frequency and features needed without breaking the bank.

-

How quickly can I submit the blank WV low earnings form using airSlate SignNow?

You can submit the blank WV low earnings form almost instantly using airSlate SignNow. The platform's user-friendly interface allows you to fill, sign, and send your documents without delay. This efficiency is particularly beneficial for meeting deadlines or urgent submissions.

Get more for West Virginia It141

- The graduate school cornells ecommons cornell university form

- Brigham and womens hospital patient slide consultation formpdf

- Request for medical staff application pre application tgh form

- New patient questionnaire form

- Anthem bluecross member authorization instructions and form anthem bluecross member authorization instructions and form

- Ucla molecular diagnostics laboratories molecular oncology form

- Value options authorization disclose health information

- Carecore national llc form

Find out other West Virginia It141

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement