Nycgovdeferredcomp Form

What is the Nycgovdeferredcomp Form

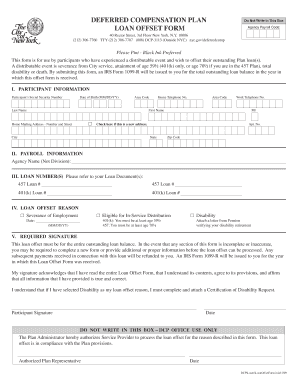

The Nycgovdeferredcomp form is a document used by employees in New York City to participate in a deferred compensation plan. This plan allows employees to set aside a portion of their earnings for retirement, providing tax advantages and financial security. The form outlines the terms and conditions of the deferred compensation arrangement, ensuring that employees understand their options and obligations.

How to use the Nycgovdeferredcomp Form

Using the Nycgovdeferredcomp form involves several steps. First, employees must obtain the form from their employer or the official NYC government website. Once acquired, individuals should fill out the required sections, including personal information and the amount they wish to defer. After completing the form, it should be submitted to the appropriate department within the employer's organization for processing.

Steps to complete the Nycgovdeferredcomp Form

Completing the Nycgovdeferredcomp form requires careful attention to detail. Here are the essential steps:

- Obtain the form from your employer or the NYC government website.

- Fill in your personal details, including your name, employee ID, and contact information.

- Specify the amount you wish to defer from your paycheck.

- Review the terms and conditions outlined in the form.

- Sign and date the form to confirm your agreement.

- Submit the completed form to your HR department.

Legal use of the Nycgovdeferredcomp Form

The Nycgovdeferredcomp form is legally binding when completed and submitted according to the regulations set forth by the NYC government. To ensure its legality, employees must provide accurate information and adhere to the guidelines outlined in the form. Additionally, electronic signatures may be used if compliant with applicable eSignature laws, ensuring the document's validity in a digital format.

Eligibility Criteria

To participate in the deferred compensation plan using the Nycgovdeferredcomp form, employees must meet specific eligibility criteria. Generally, this includes being a full-time employee of the City of New York and having a minimum level of income. It is essential to check with your HR department for any additional requirements or restrictions that may apply to your situation.

Form Submission Methods

The Nycgovdeferredcomp form can be submitted through various methods, depending on your employer's policies. Common submission methods include:

- Online submission through the employer's HR portal.

- Mailing the completed form to the designated HR office.

- In-person submission at your workplace's HR department.

Key elements of the Nycgovdeferredcomp Form

Understanding the key elements of the Nycgovdeferredcomp form is crucial for effective completion. Important sections typically include:

- Personal information, such as name and employee ID.

- Deferral amount selection.

- Terms and conditions of the deferred compensation plan.

- Signature and date fields to confirm agreement.

Quick guide on how to complete nycgovdeferredcomp form 5291948

Effortlessly Prepare Nycgovdeferredcomp Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely save it online. airSlate SignNow provides all the tools necessary for swiftly creating, editing, and eSigning your documents without delays. Handle Nycgovdeferredcomp Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The Easiest Way to Modify and eSign Nycgovdeferredcomp Form with Ease

- Find Nycgovdeferredcomp Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or obscure sensitive details using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all information and click the Done button to save your changes.

- Decide how you want to submit your form, whether by email, text message (SMS), invite link, or download to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Nycgovdeferredcomp Form to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nycgovdeferredcomp form 5291948

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nycgovdeferredcomp Form used for?

The Nycgovdeferredcomp Form is designed for employees of New York City who want to participate in the Deferred Compensation Plan. This form allows employees to allocate a portion of their salaries into a tax-deferred retirement savings account, ensuring long-term financial security.

-

How can I access the Nycgovdeferredcomp Form?

You can access the Nycgovdeferredcomp Form easily through the official NYC government website or directly through the airSlate SignNow platform, which offers a streamlined way to obtain and complete this essential form.

-

What are the benefits of using the Nycgovdeferredcomp Form?

Using the Nycgovdeferredcomp Form provides numerous benefits, including tax-deferred growth of your savings and lower taxable income during the contribution years. It facilitates better financial planning for retirement, giving you more control over your future.

-

Is there a cost associated with submitting the Nycgovdeferredcomp Form?

Submitting the Nycgovdeferredcomp Form is typically free; however, it’s essential to understand that there may be administrative fees associated with the Deferred Compensation Plan itself. Using airSlate SignNow to manage the submission can save time and enhance efficiency without added costs.

-

What features does airSlate SignNow offer for the Nycgovdeferredcomp Form?

airSlate SignNow offers a range of features for the Nycgovdeferredcomp Form, including electronic signatures, template creation, and secure document storage. These tools simplify the process of completing and managing your forms digitally.

-

Can I integrate the Nycgovdeferredcomp Form with other tools?

Yes, airSlate SignNow allows you to integrate the Nycgovdeferredcomp Form with various business tools and applications, enhancing your workflow. This integration capability ensures that managing your form fits seamlessly into your existing processes.

-

How does airSlate SignNow ensure the security of the Nycgovdeferredcomp Form?

airSlate SignNow employs top-level security protocols, including encryption and secure authentication measures, to protect the Nycgovdeferredcomp Form. Your sensitive information is safeguarded throughout the signing and submission process.

Get more for Nycgovdeferredcomp Form

- Boyscout campfire program 1993 form

- Defensive driving course online form

- Communication score form

- Air handling units air handler start up checklist johnson controls inc johnsoncontrols form

- Ah sollicitatieformulier pdf

- Eagle scout rank application 58 728a 2001 form

- Ikea donation form

- On an ex parte basis form

Find out other Nycgovdeferredcomp Form

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online