Joe G Tedder Tax Collector Form

What is the Joe E Tedder Tax Collector

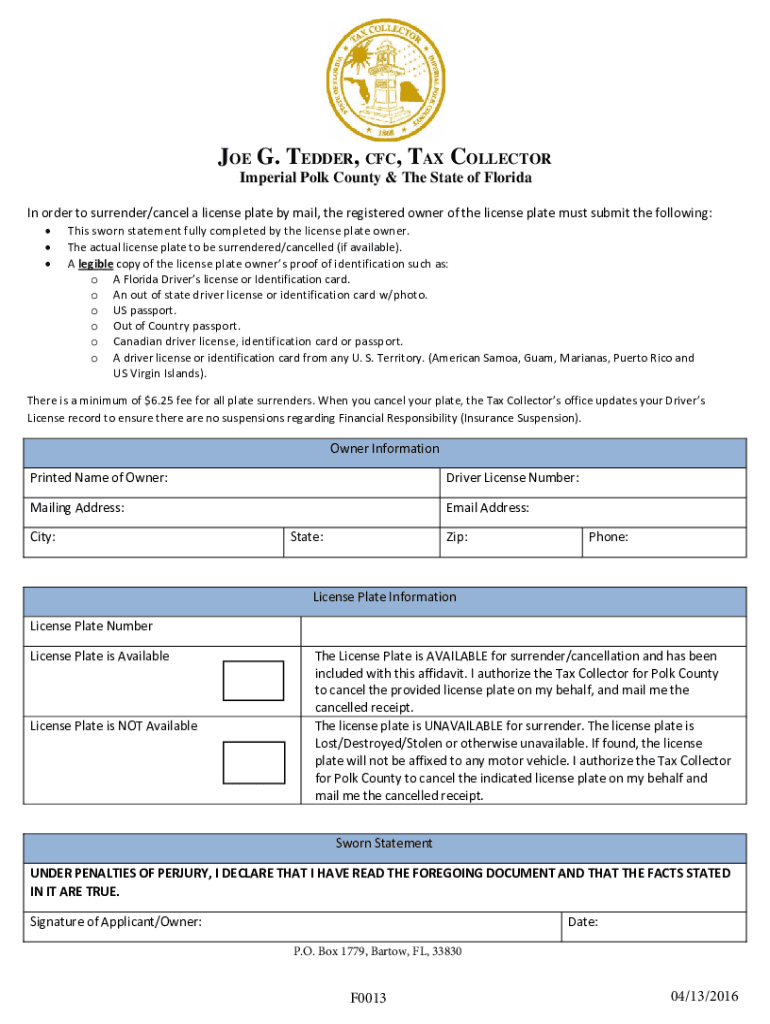

The Joe E Tedder Tax Collector is an official document used in the state of Florida for tax collection purposes. This form is essential for individuals and businesses to comply with local tax regulations. It serves as a means to report and remit taxes owed to the county, ensuring that all financial obligations are met in a timely manner. Understanding this form is crucial for maintaining compliance and avoiding penalties related to tax liabilities.

How to use the Joe E Tedder Tax Collector

Using the Joe E Tedder Tax Collector form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, fill out the form with the required information, including personal details and tax amounts. Once completed, review the form for accuracy before submitting it. Utilizing electronic signature solutions can streamline this process, making it easier to sign and send the document securely.

Steps to complete the Joe E Tedder Tax Collector

Completing the Joe E Tedder Tax Collector form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents.

- Fill in your personal information, including name, address, and identification number.

- Report your income and any applicable deductions.

- Calculate the total tax owed based on the provided instructions.

- Review the form for any errors or omissions.

- Sign the form using a secure electronic signature solution.

- Submit the completed form to the appropriate tax authority.

Legal use of the Joe E Tedder Tax Collector

The Joe E Tedder Tax Collector form is legally binding when completed and submitted in accordance with state regulations. To ensure its validity, it is important to comply with all relevant laws regarding tax reporting and payment. Electronic signatures are recognized under the ESIGN and UETA acts, making them a secure option for signing this form. Maintaining compliance with these legal frameworks helps protect against potential disputes or penalties.

Required Documents

When preparing to complete the Joe E Tedder Tax Collector form, several documents are necessary to ensure accurate reporting. Required documents typically include:

- Previous tax returns for reference.

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Identification documents, including Social Security numbers.

Form Submission Methods

The Joe E Tedder Tax Collector form can be submitted through various methods, including:

- Online submission via secure electronic platforms.

- Mailing the completed form to the designated tax office.

- In-person delivery at local tax collector offices.

Choosing the appropriate submission method can depend on personal preferences and the urgency of the tax obligation.

Quick guide on how to complete joe g tedder tax collector

Effortlessly Prepare Joe G Tedder Tax Collector on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Joe G Tedder Tax Collector on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Modify and Electronically Sign Joe G Tedder Tax Collector with Ease

- Locate Joe G Tedder Tax Collector and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the information and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Joe G Tedder Tax Collector to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the joe g tedder tax collector

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What role does Joe E. Tedder play as a tax collector?

Joe E. Tedder serves as the elected tax collector, responsible for collecting various taxes and ensuring that the tax process operates smoothly. His office provides essential services to residents, assisting them in understanding their tax obligations and ensuring compliance with local laws.

-

How can using airSlate SignNow help in tax-related processes?

Using airSlate SignNow can streamline tax-related processes by allowing users to eSign essential documents securely and efficiently. This not only saves time but also reduces the risk of errors, ensuring that important documents related to Joe E. Tedder's tax collection can be processed quickly and accurately.

-

What are the pricing options for airSlate SignNow for businesses dealing with Joe E. Tedder's office?

airSlate SignNow offers flexible pricing plans to cater to businesses of all sizes. Whether you are a small business or a large organization needing to handle documents related to Joe E. Tedder, you can find a plan that fits your needs and budget, all while ensuring a cost-effective solution for document management.

-

What features does airSlate SignNow provide for tax collectors?

AirSlate SignNow boasts several features that are beneficial for tax collectors, including customizable templates and automated workflows. These features allow Joe E. Tedder's office to manage documents more efficiently, helping taxpayers complete necessary forms without hassle.

-

How does airSlate SignNow enhance document security for tax collection?

AirSlate SignNow enhances security for tax collection by employing advanced encryption and secure storage methods. This ensures that sensitive documents related to Joe E. Tedder's tax collection remain protected from unauthorized access while providing peace of mind for both the office and taxpayers.

-

Can airSlate SignNow be integrated with other platforms for tax management?

Yes, airSlate SignNow can seamlessly integrate with various platforms used for tax management. This capability allows Joe E. Tedder's office to sync data and simplify processes, enhancing overall efficiency and making tax-related operations smoother.

-

What benefits does eSigning with airSlate SignNow provide for taxpayers?

eSigning with airSlate SignNow offers taxpayers the convenience of signing documents from anywhere, at any time. This flexibility is especially beneficial for individuals dealing with Joe E. Tedder's office, as it facilitates quick responses and easier completion of tax-related documentation.

Get more for Joe G Tedder Tax Collector

Find out other Joe G Tedder Tax Collector

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template