Verification of Mortgage Form

What is the verification of mortgage form?

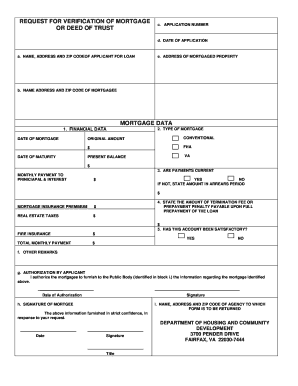

The verification of mortgage form, often referred to as the VOM form, is a document used to confirm the details of a mortgage loan. This form typically includes information such as the loan amount, payment history, and current balance. It is primarily utilized by lenders, borrowers, and financial institutions to facilitate the loan approval process or refinancing. Understanding the specifics of this form is crucial for anyone involved in real estate transactions or mortgage applications.

How to use the verification of mortgage form

Using the verification of mortgage form involves several steps to ensure that all necessary information is accurately captured. First, the borrower must complete the form with their personal details and mortgage information. Next, the lender or financial institution will review the submitted form to verify the mortgage details. This verification process is essential for assessing the borrower's financial health and determining eligibility for new loans or refinancing options.

Steps to complete the verification of mortgage form

Completing the verification of mortgage form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, such as your mortgage statement and identification.

- Fill out the form with accurate personal and mortgage information, including loan amount and payment history.

- Review the completed form for any errors or omissions.

- Submit the form to the lender or financial institution for verification.

Key elements of the verification of mortgage form

Several key elements must be included in the verification of mortgage form to ensure its effectiveness. These elements typically consist of:

- Borrower's full name and contact information

- Property address associated with the mortgage

- Loan number and type of mortgage

- Current balance and payment history

- Signature of the borrower and lender representative

Legal use of the verification of mortgage form

The verification of mortgage form is legally binding when completed correctly. It serves as an official record of the mortgage details and can be used in various legal contexts, such as loan applications or disputes. Compliance with relevant laws and regulations, including the Electronic Signatures in Global and National Commerce (ESIGN) Act, is essential to ensure the form's validity when signed electronically.

How to obtain the verification of mortgage form

Obtaining the verification of mortgage form is a straightforward process. Borrowers can typically request the form directly from their lender or financial institution. Many lenders provide the form online, allowing for easy access and completion. Additionally, templates for the verification of mortgage form may be available through various financial websites, ensuring that borrowers have the resources needed to complete this important document.

Quick guide on how to complete verification of mortgage form

Complete Verification Of Mortgage Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Verification Of Mortgage Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Verification Of Mortgage Form without hassle

- Locate Verification Of Mortgage Form and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important paragraphs of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the stress of lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Verification Of Mortgage Form to ensure outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the verification of mortgage form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the verification of mortgage?

The verification of mortgage is a process that confirms the details of a mortgage for a borrower. This includes validating loan balances, payment history, and other key loan terms, which are crucial for potential lenders and buyers.

-

How does airSlate SignNow facilitate the verification of mortgage?

airSlate SignNow streamlines the verification of mortgage process by allowing users to send and eSign necessary documents electronically. This eliminates paperwork delays and ensures that all parties can access and verify mortgage information quickly.

-

What are the costs associated with using airSlate SignNow for verification of mortgage?

airSlate SignNow offers a cost-effective pricing model tailored for businesses needing verification of mortgage solutions. Users can choose from various plans that suit their budget, with scalable options as their needs grow.

-

Are there any integrations available for the verification of mortgage process?

Yes, airSlate SignNow integrates seamlessly with various platforms like CRM systems, cloud storage services, and more to enhance the verification of mortgage process. This allows users to manage their documents efficiently without switching between applications.

-

What benefits does airSlate SignNow provide for the verification of mortgage?

The benefits of using airSlate SignNow for the verification of mortgage include improved efficiency, reduced turnaround time, and enhanced accuracy in document handling. The electronic signature feature also ensures compliance and adds a layer of security.

-

Is airSlate SignNow user-friendly for the verification of mortgage?

Absolutely! airSlate SignNow is designed with an intuitive interface, making it easy for users to navigate and complete the verification of mortgage process without extensive technical skills. Training resources are also available to aid users.

-

Can I track the verification of mortgage status in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking features that allow users to monitor the status of the verification of mortgage. Notifications are sent to ensure users are always informed about important updates.

Get more for Verification Of Mortgage Form

Find out other Verification Of Mortgage Form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract