Schwab Simple Ira Elective Deferral Agreement Form

What is the Schwab Simple IRA Elective Deferral Agreement

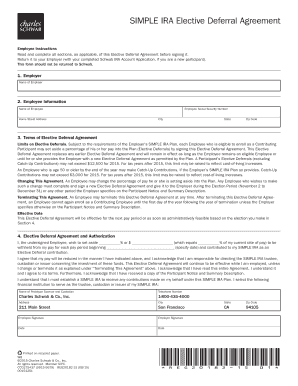

The Schwab Simple IRA Elective Deferral Agreement is a crucial document used by employees to designate the amount they wish to contribute to their Simple IRA accounts. This agreement outlines the employee's elective deferral percentage, which is the portion of their salary that will be contributed to the retirement account. It is essential for both employees and employers to understand this agreement, as it ensures compliance with IRS regulations and promotes effective retirement savings.

How to Use the Schwab Simple IRA Elective Deferral Agreement

Using the Schwab Simple IRA Elective Deferral Agreement involves several straightforward steps. First, employees need to review their current financial situation and determine an appropriate contribution amount. Next, they must complete the agreement form, specifying their chosen deferral percentage. Once the form is filled out, it should be submitted to the employer for processing. Employers then use this information to adjust payroll deductions accordingly, ensuring that contributions are made to the employee's Simple IRA.

Steps to Complete the Schwab Simple IRA Elective Deferral Agreement

Completing the Schwab Simple IRA Elective Deferral Agreement requires careful attention to detail. Here are the key steps:

- Gather necessary financial information, including current salary and desired contribution percentage.

- Obtain the agreement form from your employer or Schwab's website.

- Fill in personal details, including name, Social Security number, and employment information.

- Specify the elective deferral percentage you wish to contribute.

- Review the completed form for accuracy and completeness.

- Submit the form to your employer for processing.

Key Elements of the Schwab Simple IRA Elective Deferral Agreement

Several key elements are essential to the Schwab Simple IRA Elective Deferral Agreement. These include:

- Employee Information: Personal details such as name and Social Security number.

- Deferral Percentage: The specific percentage of salary to be contributed to the Simple IRA.

- Effective Date: The date the agreement becomes active.

- Employer Acknowledgment: A section for the employer to confirm receipt and understanding of the agreement.

Legal Use of the Schwab Simple IRA Elective Deferral Agreement

The legal use of the Schwab Simple IRA Elective Deferral Agreement is governed by IRS regulations. To be legally binding, the agreement must be completed accurately and submitted in a timely manner. This ensures that contributions are compliant with federal laws regarding retirement accounts. Employers are responsible for maintaining records of these agreements and ensuring that contributions are made according to the specified deferral percentages.

Quick guide on how to complete schwab simple ira elective deferral agreement

Effortlessly Prepare Schwab Simple Ira Elective Deferral Agreement on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly and without any hassles. Manage Schwab Simple Ira Elective Deferral Agreement seamlessly on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Simplest Way to Modify and eSign Schwab Simple Ira Elective Deferral Agreement with Ease

- Locate Schwab Simple Ira Elective Deferral Agreement and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to finalize your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Schwab Simple Ira Elective Deferral Agreement and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schwab simple ira elective deferral agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Charles Schwab elective deferral agreement?

A Charles Schwab elective deferral agreement allows employees to defer a portion of their pre-tax earnings into a retirement savings plan. This type of agreement aims to help employees save for retirement while benefiting from tax advantages. Understanding the details of this agreement is crucial for making informed financial decisions.

-

How can airSlate SignNow assist with Charles Schwab elective deferral agreements?

airSlate SignNow streamlines the process of signing and managing Charles Schwab elective deferral agreements. With its intuitive eSigning capabilities, users can quickly create, send, and track these important documents. This efficiency can improve compliance and ensure timely submissions.

-

Are there any costs associated with using airSlate SignNow for Charles Schwab elective deferral agreements?

airSlate SignNow offers a variety of pricing plans tailored to business needs, including features specifically for managing Charles Schwab elective deferral agreements. The cost can vary based on the plan selected, but the platform is designed to provide a cost-effective solution for document management and eSigning. You can choose a plan that best fits your business size and volume.

-

What features does airSlate SignNow provide for managing a Charles Schwab elective deferral agreement?

With airSlate SignNow, you can create customizable templates for Charles Schwab elective deferral agreements, integrate with your existing software, and track the status of each document. The platform also offers advanced security features to protect sensitive financial information and ensure compliance. These tools help streamline the documentation process for businesses.

-

What are the benefits of using airSlate SignNow for Charles Schwab elective deferral agreements?

Using airSlate SignNow for Charles Schwab elective deferral agreements enhances efficiency and reduces the time spent on paperwork. Furthermore, the electronic signing process removes the need for physical signatures, making it more convenient for employees and employers alike. By choosing airSlate, businesses can improve workflow and ensure better management of retirement plans.

-

Can airSlate SignNow integrate with other software for managing Charles Schwab elective deferral agreements?

Yes, airSlate SignNow offers various integrations with popular HR and finance software, making it easy to incorporate Charles Schwab elective deferral agreements into your existing workflow. These integrations help synchronize documents and data, ensuring a smooth experience for both employees and administrators. This flexibility can signNowly enhance operational efficiency.

-

How does airSlate SignNow ensure the security of Charles Schwab elective deferral agreements?

airSlate SignNow prioritizes security by employing industry-standard encryption and secure storage solutions for all documents, including Charles Schwab elective deferral agreements. The platform adheres to compliance regulations to protect user data and ensure that sensitive financial information remains confidential throughout the signing process. This commitment to security builds trust with users.

Get more for Schwab Simple Ira Elective Deferral Agreement

- Pain assessment form

- Ede q copy rights form

- Hurley medical center standard practice non discriminatory form

- Fill in fitness questionnaire template form

- Consentsregistration greenville health system consent and authorization umg the following are conditions for services provided form

- Dimes from the heart form

- Mymenu enphg form

- Vf1015x032 form

Find out other Schwab Simple Ira Elective Deferral Agreement

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy