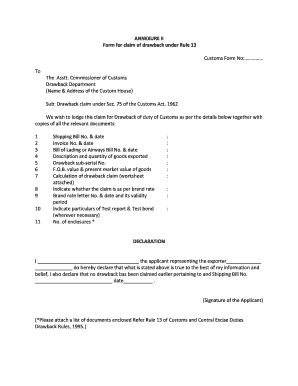

ANNEXURE II Form for Claim of Drawback under Rule 13 Customs Cbec Gov

What is the drawback declaration form?

The drawback declaration form is a crucial document used in the United States for claiming a refund on duties paid on imported goods that are subsequently exported. This form is essential for businesses looking to recover costs associated with import tariffs. It serves as a formal request to the U.S. Customs and Border Protection (CBP) for a refund, ensuring compliance with federal regulations. The form requires detailed information about the goods, including their classification and the amount of duty paid, making it a vital tool for businesses engaged in international trade.

Steps to complete the drawback declaration form

Completing the drawback declaration form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including invoices, shipping records, and proof of duty payment. Next, accurately fill out the form with details such as the description of the goods, their classification, and the amount of drawback being claimed. It is essential to review all entries for accuracy before submission, as errors can lead to delays or rejections. Finally, submit the completed form to the appropriate CBP office, either electronically or via mail, depending on the specific requirements.

Key elements of the drawback declaration form

The drawback declaration form includes several key elements that must be accurately reported. These elements typically consist of:

- Importer Information: Details about the business or individual submitting the claim.

- Goods Description: A clear description of the items for which the drawback is being claimed.

- Duty Paid: The total amount of duty paid on the imported goods.

- Export Information: Details regarding the export of the goods, including dates and destinations.

- Claim Amount: The specific amount of drawback being requested.

Providing accurate and complete information in these sections is vital for the successful processing of the claim.

Legal use of the drawback declaration form

The drawback declaration form is legally binding and must be completed in accordance with U.S. laws and regulations. When submitted, it serves as a formal declaration to the government regarding the claim for duty refunds. To ensure legal compliance, it is important to adhere to all guidelines set forth by the CBP, including maintaining supporting documentation for the claim. Failure to comply with these regulations can result in penalties, including denial of the claim or legal action.

Form submission methods

The drawback declaration form can be submitted through various methods, depending on the preferences of the filer and the requirements of the CBP. Options typically include:

- Online Submission: Many businesses opt to submit the form electronically through the CBP's Automated Commercial Environment (ACE) system, which allows for faster processing.

- Mail Submission: Alternatively, the form can be printed and mailed to the appropriate CBP office. This method may take longer due to postal processing times.

- In-Person Submission: Some filers may choose to submit the form in person at designated CBP offices, which can facilitate immediate feedback and assistance.

Choosing the right submission method can impact the efficiency of the claims process.

Eligibility criteria for claiming drawbacks

To successfully claim a drawback using the declaration form, certain eligibility criteria must be met. Generally, the goods in question must have been imported into the United States and subsequently exported without being used or altered. Additionally, the claim must be filed within the specified time frame, typically within three years from the date of importation. It is also essential that the duties paid on the imported goods are eligible for refund under U.S. law. Meeting these criteria is crucial for ensuring that the claim is valid and likely to be approved.

Quick guide on how to complete annexure ii form for claim of drawback under rule 13 customs cbec gov

Complete ANNEXURE II Form For Claim Of Drawback Under Rule 13 Customs Cbec Gov effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage ANNEXURE II Form For Claim Of Drawback Under Rule 13 Customs Cbec Gov on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The easiest method to edit and eSign ANNEXURE II Form For Claim Of Drawback Under Rule 13 Customs Cbec Gov with ease

- Obtain ANNEXURE II Form For Claim Of Drawback Under Rule 13 Customs Cbec Gov and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign ANNEXURE II Form For Claim Of Drawback Under Rule 13 Customs Cbec Gov and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annexure ii form for claim of drawback under rule 13 customs cbec gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an annexure 2 form and why is it important?

The annexure 2 form is a critical document often used in various official processes. It typically includes supplementary information required to support a primary application or agreement. Understanding its significance can help businesses ensure compliance and streamline documentation.

-

How does airSlate SignNow simplify the annexure 2 form signing process?

airSlate SignNow facilitates the signing of the annexure 2 form through its user-friendly eSigning features. Users can easily upload the document, send it for signatures, and track its status in real-time. This simplified process saves time and eliminates the hassles of manual paperwork.

-

What are the pricing options for using airSlate SignNow to handle annexure 2 forms?

airSlate SignNow offers a range of pricing plans tailored to various business needs, including affordable options for managing annexure 2 forms. Each plan is designed to provide cost-effective solutions while ensuring access to essential features for document management. You can choose a plan that fits your organization's size and requirements.

-

Can I integrate airSlate SignNow with other software when managing annexure 2 forms?

Yes, airSlate SignNow supports seamless integrations with a variety of software and tools, which is beneficial when managing annexure 2 forms. This feature allows businesses to automate workflows and enhance productivity by connecting with popular applications like CRM and project management tools. Integration helps streamline processes related to document signing.

-

What are the benefits of using airSlate SignNow for annexure 2 forms?

Using airSlate SignNow to manage annexure 2 forms offers numerous benefits, including increased efficiency and reduced turnaround times. The secure eSignature capabilities ensure that documents are legally binding and compliant with regulations. Additionally, the platform provides tracking and reminders, making the signing process smooth for all parties involved.

-

Is airSlate SignNow secure for handling sensitive annexure 2 forms?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and authentication protocols to protect sensitive annexure 2 forms. This commitment to data protection ensures that your documents remain secure throughout the signing process, giving you peace of mind.

-

How can I access and manage my annexure 2 forms within airSlate SignNow?

Managing your annexure 2 forms in airSlate SignNow is straightforward. Once you log in, you can upload documents, organize them into folders, and access them anytime from any device. The intuitive dashboard allows for efficient navigation, ensuring you can find and manage your forms easily.

Get more for ANNEXURE II Form For Claim Of Drawback Under Rule 13 Customs Cbec Gov

- Fedex commercial invoice template word form

- Security deposit deductions list pdf form

- Dave ramsey financial snapshot card form

- Security daily activity report example pdf form

- Deathwatch character sheet form

- Da form 5960

- Caregiver evaluation form

- How to fill foreigner physical examination form china pdf

Find out other ANNEXURE II Form For Claim Of Drawback Under Rule 13 Customs Cbec Gov

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document