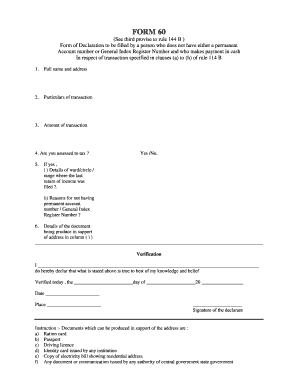

FORM 60

What is the FORM 60

The FORM 60 is a document used primarily for tax purposes in the United States. It serves as a declaration for individuals who are required to provide their taxpayer identification information when engaging in certain financial transactions. This form is particularly relevant for those who do not have a Social Security Number (SSN) and need to report income or claim tax benefits. Understanding the purpose and requirements of FORM 60 is essential for compliance with U.S. tax laws.

How to use the FORM 60

Using the FORM 60 involves several key steps to ensure accurate completion. First, gather all necessary personal information, including your name, address, and taxpayer identification number, if applicable. Next, clearly fill out the form, ensuring that all sections are completed accurately. Once completed, the form must be submitted to the appropriate tax authority or financial institution as required. It is important to keep a copy for your records to maintain a clear audit trail.

Steps to complete the FORM 60

Completing the FORM 60 can be straightforward if you follow these steps:

- Gather your personal information, including your full name, address, and any relevant identification numbers.

- Obtain a copy of the FORM 60 from the appropriate source, such as the IRS or your financial institution.

- Fill out the form carefully, ensuring that all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the designated authority, either online or via mail, as per their guidelines.

Legal use of the FORM 60

The FORM 60 is legally binding when completed correctly and submitted to the appropriate entities. It is essential to ensure that the information provided is accurate and truthful to avoid potential legal repercussions. The form is often required in situations involving financial transactions and tax reporting, making its proper use vital for compliance with tax regulations.

Key elements of the FORM 60

Several key elements must be included in the FORM 60 for it to be considered valid:

- Personal Information: Full name, address, and taxpayer identification number.

- Signature: The form must be signed by the individual submitting it, confirming the accuracy of the information.

- Date: The date of submission should be clearly indicated.

- Purpose: A brief explanation of why the form is being submitted may be required, depending on the context.

Form Submission Methods (Online / Mail / In-Person)

FORM 60 can typically be submitted through various methods, depending on the requirements of the receiving authority. Common submission methods include:

- Online: Many tax authorities allow for electronic submission through their official websites.

- Mail: The form can be printed and mailed to the appropriate office, ensuring it is sent to the correct address.

- In-Person: Some individuals may choose to submit the form in person at designated tax offices or financial institutions.

Quick guide on how to complete form 60 31819130

Effortlessly Complete FORM 60 on Any Device

Managing documents online has gained signNow traction among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and without delays. Handle FORM 60 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related processes today.

How to Edit and Electronically Sign FORM 60 with Ease

- Locate FORM 60 and click on Get Form to initiate.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet signature.

- Verify the information and then click the Done button to store your changes.

- Choose how you prefer to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes requiring new copies to be printed. airSlate SignNow meets your needs in document management with just a few clicks from your chosen device. Edit and electronically sign FORM 60 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 60 31819130

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FORM 60, and why is it important?

FORM 60 is a declaration form used in financial transactions in India, especially relating to income tax. It is important because it helps individuals who do not have a Permanent Account Number (PAN) to still conduct certain financial activities legally, ensuring compliance with tax regulations.

-

How can airSlate SignNow help with the FORM 60 process?

airSlate SignNow streamlines the FORM 60 signing process by allowing users to send, sign, and store documents electronically. This ensures that the completion and submission of FORM 60 are efficient and secure, mitigating the risk of paperwork errors.

-

Is there a cost associated with using airSlate SignNow for FORM 60?

Yes, airSlate SignNow offers various pricing plans to meet different business needs. These plans provide different features, but they all allow you to manage your FORM 60 requirements effectively at a cost-effective rate.

-

What features does airSlate SignNow provide for managing FORM 60?

airSlate SignNow offers features such as customizable templates, secure electronic signatures, and cloud document storage which are ideal for managing FORM 60. These features enable users to ensure that their forms are properly filled out and stored for easy access.

-

Can airSlate SignNow integrate with other software for FORM 60 processing?

Absolutely! airSlate SignNow integrates seamlessly with various popular software applications, which can enhance the handling of FORM 60. This allows you to synchronize your data across platforms, increasing efficiency in document management.

-

Is FORM 60 submission secure with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. Your FORM 60 submissions are protected with bank-level encryption and secure storage, ensuring that your sensitive information remains confidential and safeguarded against unauthorized access.

-

How does airSlate SignNow improve the efficiency of filling out FORM 60?

airSlate SignNow simplifies the FORM 60 process through user-friendly features such as template autofill and reminders. This reduces time spent on paperwork, ensuring that users can focus on their essential tasks rather than getting bogged down by forms.

Get more for FORM 60

Find out other FORM 60

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement