Form 8829 Instructions

What is the Form 8829 Instructions

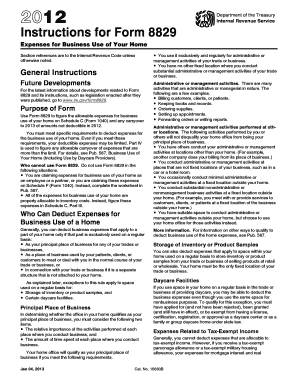

The Form 8829 instructions guide taxpayers on how to claim expenses for business use of their home. This form is essential for self-employed individuals or those running a business from their residence. It allows for the deduction of certain costs associated with maintaining a home office, which can include utilities, repairs, and depreciation. Understanding the specifics of the form is crucial for ensuring compliance with IRS regulations and maximizing potential deductions.

Steps to complete the Form 8829 Instructions

Completing the Form 8829 involves several key steps:

- Gather necessary documents, including receipts for home expenses and details about the business use of your home.

- Determine the percentage of your home used for business purposes, which will affect the deductions you can claim.

- Fill out the form by providing information about your home office, including the size of the office and total home area.

- Calculate allowable expenses based on the percentage of business use, ensuring accuracy to avoid issues with the IRS.

- Review the completed form for any errors before submission.

Legal use of the Form 8829 Instructions

The legal use of the Form 8829 instructions is defined by IRS guidelines. To ensure the deductions are valid, taxpayers must adhere to specific criteria, including the requirement that the home office must be used regularly and exclusively for business. Additionally, the form must be filled out accurately and submitted with the appropriate tax return. Non-compliance can lead to penalties or disallowed deductions, making it essential to follow the instructions carefully.

IRS Guidelines

The IRS provides detailed guidelines for completing the Form 8829 instructions. These guidelines outline what qualifies as a home office, the types of expenses that can be deducted, and the documentation required to support claims. Taxpayers should refer to the latest IRS publications to ensure they are using the most current information and to understand any changes in tax law that may affect their deductions.

Required Documents

When completing the Form 8829, certain documents are necessary to substantiate the claims made. These include:

- Receipts for home expenses such as utilities, insurance, and repairs.

- Records of the size of the home and the area used for business.

- Any relevant tax documents from previous years that may support the business use of the home.

Having these documents organized and readily available can streamline the process of filling out the form and ensure compliance with IRS requirements.

Examples of using the Form 8829 Instructions

Examples of using the Form 8829 instructions can help clarify its application. For instance, a freelance graphic designer who works from a dedicated room in their home may use the form to deduct a portion of their rent, utilities, and internet costs. Similarly, a consultant who meets clients in a designated home office can also claim related expenses. These examples illustrate how the form can benefit various self-employed individuals by reducing their taxable income.

Quick guide on how to complete form 8829 instructions

Effortlessly prepare Form 8829 Instructions on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Handle Form 8829 Instructions on any device using airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

The easiest way to modify and eSign Form 8829 Instructions without any hassle

- Find Form 8829 Instructions and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 8829 Instructions and ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8829 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to form 8829 instructions?

airSlate SignNow offers a user-friendly interface that simplifies the completion of form 8829 instructions. Our platform provides templates, real-time collaboration, and eSigning capabilities to ensure you fill out and submit your forms accurately and efficiently.

-

How can airSlate SignNow help me with the filing of form 8829 instructions?

With airSlate SignNow, you can easily prepare and file form 8829 instructions using our customizable templates. The platform ensures that you have all the necessary fields covered, making the entire process straightforward and less time-consuming.

-

Is there a free trial available for airSlate SignNow when handling form 8829 instructions?

Yes, airSlate SignNow offers a free trial, allowing you to explore our features for handling form 8829 instructions at no cost. This trial gives you access to all the tools needed to simplify your document signing and management.

-

How does airSlate SignNow ensure the security of my form 8829 instructions?

Security is a top priority at airSlate SignNow. We implement AES-256 encryption protocol, multi-factor authentication, and secure cloud storage to keep your form 8829 instructions and other sensitive documents safe from unauthorized access.

-

Can I integrate airSlate SignNow with my existing accounting software for form 8829 instructions?

Absolutely! airSlate SignNow supports various third-party integrations, making it easy to connect with your accounting software. This integration helps streamline the completion and submission of form 8829 instructions, along with other financial documents.

-

What types of businesses can benefit from using airSlate SignNow for form 8829 instructions?

Any business that requires precise and efficient documentation, especially those claiming deductions for home office expenses, can benefit from using airSlate SignNow for form 8829 instructions. Our platform caters to freelancers, small business owners, and corporations alike.

-

What is the pricing structure for airSlate SignNow when managing form 8829 instructions?

airSlate SignNow offers flexible pricing plans designed to accommodate different business needs. You can select a plan that fits your requirements for handling form 8829 instructions and costs vary based on the features and usage levels you need.

Get more for Form 8829 Instructions

- Lung health updateevery breath you take racgp form

- Scu theses collection thesis deposit and verification form

- For trimester abroad program students form

- Clinical emergency form

- 2019 chapter of the year award application form

- Vha office of emergency management home veterans affairs form

- Outgoing study plan deakin edu form

- Please fill out in capital letters form

Find out other Form 8829 Instructions

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later