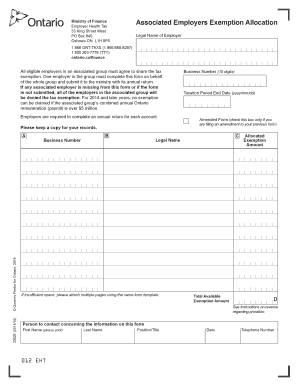

Associated Employers Exemption Allocation Form

What is the Associated Employers Exemption Allocation Form

The associated employers exemption allocation form is a critical document used by businesses to manage and allocate exemptions among associated employers. This form is particularly relevant for organizations that operate under multiple entities but wish to consolidate certain tax exemptions or benefits. Understanding the purpose and implications of this form is essential for compliance with tax regulations and ensuring that all associated employers are accurately represented in tax filings.

How to use the Associated Employers Exemption Allocation Form

Using the associated employers exemption allocation form involves several straightforward steps. First, gather all necessary information regarding the associated employers and the specific exemptions being allocated. Next, fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, it should be reviewed for accuracy before submission. This review process is crucial to avoid any potential issues with tax authorities.

Steps to complete the Associated Employers Exemption Allocation Form

Completing the associated employers exemption allocation form requires careful attention to detail. Follow these steps for a smooth process:

- Collect necessary documentation related to each associated employer.

- Fill in the identification details for all associated employers involved.

- Specify the exemptions being allocated and provide the rationale for the allocation.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission guidelines.

Legal use of the Associated Employers Exemption Allocation Form

The associated employers exemption allocation form must be used in compliance with relevant tax laws and regulations. This includes adhering to guidelines set forth by the Internal Revenue Service (IRS) and state tax authorities. Proper use of the form ensures that businesses can legitimately claim exemptions without facing penalties or legal repercussions.

Key elements of the Associated Employers Exemption Allocation Form

Several key elements must be included in the associated employers exemption allocation form to ensure its validity. These elements typically include:

- The names and identification numbers of all associated employers.

- A detailed description of the exemptions being allocated.

- Signatures of authorized representatives from each associated employer.

- The date of submission and any relevant tax periods.

Form Submission Methods

The associated employers exemption allocation form can be submitted through various methods, depending on the requirements of the tax authority. Common submission methods include:

- Online submission through designated tax authority portals.

- Mailing the completed form to the appropriate tax office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete associated employers exemption allocation form

Easily prepare Associated Employers Exemption Allocation Form on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Associated Employers Exemption Allocation Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Associated Employers Exemption Allocation Form effortlessly

- Find Associated Employers Exemption Allocation Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Associated Employers Exemption Allocation Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the associated employers exemption allocation form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the associated employers exemption allocation form?

The associated employers exemption allocation form is a document that allows businesses to allocate exemptions among associated employers for tax purposes. By using this form, companies can ensure accurate reporting and compliance with relevant tax regulations. airSlate SignNow enables you to easily fill out and sign this form online, streamlining your process.

-

How can I access the associated employers exemption allocation form?

You can access the associated employers exemption allocation form through the airSlate SignNow platform. Simply log in to your account, navigate to the document library, and search for the form you need. Our user-friendly interface makes it quick and easy to locate and manage your forms.

-

Is there a fee for using the associated employers exemption allocation form with airSlate SignNow?

airSlate SignNow offers various pricing plans that allow you to use the associated employers exemption allocation form at an affordable rate. Depending on your chosen plan, you may have access to additional features and functionalities that simplify document management. Please visit our pricing page for detailed information tailored to your needs.

-

What features does airSlate SignNow offer for the associated employers exemption allocation form?

With airSlate SignNow, you can eSign the associated employers exemption allocation form securely and efficiently. Our platform includes features such as document tracking, automatic notifications, and customizable templates, all designed to enhance your document signing experience. This ensures that your form is processed quickly and accurately.

-

Can I integrate airSlate SignNow with other applications for the associated employers exemption allocation form?

Yes, airSlate SignNow offers integrations with various applications to streamline the use of the associated employers exemption allocation form. You can connect with tools like Salesforce, Google Drive, and others for a cohesive workflow. This allows you to manage documents efficiently from multiple platforms.

-

What benefits does using airSlate SignNow with the associated employers exemption allocation form provide?

Using airSlate SignNow for the associated employers exemption allocation form provides numerous benefits, including enhanced efficiency and reduced turnaround times for document processing. Our platform also ensures compliance with regulations, reducing the risk of errors. Additionally, you can access your forms anytime, anywhere.

-

Is it easy to share the associated employers exemption allocation form with others?

Absolutely! airSlate SignNow makes it easy to share the associated employers exemption allocation form with team members or stakeholders. You can send the form via email or create shareable links, allowing recipients to view or sign the document as needed. This flexible sharing capability enhances collaboration.

Get more for Associated Employers Exemption Allocation Form

Find out other Associated Employers Exemption Allocation Form

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document