Federal Credit Application Insurance Disclosure Form

Understanding the Federal Credit Application Insurance Disclosure

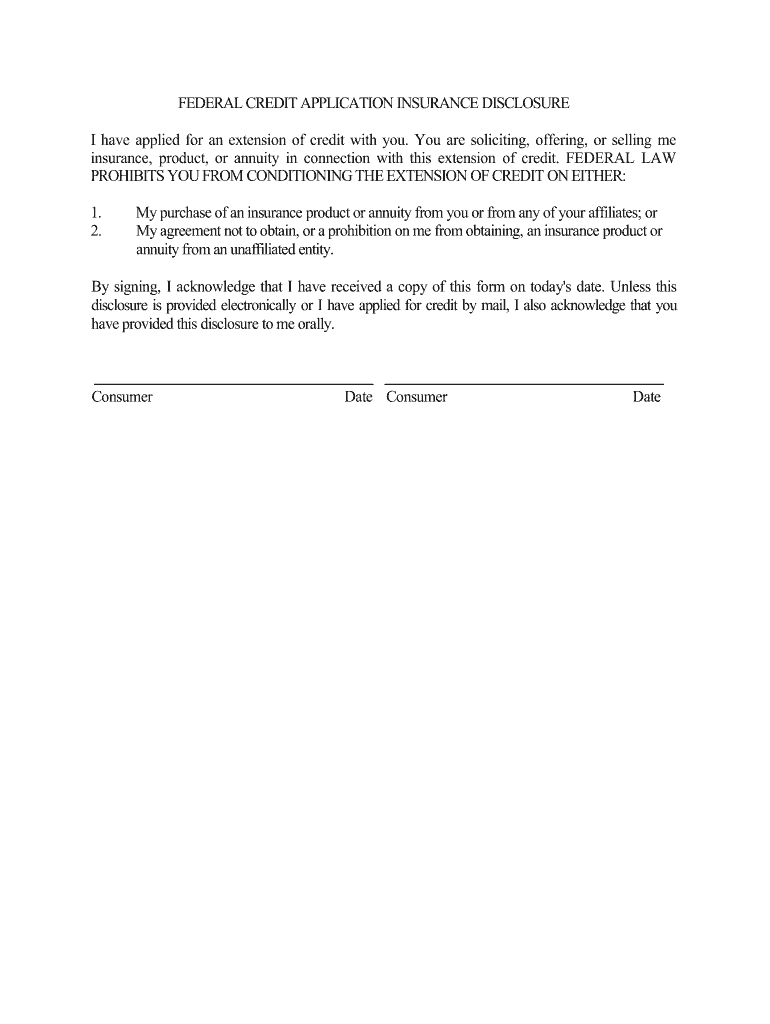

The Federal Credit Application Insurance Disclosure is a crucial document that informs applicants about the terms and conditions associated with credit insurance. This disclosure outlines the rights and responsibilities of both the lender and the borrower, ensuring transparency in the credit application process. It includes essential information regarding the insurance coverage, potential costs, and any obligations that may arise from the agreement. Understanding this disclosure is vital for individuals seeking credit insurance, as it helps them make informed decisions.

Steps to Complete the Federal Credit Application Insurance Disclosure

Completing the Federal Credit Application Insurance Disclosure involves several key steps to ensure accuracy and compliance. Start by gathering all necessary personal and financial information, including your Social Security number, income details, and any existing debts. Next, carefully read through the disclosure to understand the terms of the credit insurance being offered. Fill in the required fields accurately, ensuring that all information is truthful and up-to-date. Once completed, review the document for any errors before signing it electronically, which confirms your agreement to the terms outlined in the disclosure.

Legal Use of the Federal Credit Application Insurance Disclosure

The legal use of the Federal Credit Application Insurance Disclosure is governed by various federal regulations, including the Fair Credit Reporting Act (FCRA). This ensures that the information provided is used appropriately and that applicants are protected from unfair practices. The disclosure must be provided to applicants in a clear and understandable format, allowing them to fully comprehend their rights. Compliance with these regulations is essential for lenders, as failure to adhere can result in legal penalties and loss of credibility.

Key Elements of the Federal Credit Application Insurance Disclosure

Several key elements are essential in the Federal Credit Application Insurance Disclosure. These include:

- Insurance Coverage Details: A description of what the credit insurance covers, including any limitations or exclusions.

- Cost Information: Clear information regarding any premiums or fees associated with the insurance.

- Borrower Rights: An outline of the rights of the borrower, including the right to cancel the insurance.

- Claims Process: Instructions on how to file a claim if needed, ensuring borrowers know their options.

How to Use the Federal Credit Application Insurance Disclosure

Using the Federal Credit Application Insurance Disclosure effectively requires a thorough understanding of its contents. Applicants should first read the disclosure carefully to grasp the terms of the insurance. It is advisable to compare the offered insurance with other options available in the market to ensure it meets personal needs. Additionally, applicants should keep a copy of the signed disclosure for their records, as it serves as proof of their agreement and can be referenced in future communications with the lender.

State-Specific Rules for the Federal Credit Application Insurance Disclosure

State-specific rules may apply to the Federal Credit Application Insurance Disclosure, varying by jurisdiction. Each state may have its own regulations regarding the provision of credit insurance, including additional disclosures or consumer protections. It is important for applicants to be aware of these regulations, as they can affect the terms of the insurance and the rights of the borrower. Consulting with a legal expert or financial advisor familiar with state laws can provide valuable guidance in navigating these requirements.

Quick guide on how to complete federal credit application insurance disclosure form

The simplest method to obtain and endorse Federal Credit Application Insurance Disclosure

On the scale of a whole organization, ineffective procedures surrounding paper approvals can consume a signNow amount of working hours. Endorsing documents such as Federal Credit Application Insurance Disclosure is an inherent aspect of operations across any sector, which is why the efficiency of each agreement’s lifecycle signNowly impacts the company’s overall productivity. With airSlate SignNow, endorsing your Federal Credit Application Insurance Disclosure is as straightforward and quick as possible. This platform provides you with the latest version of nearly any document. Even better, you can endorse it instantly without needing to install external applications on your computer or printing anything as physical copies.

Steps to obtain and endorse your Federal Credit Application Insurance Disclosure

- Browse our library by category or utilize the search bar to locate the document you require.

- Check the document preview by clicking Learn more to ensure it’s the correct one.

- Click Get form to start editing immediately.

- Fill out your document and include any required details using the toolbar.

- Once finished, click the Sign tool to endorse your Federal Credit Application Insurance Disclosure.

- Choose the signing method that is most suitable for you: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to conclude editing and proceed to document-sharing options as needed.

With airSlate SignNow, you have everything necessary to handle your documents efficiently. You can discover, fill out, modify, and even dispatch your Federal Credit Application Insurance Disclosure within a single tab without any inconvenience. Enhance your workflows by utilizing a singular, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill the JEE (Main) application form?

This is a step by step guide to help you fill your JEE (Main) application form online brought to you by Toppr. We intend to help you save time and avoid mistakes so that you can sail through this whole process rather smoothly. In case you have any doubts, please talk to our counselors by first registering at Toppr. JEE Main Application Form is completely online and there is no offline component or downloadable application form. Here are some steps you need to follow:Step 1: Fill the Application FormEnter all the details while filling the Online Application Form and choose a strong password and security question with a relevant answer.After entering the data, an application number will be generated and it will be used to complete the remaining steps. Make sure your note down this number.Once you register, you can use this number and password for further logins. Do not share the login credentials with anyone but make sure you remember them.Step 2: Upload Scanned ImagesThe scanned images of photographs, thumb impression and signature should be in JPG/JPEG format only.While uploading the photograph, signature and thumb impression, please see its preview to check if they have been uploaded correctly.You will be able to modify/correct the particulars before the payment of fees.Step 3: Make The PaymentPayment of the Application Fees for JEE (Main) is through Debit card or Credit Card or E Challan.E-challan has to be downloaded while applying and the payment has to be made in cash at Canara Bank or Syndicate Bank or ICICI bank.After successful payment, you will be able to print the acknowledgment page. In case acknowledgment page is not generated after payment, then the transaction is cancelled and amount will be refunded.Step 4: Selection of Date/SlotIf you have opted for Computer Based Examination of Paper – 1, you should select the date/slot after payment of Examination Fee.If you do not select the date/slot, you will be allotted the date/slot on random basis depending upon availability.In case you feel you are ready to get started with filling the application form, pleaseclick here. Also, if you are in the final stages of your exam preparation process, you can brush up your concepts and solve difficult problems on Toppr.com to improve your accuracy and save time.

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

What is the procedure for filling out the CPT registration form online?

CHECK-LIST FOR FILLING-UP CPT JUNE - 2017 EXAMINATION APPLICATION FORM1 - BEFORE FILLING UP THE FORM, PLEASE DETERMINE YOUR ELIGIBILITY AS PER DETAILS GIVEN AT PARA 1.3 (IGNORE FILLING UP THE FORM IN CASE YOU DO NOT COMPLY WITH THE ELIGIBILITY REQUIREMENTS).2 - ENSURE THAT ALL COLUMNS OF THE FORM ARE FILLED UP/SELECTED CORRECTLY AND ARE CORRECTLY APPEARING IN THE PDF.3 - CENTRE IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF. (FOR REFERENCE SEE APPENDIX-A).4 - MEDIUM OF THE EXAMINATION IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.5 - THE SCANNED COPY OF THE DECLARATION UPLOADED PERTAINS TO THE CURRENT EXAM CYCLE.6 - ENSURE THAT PHOTOGRAPHS AND SIGNATURES HAVE BEEN AFFIXED (If the same are not appearing in the pdf) AT APPROPRIATE COLUMNS OF THE PRINTOUT OF THE EXAM FORM.7 - ADDRESS HAS BEEN RECORDED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.8 - IN CASE THE PDF IS NOT CONTAINING THE PHOTO/SIGNATURE THEN CANDIDATE HAS TO GET THE DECLARATION SIGNED AND PDF IS GOT ATTESTED.9 - RETAIN A COPY OF THE PDF/FILLED-IN FORM FOR YOUR FUTURE REFERENCE.10 - IN CASE THE PHOTO/SIGN IS NOT APPEARING IN THE PDF, PLEASE TAKE ATTESTATIONS AND SEND THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION BY SPEED POST/REGISTERED POST ONLY.11 - KEEP IN SAFE CUSTODY THE SPEED POST/REGISTERED POST RECEIPT ISSUED BY POSTAL AUTHORITY FOR SENDING THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION FORM TO THE INSTITUTE/ RECEIPT ISSUED BY ICAI IN CASE THE APPLICATION IS DEPOSITED BY HAND.Regards,Scholar For CA089773 13131Like us on facebookScholar for ca,cma,cs https://m.facebook.com/scholarca...Sambamurthy Nagar, 5th Street, Kakinada, Andhra Pradesh 533003https://g.co/kgs/VaK6g0

-

How do I fill out the Assam CEE application form?

The application form for Assam CEE 2018 has been released on 1st March 2018.The last date for submission of the same is 20th March 2018.Filling up the Application FormAll information submitted must be valid and as per the documents possessed by the candidates.Uploading of Scanned DocumentsThe documents have to be uploaded according to the specifications mentioned by the DTE.Submission of Filled Application FormThe e-challan will be generated after the application form is successfully submitted.Payment of Application FeesThe candidates will be able to pay the required application fees of Rs. 600 through online (net banking/credit card/debit card) or offline mode (e-challan).For more information, visit this site: Assam CEE 2018 Application Form Released - Apply Now!

Create this form in 5 minutes!

How to create an eSignature for the federal credit application insurance disclosure form

How to make an electronic signature for the Federal Credit Application Insurance Disclosure Form in the online mode

How to create an electronic signature for your Federal Credit Application Insurance Disclosure Form in Chrome

How to create an electronic signature for putting it on the Federal Credit Application Insurance Disclosure Form in Gmail

How to make an electronic signature for the Federal Credit Application Insurance Disclosure Form from your smartphone

How to create an electronic signature for the Federal Credit Application Insurance Disclosure Form on iOS devices

How to make an electronic signature for the Federal Credit Application Insurance Disclosure Form on Android devices

People also ask

-

What is credit application insurance and how does it work?

Credit application insurance is a protection policy that safeguards lenders against losses when a borrower defaults on a loan. It works by providing coverage for the lender based on the creditworthiness of the applicant. Using airSlate SignNow, you can easily manage and eSign credit application insurance documents, ensuring a secure and efficient process.

-

What features does airSlate SignNow offer for managing credit application insurance?

AirSlate SignNow offers a range of features tailored for credit application insurance, including customizable templates, automated workflows, and secure eSignature options. These features streamline the application process and enhance document security. With easy integrations, you can seamlessly connect with your existing systems to better manage your credit application insurance needs.

-

How can credit application insurance benefit my business?

Implementing credit application insurance can signNowly reduce financial risk for your business when extending credit to customers. It provides peace of mind, knowing that you have protection against potential defaults. By using airSlate SignNow, you can simplify the process of obtaining and managing these insurance documents efficiently.

-

Is there a cost associated with using airSlate SignNow for credit application insurance?

Yes, there is a pricing structure for using airSlate SignNow, which varies based on your subscription plan. The cost is generally affordable, especially when considering the productivity gains and security enhancements it offers for managing credit application insurance. You can find detailed pricing information on our website or contact our sales team for personalized options.

-

Can I integrate airSlate SignNow with other software for credit application insurance?

Absolutely! airSlate SignNow provides robust integration options with various software tools to help manage credit application insurance. Whether you need to connect with CRM systems, accounting software, or other financial applications, our platform makes it seamless to improve your workflow efficiency and data management.

-

How secure is the process of signing credit application insurance documents with airSlate SignNow?

The security of your documents is our top priority at airSlate SignNow. We utilize industry-standard encryption protocols and comply with various regulations to ensure that credit application insurance documents are protected. Our platform provides a secure environment for you and your customers to eSign sensitive documents confidently.

-

Can multiple users access credit application insurance documents on airSlate SignNow?

Yes, airSlate SignNow supports multiple user access, allowing several team members to view and manage credit application insurance documents. You can control user permissions and collaborate efficiently on applications. This flexibility helps facilitate teamwork and ensures that everyone involved is up-to-date with the latest document versions.

Get more for Federal Credit Application Insurance Disclosure

Find out other Federal Credit Application Insurance Disclosure

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast