Credit Card Authorization Form

What is the Credit Card Authorization Form

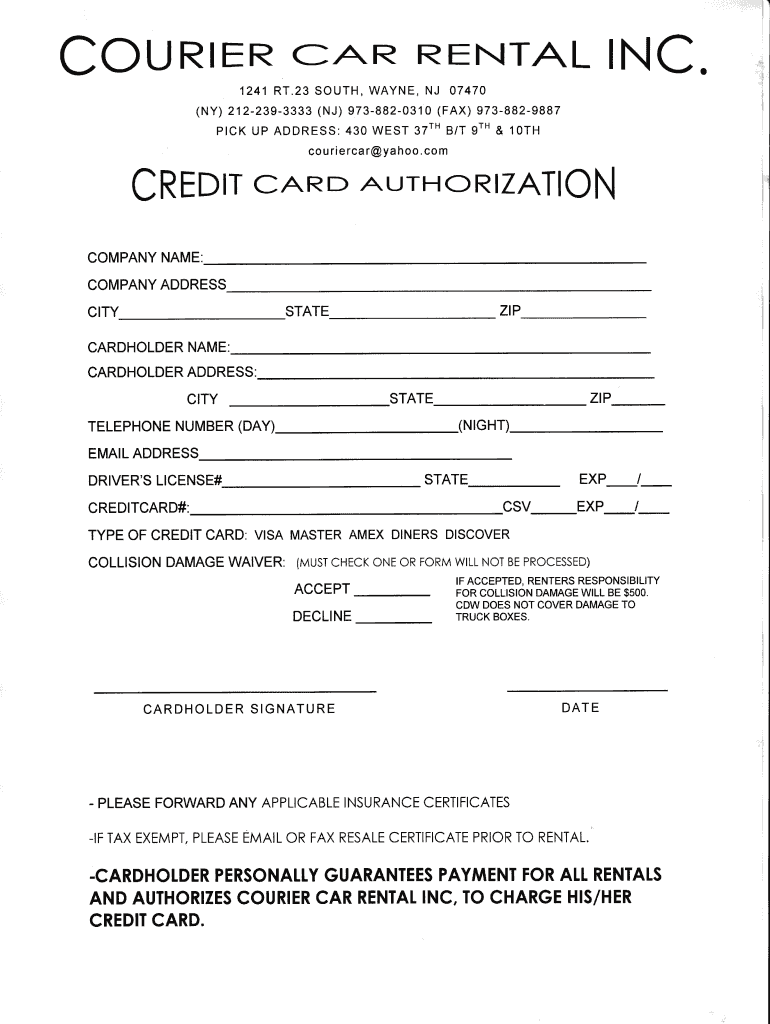

The credit card authorization form is a legal document that allows a business to charge a customer's credit card for a specified amount. This form is essential for transactions where the cardholder is not present, such as online purchases or reservations. By signing this form, the customer grants permission for the business to process charges to their credit card, ensuring that both parties are protected during the transaction.

How to Use the Credit Card Authorization Form

Using the credit card authorization form involves several straightforward steps. First, ensure that the form is fully completed with all necessary details, including the cardholder's name, card number, expiration date, and the amount to be charged. Next, the cardholder must sign the form, indicating their consent for the transaction. Once signed, the form should be securely stored by the business for record-keeping and compliance purposes. It is crucial to handle this document with care to protect sensitive information.

Steps to Complete the Credit Card Authorization Form

Completing the credit card authorization form requires attention to detail to ensure accuracy and legality. Follow these steps:

- Begin by entering the cardholder's name as it appears on the credit card.

- Fill in the credit card number, ensuring no digits are omitted.

- Include the expiration date and the security code (CVV) from the back of the card.

- Specify the amount to be charged and the purpose of the transaction.

- Have the cardholder sign and date the form to validate the authorization.

Legal Use of the Credit Card Authorization Form

The legal use of the credit card authorization form is governed by various regulations to protect consumers and businesses. It is essential that the form is used in compliance with the Fair Credit Billing Act and other applicable laws. This ensures that the cardholder's rights are upheld and that there is a clear record of consent for the charges made. Businesses should also be aware of state-specific regulations that may affect the use of this form.

Key Elements of the Credit Card Authorization Form

Several key elements should be included in a credit card authorization form to ensure its effectiveness and legality:

- Cardholder information, including name and contact details.

- Credit card details, such as the card number and expiration date.

- Amount to be charged and a description of the transaction.

- Signature of the cardholder and the date of authorization.

- Terms and conditions regarding the use of the card.

Examples of Using the Credit Card Authorization Form

The credit card authorization form can be utilized in various scenarios, including:

- Online retail transactions where the cardholder is not physically present.

- Hotel reservations requiring a deposit or guarantee.

- Subscription services that charge recurring fees.

- Rental services, such as car rentals, where a hold may be placed on the card.

Quick guide on how to complete credit card authorization form pdf cc rental

The simplest method to locate and endorse Credit Card Authorization Form

At the level of your entire organization, ineffective workflows surrounding paper approvals can consume substantial work hours. Endorsing documents like Credit Card Authorization Form is an inherent aspect of operations in any enterprise, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the firm’s overall performance. With airSlate SignNow, endorsing your Credit Card Authorization Form is as straightforward and swift as possible. This platform provides you with the latest version of nearly any document. Even better, you can endorse it instantly without needing to install external software on your computer or printing physical copies.

Steps to obtain and endorse your Credit Card Authorization Form

- Explore our collection by categorization or use the search box to find the document you require.

- View the document preview by clicking on Learn more to verify it’s the correct one.

- Select Get form to begin editing immediately.

- Fill out your document and provide any necessary details using the toolbar.

- Once finished, click the Sign tool to endorse your Credit Card Authorization Form.

- Choose the signing method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete editing and move to document-sharing options if needed.

With airSlate SignNow, you have everything you need to manage your documents efficiently. You can find, fill, modify, and even distribute your Credit Card Authorization Form in a single tab with no fuss. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Is it safe to give all my details: name, address, credit card number and CVV, when filling in a credit card authorization form?

Safety is relative.Ecommerce is safe as long as you know what to look for. If the site doesn't feel safe, go with your gut. Here are reasons why you have to fill out all of the information requested like name, address, CVV and full card number.1. When you are purchasing goods from a merchant, that merchant needs certain information to verify you are the valid cardholder. The merchant is assuming the real risk in assuming you aren't a fraudster using a stolen card. Put yourself in the merchant's position. Would you just take a card number and expiration date from some random cardholder and hope it's not a stolen card?2. Information such as Address and ZIP and CVV/CVC (Visa/MC) or CID (Amex/Disc) are tools to verify the card is valid. They mitigate risk for the merchant. Address and ZIP in a Card Not Present (CNP) situation also allow the merchant to get the best possible processing rates for that transaction. 3. A legitimate merchant will have a secure website (if this is the scenario to which you're referring). Look for 2 things when entering your payment information on the site.Secure Connection in the URL Address denoted by HTTPS:A Privacy and Security Statement that includes their Compliance and Security Assessor:4. Credit card numbers are created by a sophisticated algorithm which is why you can't simply input the last 4 digits into a form. There are sites that will allow you to enter the lat 4 digits once you have already registered with them to verify the choice of card, but this is after they have your card on file. There are billions of debit/credit cards in the world with different expiration dates, CVV values and different 11/12 beginning digits so the chances that your card is the only one with a unique 4 digit ending are pretty slim.What is not safe 1. Filling out a paper form with this same data and mailing it to someone. Imagine if it got lost and someone got this info. Shopping spree on the internet for them. It still amazes me that my water bill allows this info to be paid in this manner. I would never fill out a form with my credit card data an mail or fax it. A big no-no. 2. Never email you credit card data to anyone. This communication can be easily intercepted and go into the wrong hands. Email is a safe mode of transmitting sensitive card data..

-

How do I get my PAN card reference number? My money already debited, but I did not get the PDF of my form which I filled out.

If you applied for a PAN on line on one of the appointed sites you will soon hear from them. If there is no further response for 3 weeks then you may write to them giving details of date, name and payment reference. But I think need for that will not arise.

-

Why is Ikea requiring me to email them my credit card information in order to make a lousy appointment to see a kitchen planner? They’re requiring me to fill out forms, scan them, and email back.

The reason they are requiring your credit card information is because Ikea’s kitchen planning service isn’t free. In some cases, a portion of the planning and/or measuring fees may be reimbursed when you place your kitchen purchase, but the details may vary from store to store.

-

When you apply for a credit card on the phone, does the operator simply fill out a web form the way you would if you applied online? Or do you get to explain situations if you are denied at first?

Don't waste your time calling in, just fill it out online yourself. Your financial details and credit score are put through an automated system. Your credit history does all of the explaining for you unfortunately. Also, ditto to what Bryan said about higher end cards, they will actually take the time to verify your income and personal assets in some cases to offset tarnished credit.

-

I am trying to get my first credit card but no company will accept my application. How can I fill out the application differently to get accepted?

Look no farther than AmazonIf you are a frequent Amazon customer, as I was, you will have seen many prompts trying to get you to sign up for their rewards card. I didn’t really have a need for a credit card but I figured I might as well get the $70 or so as well as the cash back for signing up for a rewards card.I’m only 18 so I figured there was a high chance of being denied. I entered my information and was promptly denied. For some reason the prompts kept being displayed on my checkout pages, so after a month or so I applied again. Denied.Oh well… I thought.But one day I saw a new rewards card pop up. Rather than being through Synchrony Financial, this one was through Chase. Since I have no credit, it was reasonable that I was getting rejected. However, I currently have a Chase College Student Checking account and have had a Business and Savings account with them in the past. Because I was a current account holder I figured I would have a better chance.I applied one last time only to get waitlisted…? (I read too many college application questions)Waitlisted in this setting meant they needed to further review my application. I wasn’t very optimistic about the outcome but a few days later I found out I had been approved!My very first credit card: An Amazon Rewards Visa..How times have changed.Note: This only works with Chase, at least to my knowledge. You also do not need a cosigner for this method.

-

How do you feel about landlords that require you to fill out an app prior to seeing the rental property? My daughter is a CO, has a perfect rental history, and a very high credit score. We ran into this while she looks for a rental.

“How do you feel about landlords that require you to fill out an app prior to seeing the rental property? My daughter is a CO, has a perfect rental history, and a very high credit score. We ran into this while she looks for a rental.”I have a certain sympathy for landlords. It isn’t an easy way to make a living. You have huge capital tied up in immobile investments. One destructive tenant can wipe out the profits from 20 good ones.If you want a landlord who will show the property without asking questions until and unless you show an interest, you can probably find that. We had that when we rented our first apartment after retiring and selling our house (Liberty Lake Apts in Boise ID - great place BTW, we recommend them). The nice office lady showed us around the complex, and let us inside an empty unit just like the one we eventually rented. (That empty unit was already promised to someone else; the one we eventually rented was still occupied). Then we went back to the office and filled out applications.But anyways, it all comes down to supply and demand in a free market. If you want a landlord who asks no questions, you can find one. Probably a “slumlord” who doesn’t maintain the property and has lots of anti-social, destructive tenants who would make dangerous neighbors. If there is a glut of housing in your market, you can find landlords who bend over backwards to court you. If there is a housing shortage, you have to play by the landlords’ rules.

-

Even though you leave a credit card when you rent a car, if you total the car and did not take out insurance, if the credit line on the credit card is low, how does the car rental agency recoup their losses without going to court?

I do not know where this thing about being asked for proof of insurance is coming from. I am not a super frequent renter, maybe sixty or seventy times spread over fifty years but I have never once been asked for that. I have never even been asked if I had it. Of course I always got asked if I wanted their loss waiver and in refusing it I would say my insurance covered me.Why I never got asked for proof of insurance I do not know. I am being sent off in a car worth in excess of $15,000 secured by a credit card with a $5,000 limit. If I get into a serious accident and have no insurance and have not bought the loss waiver they are going to have to hunt me down for the excess.

Create this form in 5 minutes!

How to create an eSignature for the credit card authorization form pdf cc rental

How to create an electronic signature for your Credit Card Authorization Form Pdf Cc Rental online

How to create an eSignature for the Credit Card Authorization Form Pdf Cc Rental in Google Chrome

How to generate an eSignature for signing the Credit Card Authorization Form Pdf Cc Rental in Gmail

How to generate an electronic signature for the Credit Card Authorization Form Pdf Cc Rental straight from your mobile device

How to make an eSignature for the Credit Card Authorization Form Pdf Cc Rental on iOS devices

How to generate an eSignature for the Credit Card Authorization Form Pdf Cc Rental on Android OS

People also ask

-

What is an avis charge card and how does it work with airSlate SignNow?

An avis charge card is a flexible payment method that allows users to manage their business expenses efficiently. With airSlate SignNow, integrating your avis charge card simplifies the payment process for signing and sending documents, making transactions seamless.

-

What are the pricing options for using airSlate SignNow with an avis charge card?

airSlate SignNow offers several pricing plans that cater to various business needs. By using your avis charge card, you can select a plan that suits your budget while enjoying all the features offered, ensuring a cost-effective solution for document signing.

-

What features does airSlate SignNow provide when using an avis charge card?

When utilizing an avis charge card with airSlate SignNow, you gain access to robust features such as eSigning, document templates, and real-time collaboration tools. These features enhance the overall efficiency of handling documents and contracts in your business.

-

Are there any benefits to using an avis charge card with airSlate SignNow?

Yes, using an avis charge card with airSlate SignNow offers numerous benefits, including streamlined expense tracking and secure payments. This allows businesses to maintain control over their costs while enjoying the convenience of electronic signatures.

-

Can I integrate my avis charge card with airSlate SignNow?

Absolutely! airSlate SignNow allows for easy integration of your avis charge card, ensuring that you can manage payments efficiently. This integration means you won’t have to worry about multiple payment processes when sending and signing documents.

-

What security measures are in place when using an avis charge card on airSlate SignNow?

Security is a top priority when using an avis charge card with airSlate SignNow. The platform employs advanced encryption protocols and data protection measures, ensuring that your payment information and documents remain safe and secure.

-

How can I cancel a transaction made with my avis charge card on airSlate SignNow?

To cancel a transaction made with your avis charge card on airSlate SignNow, simply navigate to the account settings or transaction history. You'll find options to manage or reverse recent payments, ensuring every action is handled with ease.

Get more for Credit Card Authorization Form

- Printable 7 habits worksheet pdf form

- Intent to sue pdf form

- Sba releases new ppp loan forgiveness application forms

- Touhy letter sample form

- Immunization exemption form

- Examination fees invoice to name ship to ma form

- Transamerica continued monthly residence form

- Pre application request form tamworth borough council tamworth gov

Find out other Credit Card Authorization Form

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online