Chase Ach Form

What is the Chase ACH Form

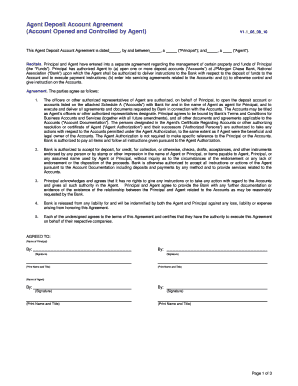

The Chase ACH form, also known as the Chase Bank ACH authorization form, is a document used to authorize automatic payments or direct deposits through the Automated Clearing House (ACH) network. This form allows individuals and businesses to electronically transfer funds between bank accounts, simplifying payment processes for recurring transactions, such as utility bills, loan payments, or payroll deposits. By completing this form, account holders grant permission to their bank to initiate these transactions on their behalf.

How to Use the Chase ACH Form

Using the Chase ACH form involves a few straightforward steps. First, you need to obtain the form, which is typically available through your bank or financial institution. Once you have the form, fill in the required information, including your bank account details, the amount to be transferred, and the frequency of the transaction. After completing the form, submit it to your bank or the organization requesting the authorization. Ensure that you keep a copy for your records to track the transactions associated with your authorization.

Steps to Complete the Chase ACH Form

Completing the Chase ACH form requires careful attention to detail. Follow these steps for accuracy:

- Obtain the Chase ACH form from your bank or the relevant organization.

- Fill in your personal information, including your name, address, and account number.

- Specify the type of transaction, whether it is a direct deposit or an automatic payment.

- Indicate the amount to be transferred and the frequency of the transaction (e.g., weekly, monthly).

- Sign and date the form to authorize the transactions.

- Submit the completed form to your bank or the requesting organization.

Key Elements of the Chase ACH Form

Several key elements must be included in the Chase ACH form to ensure it is valid and effective. These elements include:

- Account Holder Information: Full name, address, and contact details of the account holder.

- Bank Account Details: The account number and routing number for the bank account involved in the transaction.

- Transaction Details: The type of transaction (credit or debit), amount, and frequency.

- Authorization Signature: A signature from the account holder confirming consent for the transactions.

- Date: The date on which the authorization is signed.

Legal Use of the Chase ACH Form

The legal use of the Chase ACH form is governed by federal regulations that ensure the security and validity of electronic transactions. Under the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA), electronic signatures and records are legally binding, provided that certain conditions are met. This means that when you complete and sign the Chase ACH form electronically, it is considered a valid authorization for the bank to process the specified transactions.

Form Submission Methods

The Chase ACH form can be submitted through various methods, depending on the preferences of the bank or organization involved. Common submission methods include:

- Online Submission: Some banks allow users to submit the form electronically through their online banking portal.

- Mail: You can print the completed form and send it via postal mail to the appropriate bank address.

- In-Person: Visit your local bank branch to submit the form directly to a bank representative.

Quick guide on how to complete chase ach form

Complete Chase Ach Form effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Chase Ach Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to modify and eSign Chase Ach Form effortlessly

- Find Chase Ach Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you want to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, exhausting form searches, or errors that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Chase Ach Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chase ach form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the chase ach form and how does it work?

The chase ach form is a document used to authorize electronic fund transfers from a bank account. This form facilitates automated payments, making it easy for businesses to manage recurring transactions. Using airSlate SignNow, you can quickly fill out and eSign a chase ach form, ensuring secure and efficient processing of payments.

-

How can I access the chase ach form through airSlate SignNow?

You can easily access the chase ach form by navigating to our templates section within airSlate SignNow. Once there, you can locate the form, customize it to match your business needs, and send it for eSignature. This streamlined process saves time and ensures accuracy in your transactions.

-

Is there a cost associated with using the chase ach form in airSlate SignNow?

airSlate SignNow offers various pricing plans, which include the ability to use the chase ach form. Depending on your chosen plan, you can unlock different features to enhance your document management. We recommend reviewing our pricing page to find a plan that best suits your business needs.

-

What features does airSlate SignNow offer for managing the chase ach form?

airSlate SignNow provides a range of features for managing the chase ach form, including secure eSigning, templates, and audit trails. These tools enhance the efficiency of your electronic payments, making it easier to track and manage your transactions. You can also integrate the chase ach form with other business tools for seamless workflow.

-

How does eSigning the chase ach form benefit my business?

E-Signing the chase ach form provides several benefits, including faster turnaround times and reduced paperwork. It streamlines the process of obtaining authorization for transactions, leading to improved cash flow. By using airSlate SignNow, you also increase the security of sensitive payment information.

-

Can I integrate the chase ach form with other applications?

Yes, airSlate SignNow allows you to integrate the chase ach form with various third-party applications. This means you can streamline workflows by syncing data between platforms like accounting software and CRM systems. These integrations simplify the management of payments and help maintain accurate records.

-

How secure is the chase ach form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The chase ach form is protected with advanced encryption and authentication measures to safeguard your sensitive payment information. Our platform complies with industry standards, ensuring that all transactions remain secure and confidential.

Get more for Chase Ach Form

- Aws cwi renewal after 9 years form

- Nis philippines form

- Agent verification agreement minnesota energy resources form

- N 400 khmer translation 2414 form cambodian family

- Mobile coverage claim form security service ssfcu

- Scoutmasters key progress record form

- Do the math order form

- Mood assessment questionnaire form

Find out other Chase Ach Form

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter