Nyc 210 Form

What is the NYC 210 Form?

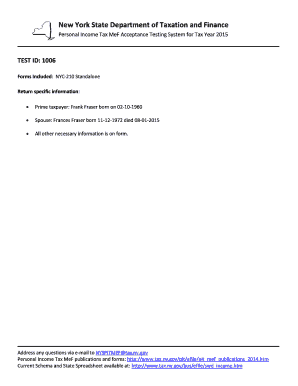

The NYC 210 Form, also known as the NYC School Tax Credit 2016 fillable form, is a tax document designed for eligible New York City residents. This form allows taxpayers to claim a credit for school taxes paid, helping to alleviate some of the financial burdens associated with education funding. The form is specific to the tax year 2016 and is part of the city’s efforts to provide financial relief to homeowners and renters who contribute to local school funding through their taxes.

How to Use the NYC 210 Form

Using the NYC 210 Form involves several steps to ensure accurate completion and submission. Taxpayers must first determine their eligibility for the school tax credit by reviewing the criteria outlined by the city. Once eligibility is confirmed, the form can be filled out with the necessary personal and financial information. It is important to gather all required documentation, such as proof of residency and tax payment records, to support the claim. After completing the form, it should be submitted according to the specified methods, ensuring all guidelines are followed to avoid delays.

Steps to Complete the NYC 210 Form

Completing the NYC 210 Form requires careful attention to detail. Here are the steps to follow:

- Review eligibility criteria to ensure you qualify for the school tax credit.

- Gather necessary documents, including proof of residency and tax payments.

- Fill out the form accurately, providing all required information.

- Double-check the form for any errors or omissions.

- Submit the completed form by the deadline, either online, by mail, or in person.

Legal Use of the NYC 210 Form

The NYC 210 Form must be used in compliance with local tax laws and regulations. To be considered legally valid, the form must be completed accurately and submitted within the designated time frame. Taxpayers should ensure that they are following the guidelines set forth by the New York City Department of Finance to avoid any potential legal issues. Proper use of the form can help secure the tax credits intended to provide financial relief to eligible residents.

Filing Deadlines / Important Dates

Filing deadlines for the NYC 210 Form are crucial for taxpayers to keep in mind. Typically, the form must be submitted by the tax filing deadline for the year in which the credit is claimed. For the 2016 tax year, this deadline would align with the general tax filing dates established by the IRS. It is advisable to check for any specific announcements from the New York City Department of Finance regarding any changes or extensions to these deadlines.

Form Submission Methods

The NYC 210 Form can be submitted through various methods, providing flexibility for taxpayers. Options for submission include:

- Online submission via the New York City Department of Finance website.

- Mailing the completed form to the appropriate address specified by the Department of Finance.

- In-person submission at designated city offices, allowing for immediate assistance if needed.

Quick guide on how to complete nyc 210 form 100674315

Prepare Nyc 210 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Nyc 210 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Nyc 210 Form with ease

- Find Nyc 210 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, either by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Nyc 210 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc 210 form 100674315

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYC 210 form 2016 used for?

The NYC 210 form 2016 is used to report the income tax obligations for businesses operating in New York City. This form is essential for ensuring compliance with local tax regulations and helps businesses accurately report their income to the city.

-

How can airSlate SignNow help with the NYC 210 form 2016?

AirSlate SignNow simplifies the process of filling out and eSigning the NYC 210 form 2016. With our user-friendly platform, you can easily create, edit, and manage your documents, making tax season less stressful and more efficient.

-

Is there a cost associated with using airSlate SignNow for the NYC 210 form 2016?

AirSlate SignNow offers a variety of pricing plans to suit different business needs. You can sign up for a free trial to explore the features and then choose a plan that best fits your requirements for managing the NYC 210 form 2016.

-

What features does airSlate SignNow offer for signing documents like the NYC 210 form 2016?

AirSlate SignNow provides features like customizable templates, easy eSigning, document sharing, and secure storage. These tools allow you to complete the NYC 210 form 2016 quickly and conveniently, ensuring you meet your deadlines.

-

Can I integrate airSlate SignNow with other software for the NYC 210 form 2016?

Yes, airSlate SignNow integrates seamlessly with various software solutions, including CRM systems and cloud storage. This integration is beneficial for managing the NYC 210 form 2016 alongside your other business processes.

-

Is it easy to access my documents for the NYC 210 form 2016 using airSlate SignNow?

Absolutely! With airSlate SignNow, you can access your documents for the NYC 210 form 2016 from anywhere at any time. Our cloud-based platform ensures you have your important documents readily available whenever you need them.

-

What benefits does eSigning the NYC 210 form 2016 provide?

eSigning the NYC 210 form 2016 not only saves time but also enhances security and reduces the risk of errors. AirSlate SignNow ensures your signatures are legally binding and compliant with regulations.

Get more for Nyc 210 Form

Find out other Nyc 210 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors