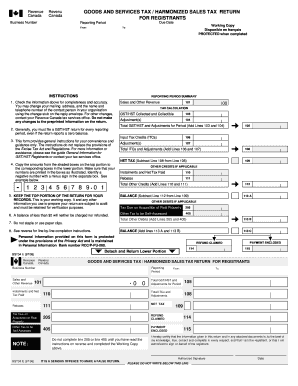

Gst34 Form

What is the Gst34?

The Gst34 is a specific form used primarily for tax purposes in the United States. It is designed to collect essential information from taxpayers, ensuring compliance with federal regulations. This form plays a crucial role in various financial transactions and is often required by institutions for record-keeping and auditing purposes. Understanding its purpose and requirements is vital for individuals and businesses alike.

How to use the Gst34

Using the Gst34 involves a straightforward process. First, gather all necessary information, including personal and financial details relevant to the form. Next, fill out the form accurately, ensuring that all fields are completed as required. Once the form is filled, it can be submitted electronically or printed for mailing, depending on the specific instructions provided for the Gst34. It is important to review the completed form for accuracy before submission to avoid potential issues.

Steps to complete the Gst34

Completing the Gst34 requires attention to detail. Follow these steps for successful submission:

- Gather necessary documents, such as identification and financial records.

- Access the Gst34 form through a reliable source.

- Fill in personal information, including name, address, and Social Security number.

- Provide any required financial details relevant to the form.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or print it for mailing, as per the guidelines.

Legal use of the Gst34

The Gst34 is legally binding when completed and submitted in accordance with established regulations. To ensure its legal validity, it must be filled out accurately and submitted through the appropriate channels. Compliance with federal and state laws is essential, as failure to adhere to these regulations can result in penalties or delays in processing. Utilizing a trusted eSignature platform can further enhance the legal standing of the completed form.

Key elements of the Gst34

Understanding the key elements of the Gst34 is crucial for proper completion. The form typically includes sections for personal identification, financial information, and specific declarations required by the IRS. Each section must be filled out carefully to ensure that all necessary information is provided. Additionally, any required signatures must be included to validate the form. Familiarity with these elements can streamline the process and reduce the likelihood of errors.

Filing Deadlines / Important Dates

Timely submission of the Gst34 is essential to avoid penalties. Important deadlines vary depending on the specific purpose of the form, such as tax filing dates or reporting requirements. It is advisable to check the IRS calendar or consult with a tax professional to stay informed about relevant dates. Being proactive in meeting these deadlines can help ensure compliance and prevent complications.

Who Issues the Form

The Gst34 is typically issued by the Internal Revenue Service (IRS) or relevant state tax authorities. These organizations provide the necessary guidelines and updates regarding the form's use and requirements. It is important to obtain the Gst34 from official sources to ensure that the correct version is being used and that all instructions are followed accurately.

Quick guide on how to complete gst34 48005385

Effortlessly prepare Gst34 on any device

Digital document management has gained popularity among businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documentation, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Gst34 on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to alter and electronically sign Gst34 without hassle

- Obtain Gst34 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sending your form, be it via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that require new copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Alter and electronically sign Gst34 and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst34 48005385

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is gst34 and how does it work with airSlate SignNow?

The gst34 is an essential feature in airSlate SignNow designed to simplify your eSignature process. By utilizing gst34, users can easily create, send, and manage signature requests efficiently. This streamlines document workflows and signNowly reduces turnaround times.

-

What are the pricing options for airSlate SignNow that include gst34 features?

airSlate SignNow offers flexible pricing plans that incorporate the gst34 functionalities. Customers can choose from various tiers based on their needs, ensuring they get the best value while benefiting from gst34. Each plan is designed to accommodate different business sizes and usage levels.

-

What are the main benefits of using gst34 with airSlate SignNow?

Using gst34 within airSlate SignNow provides numerous benefits, including enhanced document security, reduced processing times, and improved compliance. The gst34 feature allows businesses to manage their eSignatures efficiently, ultimately leading to better client relationships and accelerated business processes.

-

How does airSlate SignNow integrate with other software while using gst34?

airSlate SignNow seamlessly integrates with various applications, enhancing the effectiveness of the gst34 feature. Whether it’s CRM systems, cloud storage solutions, or accounting software, users can connect multiple tools easily, ensuring a streamlined workflow and enhanced productivity.

-

Can gst34 be used for both personal and business purposes?

Yes, the gst34 feature in airSlate SignNow is versatile enough for both personal and business uses. Individuals can facilitate personal documents, while businesses can efficiently manage contracts and agreements, all while enjoying the benefits of gst34 functionality.

-

Is it easy to use gst34 with airSlate SignNow for beginners?

Absolutely! The gst34 feature within airSlate SignNow is designed with user-friendliness in mind, making it accessible even for beginners. The intuitive interface guides users through the eSignature process, ensuring that anyone can send and manage documents with ease.

-

What security measures does airSlate SignNow implement for gst34 eSigning?

airSlate SignNow prioritizes security, especially for features like gst34. The platform uses industry-leading encryption and complies with regulations to ensure that all signed documents are secure and legally binding, protecting user data throughout the process.

Get more for Gst34

- Preschool child find questionnaire form

- Authorization form to release confidential information

- Release of information early childhood development maryland

- Student records review and update verification certification form

- Apprenticeship programs florida department of education form

- Partner agency referral tips form

- North carolina dietetic association ncdamemberclicksnet ncda memberclicks form

- Sampson county concealed carry permit form

Find out other Gst34

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form