Form 6251

What is the Form 6251

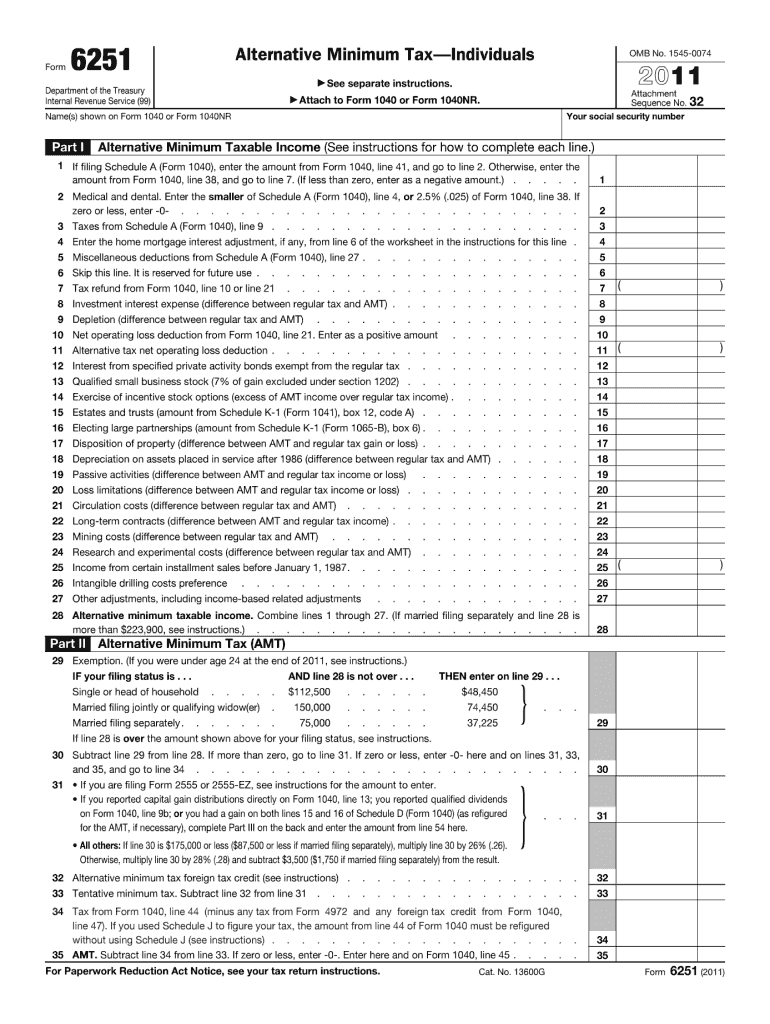

The Form 6251, also known as the Alternative Minimum Tax (AMT) Calculation, is a tax form used by individuals in the United States to determine their alternative minimum tax liability. This form is essential for taxpayers who may have a higher income or specific deductions that could trigger the AMT. The purpose of the AMT is to ensure that high-income earners pay a minimum amount of tax, regardless of deductions and credits that may significantly reduce their taxable income.

How to use the Form 6251

To use the Form 6251 effectively, taxpayers must first gather their financial documents, including income statements, deductions, and credits. The form requires specific calculations that may involve adjustments to taxable income. Taxpayers should follow the instructions provided on the form closely, ensuring they report all relevant information accurately. It is advisable to consult tax software, like TurboTax, which can simplify the process by guiding users through the necessary steps and calculations.

Steps to complete the Form 6251

Completing the Form 6251 involves several key steps:

- Gather necessary financial documents, including W-2s and 1099s.

- Calculate your regular tax liability using the appropriate forms.

- Complete the sections of Form 6251 that require adjustments to your income.

- Determine your AMT liability by following the calculations outlined in the form.

- Transfer the AMT amount to your main tax return.

Each step must be approached with care to ensure accuracy and compliance with IRS guidelines.

Key elements of the Form 6251

The Form 6251 includes several key elements that are crucial for determining AMT liability:

- Income adjustments: Certain types of income may need to be adjusted for AMT calculations.

- Deductions: Some deductions allowed under regular tax rules may not apply under AMT.

- Exemptions: Taxpayers may be eligible for AMT exemptions, which reduce the amount of income subject to AMT.

- Tax rates: The AMT has its own tax rates that differ from regular income tax rates.

Understanding these elements is essential for accurately completing the form and determining tax liability.

IRS Guidelines

The IRS provides specific guidelines for completing Form 6251, which include detailed instructions on how to report income, deductions, and credits. Taxpayers should refer to the latest IRS publications related to the AMT for updates and clarifications. These guidelines help ensure compliance with federal tax laws and provide insight into how the AMT affects overall tax liability.

Filing Deadlines / Important Dates

Form 6251 must be filed along with the taxpayer's regular income tax return. The standard deadline for filing individual tax returns is April 15 of each year, unless an extension is granted. It is important to be aware of any changes to filing deadlines, especially in light of special circumstances that may affect tax filing, such as natural disasters or legislative changes.

Quick guide on how to complete form 6251

Effortlessly prepare Form 6251 on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and without delays. Handle Form 6251 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to easily modify and electronically sign Form 6251

- Obtain Form 6251 and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or a shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 6251 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 6251

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 6251 TurboTax, and why is it important?

Form 6251 TurboTax is a tax form used to determine your alternative minimum tax (AMT) liability. It's crucial for taxpayers whose income exceeds certain thresholds, as it helps in calculating if they owe additional taxes. Understanding what is Form 6251 TurboTax can help ensure proper compliance and potentially avoid unexpected tax bills.

-

How does airSlate SignNow help with tax document management?

AirSlate SignNow simplifies the management of tax documents, including Form 6251 TurboTax, by providing a secure platform for eSigning and document sharing. Businesses can easily send tax forms for signature, ensuring a streamlined process that saves time and reduces paperwork. This efficiency is especially beneficial during tax season.

-

What features of airSlate SignNow make it suitable for handling tax forms?

AirSlate SignNow offers features like customizable templates, secure storage, and in-app collaboration, making it easy to handle tax forms such as Form 6251 TurboTax. The platform’s user-friendly interface enables quick completion and signing of documents, ensuring you stay compliant with tax regulations.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow provides a free trial that allows potential customers to explore features, including those related to document management for taxes like Form 6251 TurboTax. This trial enables users to assess the platform’s capabilities and determine if it meets their business needs before committing to a subscription.

-

How can I integrate airSlate SignNow with my existing accounting software?

AirSlate SignNow easily integrates with various accounting software, making it convenient to manage documents related to taxes, including Form 6251 TurboTax. This integration allows seamless data transfer and helps maintain consistency across your financial records, simplifying your overall accounting processes.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers a range of pricing plans to cater to businesses of all sizes. By evaluating what is Form 6251 TurboTax and similar forms, companies can choose a plan that fits their document management and eSignature needs while ensuring compliance with tax regulations at an affordable cost.

-

Can airSlate SignNow help track the status of tax documents?

Absolutely! AirSlate SignNow includes tracking features that allow you to monitor the status of tax documents, including Form 6251 TurboTax. This ensures that you stay informed about who has signed, and who still needs to take action, enhancing workflow efficiency.

Get more for Form 6251

- Verification sheet independent form

- Your personal academic plan form

- Non degree seeking graduate and professional students form

- Official transcript request form texas aampampm university

- Download our scholarship application form csea local 1000

- Letter of transient permission form the university of west georgia westga

- Pre admission screening pre operative order sheet upmccom form

- Edit data sharing agreementdocx form

Find out other Form 6251

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed