3gpkimg Form

What is the 3gpkimg?

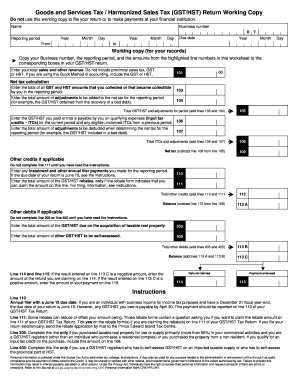

The 3gpkimg is a specific file format used in the context of Canada’s Goods and Services Tax (GST) and Harmonized Sales Tax (HST) filing. This format is designed to facilitate the electronic submission of tax-related documents, ensuring that businesses comply with Canadian tax regulations. It contains essential data required for filing GST and HST returns, making it a crucial component for businesses operating in Canada.

How to use the 3gpkimg

To utilize the 3gpkimg effectively, businesses must first ensure they have the appropriate software that supports this file format. Once the software is in place, users can import their GST or HST data into the 3gpkimg file. This process typically involves entering financial information, such as sales and tax collected, into the designated fields. After completing the data entry, the file can be saved and submitted electronically to the Canada Revenue Agency (CRA) as part of the GST and HST filing process.

Steps to complete the 3gpkimg

Completing the 3gpkimg involves several key steps:

- Gather all necessary financial documents, including sales records and previous tax filings.

- Open your tax software that supports the 3gpkimg format.

- Enter the required information into the designated fields, ensuring accuracy.

- Review the data for any errors or omissions.

- Save the completed file in the 3gpkimg format.

- Submit the file electronically to the CRA through the appropriate channels.

Filing Deadlines / Important Dates

Filing deadlines for GST and HST returns are critical for compliance. Businesses must be aware of the specific dates applicable to their reporting periods. Generally, quarterly filers must submit their returns within one month after the end of each quarter, while annual filers have a deadline of three months after their fiscal year-end. Missing these deadlines can result in penalties and interest charges, making it essential for businesses to stay informed about their obligations.

Required Documents

When preparing to file using the 3gpkimg, businesses should have several key documents on hand:

- Sales records detailing all taxable and exempt sales.

- Invoices issued to customers.

- Records of GST and HST collected.

- Any relevant receipts for purchases that include GST or HST.

Having these documents readily available will streamline the process of completing the 3gpkimg and ensure that all necessary information is accurately reported.

Penalties for Non-Compliance

Failure to comply with GST and HST filing requirements can lead to significant penalties. Businesses may face fines based on the amount of tax owed, as well as interest on any late payments. Additionally, repeated non-compliance can result in more severe consequences, including audits or increased scrutiny from tax authorities. It is crucial for businesses to adhere to filing deadlines and maintain accurate records to avoid these penalties.

Quick guide on how to complete 3gpkimg

Accomplish 3gpkimg with ease on any device

Digital document management has gained traction among businesses and individuals alike. It offers a fantastic eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools you require to generate, modify, and eSign your documents quickly and without delays. Handle 3gpkimg on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign 3gpkimg effortlessly

- Locate 3gpkimg and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact confidential information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then hit the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 3gpkimg and guarantee outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 3gpkimg

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 3gpkimg and how does it relate to airSlate SignNow?

3gpkimg is a crucial file format supported by airSlate SignNow that enhances the electronic signing process. This format allows users to easily manage and sign documents while ensuring security and compliance. By utilizing 3gpkimg, businesses can streamline their workflows and improve collaboration.

-

How much does airSlate SignNow cost for using 3gpkimg?

Pricing for airSlate SignNow varies depending on the plan chosen, but it is designed to be cost-effective for all business sizes. Subscribing to airSlate SignNow allows you to work seamlessly with 3gpkimg files and other formats. Contact us for detailed pricing information tailored to your specific needs.

-

What features does airSlate SignNow offer for 3gpkimg files?

AirSlate SignNow offers a range of features tailored for 3gpkimg files including document editing, advanced templates, and powerful eSigning capabilities. Users can also track the status of documents signed in the 3gpkimg format, ensuring efficient management of their business processes. The user-friendly interface makes accessing these features simple and intuitive.

-

Can airSlate SignNow integrate with other applications while using 3gpkimg?

Yes, airSlate SignNow easily integrates with various applications to enhance your workflow while managing 3gpkimg files. Popular integrations include Google Drive, Salesforce, and Microsoft Office, among others. This interoperability ensures that you can efficiently work across different platforms without disrupting your process.

-

What benefits does airSlate SignNow provide when handling 3gpkimg documents?

Utilizing airSlate SignNow for 3gpkimg documents offers numerous benefits such as improved efficiency, reduced turnaround times, and enhanced security. With electronic signing, you eliminate the need for paper, ultimately saving time and costs. Additionally, the platform’s compliance features give businesses peace of mind.

-

Is airSlate SignNow user-friendly for new users handling 3gpkimg?

Absolutely! airSlate SignNow is designed with user experience in mind, making it intuitive for new users to handle 3gpkimg documents. Step-by-step guides and tutorials are available to help users get started quickly. You will be signing your 3gpkimg documents in no time.

-

What support does airSlate SignNow provide for users working with 3gpkimg?

AirSlate SignNow offers comprehensive customer support for users of 3gpkimg files, including live chat, email support, and a robust knowledge base. Whether you have technical questions or need help navigating features, our support team is ready to assist. We ensure that you can make the most of your experience with 3gpkimg.

Get more for 3gpkimg

- 2019 d 30 district of columbia office of tax and revenue dcgov form

- Board of appeals petition form reed smith llp

- 2019 business income amp receipts tax form

- Individual vehicle mileage record ifta 300 formspublications

- D 76 estate tax instructions form

- Complete a change in business status form

- Uh form wh 1 university of hawaii financial management

- Rev 1220 tr 05 20 fi form

Find out other 3gpkimg

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice