Ptax 340 Form

What is the Ptax 340 Form

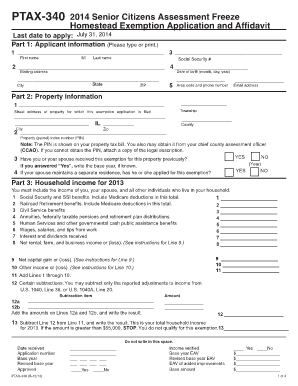

The Ptax 340 Form is a crucial document used in the property tax assessment process in the United States. It is primarily utilized by property owners to appeal their property tax assessments. This form allows taxpayers to formally contest the valuation of their property, which can significantly impact their tax obligations. Understanding the purpose and function of the Ptax 340 Form is essential for property owners who believe their assessments are inaccurate or unfair.

How to obtain the Ptax 340 Form

To obtain the Ptax 340 Form, individuals can typically visit their local tax assessor's office or the official website of their state or county tax authority. Many jurisdictions provide the form online for easy access. It is advisable to check with the local tax office for any specific requirements or additional documentation that may be needed when requesting the form. In some cases, the form may also be available at public libraries or community centers.

Steps to complete the Ptax 340 Form

Completing the Ptax 340 Form requires careful attention to detail. Here are the essential steps:

- Begin by entering your personal information, including your name, address, and contact details.

- Provide the property details, including the property address and parcel number.

- Clearly state the reason for the appeal, outlining any discrepancies in the property assessment.

- Attach any supporting documentation that substantiates your claim, such as recent appraisals or comparable property sales.

- Review the completed form for accuracy and completeness before submitting.

Legal use of the Ptax 340 Form

The Ptax 340 Form serves a legal function in the property tax appeal process. When submitted correctly, it initiates a formal review of the property assessment by the relevant tax authority. This form must be filled out accurately to ensure that the appeal is considered valid. Legal guidelines dictate that property owners must adhere to specific filing deadlines and procedures to maintain their right to contest the assessment.

Key elements of the Ptax 340 Form

Several key elements must be included in the Ptax 340 Form to ensure its effectiveness:

- Property Identification: Accurate details about the property, including its location and parcel number.

- Taxpayer Information: Complete contact information for the individual filing the appeal.

- Reason for Appeal: A clear and concise explanation of why the property assessment is being contested.

- Supporting Documentation: Any evidence that supports the appeal, such as appraisals or market analysis.

Form Submission Methods

The Ptax 340 Form can be submitted through various methods, depending on local regulations. Common submission options include:

- Online Submission: Many jurisdictions allow electronic filing through their official websites.

- Mail: The form can often be printed and mailed to the appropriate tax office.

- In-Person: Property owners may also submit the form directly at their local tax assessor's office.

Quick guide on how to complete ptax 340 form

Effortlessly prepare Ptax 340 Form on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Ptax 340 Form on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Ptax 340 Form with ease

- Obtain Ptax 340 Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ptax 340 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 340 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ptax 340 Form?

The Ptax 340 Form is a property tax assessment form used in Illinois. It is essential for property owners to understand its implications for tax assessments and appeals. airSlate SignNow simplifies the process of completing and submitting the Ptax 340 Form electronically, saving you time and enhancing accuracy.

-

How can airSlate SignNow help with the Ptax 340 Form?

airSlate SignNow offers a streamlined platform for filling out and electronically signing the Ptax 340 Form. With our user-friendly interface, you can easily complete the form and share it securely with the relevant authorities. Our features ensure that your Ptax 340 Form is processed quickly and efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to suit business needs. You can choose from various options based on the number of users and features required, including support for the Ptax 340 Form. Our competitive pricing ensures that you get great value while handling important documents like the Ptax 340 Form.

-

Is it easy to integrate airSlate SignNow with other software for handling the Ptax 340 Form?

Yes, airSlate SignNow integrates seamlessly with various software applications, making it easy to manage your Ptax 340 Form alongside other documents. Our integrations enhance workflow efficiency, allowing you to import data directly into the form. This capability reduces errors and saves you time.

-

What benefits does airSlate SignNow offer for managing the Ptax 340 Form?

With airSlate SignNow, you benefit from enhanced accuracy, security, and speed when managing the Ptax 340 Form. Our electronic signatures and secure sharing options ensure that your documents are valid and protected. This simplifies the process of submitting necessary forms and keeps you compliant.

-

Can I track changes made to the Ptax 340 Form using airSlate SignNow?

Absolutely! airSlate SignNow provides features for tracking changes and managing versions of the Ptax 340 Form. This transparency helps you maintain oversight over document revisions and ensures that you are always working with the most up-to-date information.

-

What type of support is available for using airSlate SignNow with the Ptax 340 Form?

We offer comprehensive support for users needing assistance with the Ptax 340 Form on airSlate SignNow. Our customer support team is available via chat, email, or phone to address your queries. Additionally, we provide helpful resources and tutorials to guide you through the process.

Get more for Ptax 340 Form

- Form 110

- Db6ba medicare form

- 2017 2020 form ssa 44 fill online printable fillable blank

- B300 section 77g depot licence application form

- Sf500 application for a budgeting loan form

- How to apply for a watch rating certificate govuk form

- S pass application form filled sample fill out and sign

- Nat 1067 form

Find out other Ptax 340 Form

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself