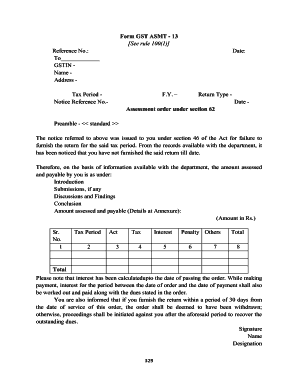

Asmt 13 Word Format

What is the ASMT 12 Format?

The ASMT 12 format is a specific document used primarily for assessment purposes within various sectors, including education and taxation. This format is designed to standardize the collection of necessary information, ensuring that all required fields are filled out accurately. The ASMT 12 format is particularly relevant in contexts where data consistency and legal compliance are essential.

Key Elements of the ASMT 12 Format

Several key elements define the ASMT 12 format, making it essential for users to understand its structure. These include:

- Identification Information: This section typically requires the name, address, and identification number of the individual or entity submitting the form.

- Assessment Details: Users must provide specific details regarding the assessment being conducted, including the purpose and relevant dates.

- Signature Section: A designated area for signatures is crucial, as it validates the authenticity of the document.

- Compliance Statements: Statements affirming adherence to applicable laws and regulations are often included to ensure legal validity.

Steps to Complete the ASMT 12 Format

Completing the ASMT 12 format requires careful attention to detail. Here are the steps involved:

- Obtain the ASMT 12 Form: Ensure you have the correct version of the form, which can typically be downloaded from official sources.

- Fill in Identification Information: Accurately enter your personal or business identification details.

- Provide Assessment Details: Clearly state the purpose of the assessment and any relevant dates.

- Review for Accuracy: Double-check all entries for completeness and correctness to avoid issues later.

- Sign and Date the Form: Ensure all required signatures are provided, as this is critical for the document's validity.

- Submit the Form: Follow the appropriate submission method, whether online, by mail, or in person, as dictated by the governing body.

Legal Use of the ASMT 12 Format

The ASMT 12 format is legally binding when completed correctly. To ensure its legal use, it is essential to comply with relevant regulations. This includes adhering to eSignature laws such as the ESIGN Act and UETA, which govern the validity of electronic signatures. Additionally, maintaining accurate records and ensuring that all parties involved understand the document's implications is crucial for its legal standing.

Form Submission Methods

Submitting the ASMT 12 can be done through various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online Submission: Many agencies allow for electronic submission through secure portals, streamlining the process.

- Mail Submission: Traditional mail is still a viable option, requiring careful attention to postage and delivery times.

- In-Person Submission: Some forms may need to be submitted directly at designated locations, ensuring immediate processing.

Quick guide on how to complete asmt 13 word format

Complete Asmt 13 Word Format effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It provides an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents rapidly and without delays. Manage Asmt 13 Word Format on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Asmt 13 Word Format with ease

- Locate Asmt 13 Word Format and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your updates.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Asmt 13 Word Format and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the asmt 13 word format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is asmt 12 and how does it work with airSlate SignNow?

Asmt 12 is a feature offered by airSlate SignNow that streamlines the process of creating and managing electronic signatures. With this feature, users can easily prepare, send, and sign documents securely and efficiently, ensuring compliance and enhancing productivity.

-

How much does it cost to use airSlate SignNow with asmt 12?

airSlate SignNow offers competitive pricing plans that include access to the asmt 12 feature. The pricing varies based on the number of users and additional features required, but it remains an affordable solution for businesses looking to leverage eSigning capabilities.

-

What are the key features of asmt 12 in airSlate SignNow?

Asmt 12 includes essential features such as template creation, automated workflows, and real-time notifications. These features help businesses manage the signing process efficiently, reducing the time spent on document handling and improving overall operational efficiency.

-

How can asmt 12 benefit my business?

By utilizing asmt 12, businesses can achieve faster turnaround times for document approvals and enhance security through encrypted signing. The streamlined process not only saves time but also enhances customer satisfaction by making transactions seamless.

-

Can I integrate asmt 12 with other applications?

Yes, airSlate SignNow allows for integration with various applications, enhancing the functionality of the asmt 12 feature. Common integrations include CRM systems, project management tools, and cloud storage solutions, enabling a smoother workflow across your organization.

-

Is there a mobile version available for using asmt 12?

Absolutely! airSlate SignNow provides a mobile-friendly version that allows users to access the asmt 12 feature on-the-go. This enables users to send, manage, and sign documents from their smartphones or tablets, increasing flexibility and accessibility.

-

What kind of support is available for asmt 12 users?

airSlate SignNow offers comprehensive customer support for users of the asmt 12 feature. This includes access to documentation, tutorials, and a dedicated support team ready to assist with any questions or issues, ensuring that you maximize the use of the software.

Get more for Asmt 13 Word Format

Find out other Asmt 13 Word Format

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself