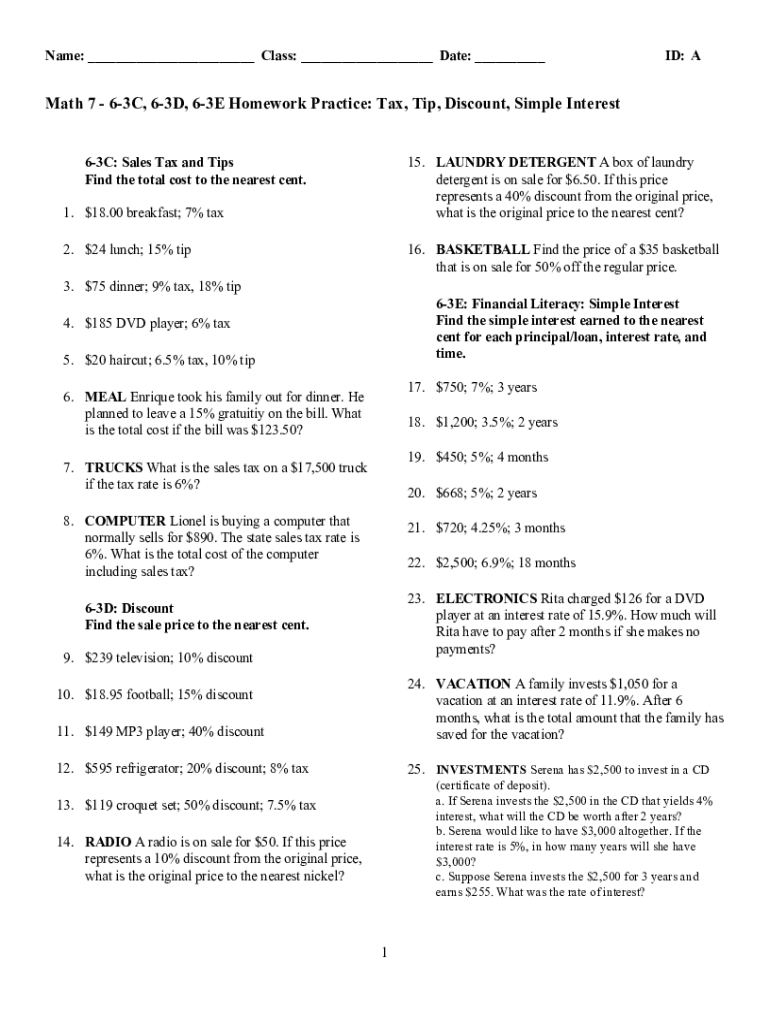

Tax and Tip Worksheet Form

What is the Tax and Tip Worksheet

The tax and tip worksheet is a crucial document used by employees in the service industry to report tips received and calculate the associated taxes. This worksheet helps ensure compliance with IRS regulations by accurately documenting tip income, which may not always be reported through traditional payroll systems. The worksheet typically includes sections for listing daily tips, calculating total income, and determining the tax liability based on that income.

How to Use the Tax and Tip Worksheet

Using the tax and tip worksheet involves several straightforward steps. First, gather all necessary information about your tip income, including cash tips, credit card tips, and any other forms of compensation. Next, fill in the daily tip amounts in the designated sections of the worksheet. Once all daily amounts are recorded, sum these figures to find your total tip income for the reporting period. Finally, use the worksheet to calculate your tax obligations based on the total income reported, ensuring that you are compliant with federal and state tax laws.

Steps to Complete the Tax and Tip Worksheet

To complete the tax and tip worksheet effectively, follow these steps:

- Gather all relevant documentation, including pay stubs and records of tips received.

- Record daily tips in the appropriate sections, ensuring accuracy.

- Calculate the total tips for the reporting period by summing daily amounts.

- Determine the applicable tax rates based on your total income.

- Complete the tax calculations and review for accuracy before submission.

Key Elements of the Tax and Tip Worksheet

The tax and tip worksheet includes several key elements that are essential for accurate reporting. These elements typically consist of:

- Sections for recording daily tip amounts.

- Fields for calculating total tip income.

- Tax rate information based on income brackets.

- Signature line for verification of the information provided.

Legal Use of the Tax and Tip Worksheet

Legally, the tax and tip worksheet is recognized as an important tool for reporting income to the IRS. It ensures that employees accurately declare their tip income, which is subject to federal income tax and Social Security tax. Proper use of this worksheet can help prevent discrepancies during tax audits and ensures compliance with IRS regulations. It is advisable to retain copies of completed worksheets for personal records.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of tip income. According to IRS regulations, employees must report tips that exceed twenty dollars in a month. The tax and tip worksheet serves as a means to document these earnings accurately. It is important to adhere to these guidelines to avoid penalties and ensure that all income is reported correctly. Familiarizing oneself with IRS publications related to tip income can provide further clarity on compliance requirements.

Quick guide on how to complete tax and tip worksheet

Complete Tax And Tip Worksheet effortlessly on any device

Online document management has become prevalent among companies and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without any delays. Manage Tax And Tip Worksheet on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Tax And Tip Worksheet without stress

- Find Tax And Tip Worksheet and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax And Tip Worksheet and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax and tip worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax and tip worksheet?

A tax and tip worksheet is a useful tool designed to help individuals and businesses calculate and document taxes and tips accurately. It simplifies the process, ensuring compliance with regulations while facilitating financial tracking. With airSlate SignNow, you can easily create and share your tax and tip worksheet for efficient record-keeping.

-

How does airSlate SignNow enhance the use of a tax and tip worksheet?

airSlate SignNow provides an intuitive platform that allows users to eSign and manage tax and tip worksheets seamlessly. This simplifies the sharing process among team members and clients, ensuring that everyone has access to updated documents. With our solution, you can streamline workflows and reduce the time spent on paperwork.

-

Is there a cost associated with creating a tax and tip worksheet using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. While some features can be accessed for free, creating and using a comprehensive tax and tip worksheet may require a subscription. However, our pricing is competitive and designed to provide excellent value for businesses of all sizes.

-

Can I customize my tax and tip worksheet with airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your tax and tip worksheet to meet your specific requirements. You can add fields, adjust layouts, and include company branding, ensuring that your worksheets align with your business identity and operational needs.

-

What benefits does a tax and tip worksheet offer?

A tax and tip worksheet offers several benefits, including accurate record-keeping, simplified calculations, and compliance with tax laws. It also helps businesses track employee tips effectively and manage finances better. Using airSlate SignNow ensures that your worksheets are electronically signed and securely stored, adding another layer of professionalism.

-

Does airSlate SignNow integrate with other software for tax and tip worksheets?

Yes, airSlate SignNow integrates seamlessly with various accounting and finance software, facilitating the easy transfer of information. This allows you to automatically populate your tax and tip worksheet with data from other applications, reducing manual entry and minimizing errors. Our integration capabilities enhance your overall efficiency.

-

Can I access my tax and tip worksheet on mobile devices?

Certainly! The airSlate SignNow platform is accessible on mobile devices, allowing you to create, edit, and sign your tax and tip worksheet on the go. This flexibility ensures that you can manage your documents anytime, anywhere, making it ideal for busy professionals and teams that require remote access.

Get more for Tax And Tip Worksheet

- Sss sickness notification form

- 221g document submission email form

- Change management simulation power and influence cheat sheet form

- Ies r form

- Dfw terminal map form

- Quality control in cleaning services pdf form

- Unit rates and ratios of fractions matching worksheet answers form

- Winz landlord registration form

Find out other Tax And Tip Worksheet

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word