Form 8554 Online

What is the Form 8554 Online

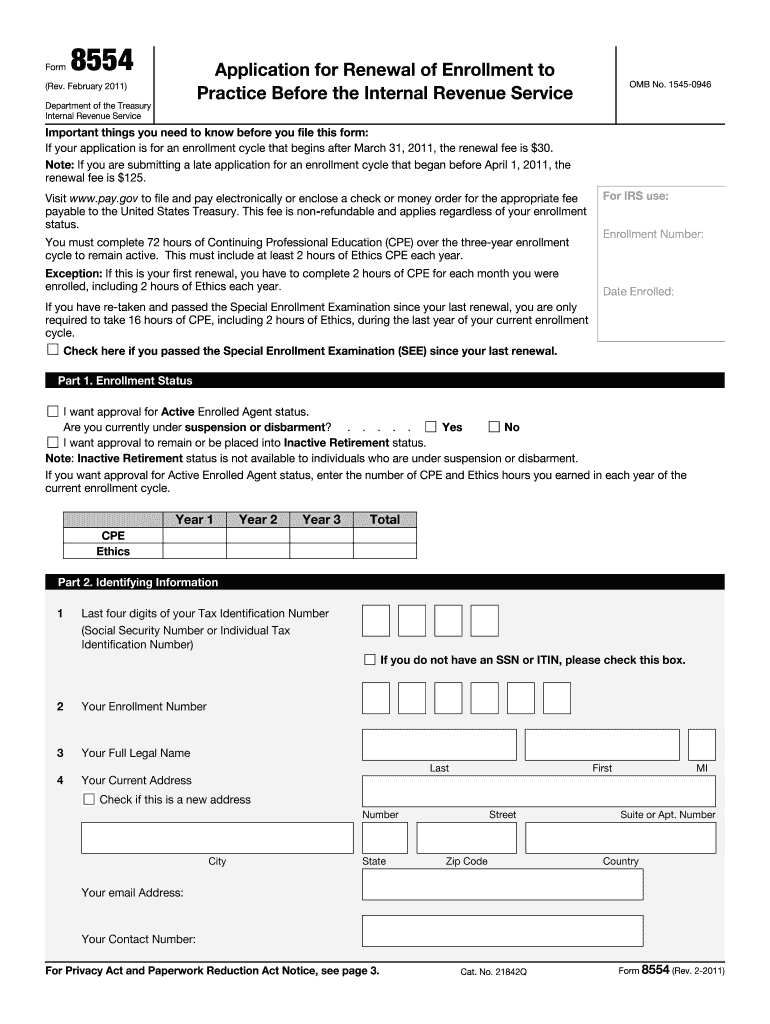

The Form 8554 is an application used by certain tax-exempt organizations to notify the IRS of their intent to maintain their tax-exempt status. This form is particularly relevant for organizations that are required to file annual returns, such as Form 990, to remain compliant with federal regulations. By submitting Form 8554 online, organizations can streamline their communication with the IRS, ensuring that they meet necessary requirements and deadlines.

How to use the Form 8554 Online

Using the Form 8554 online involves several steps to ensure accurate completion and submission. First, access the form through a reliable e-signature platform, which provides a user-friendly interface for filling out the necessary fields. Next, gather all required information, such as the organization’s name, address, and tax identification number. Complete the form by entering the relevant details and review for accuracy. Finally, submit the form electronically, which allows for immediate processing and confirmation of receipt by the IRS.

Steps to complete the Form 8554 Online

Completing the Form 8554 online can be done efficiently by following these steps:

- Access the Form 8554 through a trusted e-signature platform.

- Input the organization’s legal name and contact information.

- Provide the organization’s EIN (Employer Identification Number) accurately.

- Fill in any additional required fields, ensuring all information is correct.

- Review the completed form for any errors or omissions.

- Submit the form electronically for processing.

Legal use of the Form 8554 Online

The legal validity of the Form 8554 online hinges on compliance with federal regulations governing electronic signatures. To ensure that the form is legally binding, it must be signed using a secure e-signature solution that adheres to the ESIGN Act and UETA guidelines. This means that the electronic signature must be verifiable and linked to the signatory, providing an audit trail that confirms the identity of the signer and the time of signing.

Filing Deadlines / Important Dates

Timely filing of the Form 8554 is crucial for maintaining tax-exempt status. Organizations should be aware of the specific deadlines associated with their tax year. Generally, the form should be filed by the 15th day of the fifth month after the end of the organization’s tax year. Missing this deadline can result in penalties or loss of tax-exempt status, making it essential to plan ahead and file on time.

Required Documents

When completing the Form 8554 online, organizations must have certain documents ready to ensure accurate submission. These may include:

- The organization’s IRS determination letter confirming tax-exempt status.

- Financial statements or records that support the organization's activities.

- Any previous tax returns filed, such as Form 990.

Having these documents at hand will facilitate a smoother completion process and help avoid potential delays.

Quick guide on how to complete form 8554 online

Effortlessly Prepare Form 8554 Online on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage Form 8554 Online on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest method to modify and eSign Form 8554 Online without stress

- Obtain Form 8554 Online and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or blackout confidential information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your adjustments.

- Choose how you would prefer to distribute your form, whether by email, text message (SMS), invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8554 Online and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8554 online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8554 and why is it important?

Form 8554 is a critical document used by tax professionals to maintain their enrollment with the IRS as an authorized e-file provider. It ensures that your practice can legally file taxes electronically, enhancing your operational capabilities, and ultimately improving client satisfaction.

-

How can airSlate SignNow help with form 8554 submission?

airSlate SignNow streamlines the process of completing and submitting form 8554 by allowing users to electronically sign documents and send them securely. With our platform, you can complete this essential form quickly, ensuring compliance and timely submission to the IRS.

-

What features does airSlate SignNow offer for managing form 8554?

airSlate SignNow provides features such as custom templates, secure document storage, and easy sharing options specifically for form 8554. Our platform also allows for real-time collaboration, making it convenient for tax professionals to work together on this form effectively.

-

Is there a cost to use airSlate SignNow for submitting form 8554?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs. Investing in our service allows for seamless eSigning and document management, which can save you time and improve your workflow when dealing with form 8554.

-

Can I integrate airSlate SignNow with other software for form 8554 processing?

Absolutely! airSlate SignNow integrates with many popular software applications such as CRM systems and accounting tools, making your form 8554 processing more efficient. This integration ensures that you can manage your workflow effectively without disrupting your existing processes.

-

What are the benefits of using airSlate SignNow for form 8554?

Using airSlate SignNow for form 8554 provides numerous benefits, including enhanced security for sensitive information, faster turnaround times, and ease of use. Our platform simplifies the eSigning process, allowing you to focus on what matters most - serving your clients.

-

Is airSlate SignNow compliant with legal regulations for form 8554?

Yes, airSlate SignNow is fully compliant with legal and industry regulations regarding electronic signatures. This compliance ensures that your signed form 8554 is legally valid and can be submitted to the IRS without issues.

Get more for Form 8554 Online

Find out other Form 8554 Online

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now