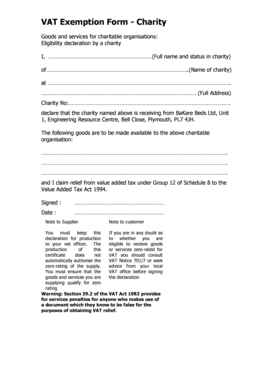

VAT Exemption Form Charity BaKare

What is the VAT Exemption Certificate?

The VAT exemption certificate is a crucial document that allows businesses and organizations to purchase goods and services without paying Value Added Tax (VAT). This certificate is particularly important for non-profit entities, charities, and certain educational institutions that qualify for VAT exemptions under U.S. tax laws. By providing this certificate to suppliers, these organizations can reduce their operational costs significantly, enabling them to allocate more resources towards their core missions.

How to Use the VAT Exemption Certificate

Utilizing the VAT exemption certificate involves several steps to ensure compliance and proper usage. First, the organization must verify its eligibility for VAT exemption based on its status and activities. Once confirmed, the organization can fill out the VAT exemption certificate template accurately, ensuring all required fields are completed. After obtaining the necessary signatures, the certificate should be presented to vendors at the time of purchase. It is essential to keep a copy of the certificate for the organization’s records, as it may be required for audits or compliance checks.

Steps to Complete the VAT Exemption Certificate

Completing the VAT exemption certificate involves a systematic approach to ensure accuracy and compliance. Here are the key steps:

- Gather Required Information: Collect all necessary details such as the organization's name, address, and tax identification number.

- Fill Out the Template: Use a VAT exemption certificate template to fill in the required fields, ensuring all information is accurate.

- Obtain Signatures: Ensure that the appropriate authority within the organization signs the certificate to validate it.

- Distribute to Vendors: Present the completed certificate to suppliers when making purchases to avoid VAT charges.

- Keep Records: Maintain a copy of the certificate for your records in case of future audits or inquiries.

Key Elements of the VAT Exemption Certificate

The VAT exemption certificate must include specific key elements to be considered valid. These elements typically include:

- Organization Information: Name, address, and tax identification number of the exempt entity.

- Vendor Information: Name and address of the supplier to whom the certificate is presented.

- Description of Goods/Services: A clear description of the items or services being purchased under the exemption.

- Signature: An authorized signature from the organization, confirming the validity of the certificate.

- Effective Date: The date when the certificate is issued and becomes effective.

IRS Guidelines for VAT Exemption

The Internal Revenue Service (IRS) provides guidelines regarding the use of VAT exemption certificates. Organizations must ensure they meet the eligibility criteria set forth by the IRS to qualify for VAT exemptions. This includes maintaining accurate records of all transactions involving the use of the certificate. The IRS may require documentation to support the exemption status during audits, so it is vital for organizations to adhere to these guidelines closely.

Eligibility Criteria for VAT Exemption

To qualify for a VAT exemption, organizations must meet specific eligibility criteria. Generally, these criteria include:

- Non-Profit Status: The organization must be recognized as a non-profit entity under U.S. tax laws.

- Charitable Purpose: The organization should operate for charitable, educational, or religious purposes.

- Compliance with State Laws: The organization must comply with state-specific regulations regarding VAT exemptions.

Quick guide on how to complete vat exemption form charity bakare

Complete VAT Exemption Form Charity BaKare smoothly on any device

Online document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage VAT Exemption Form Charity BaKare on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign VAT Exemption Form Charity BaKare effortlessly

- Find VAT Exemption Form Charity BaKare and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign VAT Exemption Form Charity BaKare and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat exemption form charity bakare

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VAT certificate sample and why do I need it?

A VAT certificate sample is an official document that confirms your business's VAT registration. It provides essential details, such as your VAT number and the existence of your VAT status. Having a VAT certificate sample is crucial for businesses to prove VAT compliance and facilitate transactions with clients and suppliers.

-

How can airSlate SignNow help me manage my VAT certificate sample?

airSlate SignNow allows you to easily upload, sign, and store your VAT certificate sample digitally. This eliminates the hassle of paper documents, providing a secure and organized way to manage important paperwork. The platform also offers templates that can help streamline the process of creating and sharing your VAT certificate sample.

-

Is there a cost associated with generating my VAT certificate sample on airSlate SignNow?

The cost of generating a VAT certificate sample on airSlate SignNow depends on the subscription plan you choose. With flexible pricing plans, airSlate SignNow offers a cost-effective solution for businesses of all sizes. By investing in our platform, you'll save time and resources while managing your documents efficiently.

-

Can I eSign my VAT certificate sample using airSlate SignNow?

Yes, airSlate SignNow allows you to eSign your VAT certificate sample quickly and securely. Our platform complies with electronic signature laws, ensuring that your signed document is legally binding. You can easily send your VAT certificate sample for signature to clients or partners directly from the platform.

-

What integrations does airSlate SignNow offer for managing my VAT certificate sample?

airSlate SignNow integrates seamlessly with various business applications, enhancing your ability to manage your VAT certificate sample. You can connect it with cloud storage solutions, CRM systems, and other productivity tools to streamline your workflow. These integrations help ensure that your VAT documents are easily accessible wherever you need them.

-

What features does airSlate SignNow provide for handling VAT certificate samples?

airSlate SignNow provides a variety of features specifically designed for handling VAT certificate samples, including document templates, eSignature capabilities, and secure cloud storage. Additionally, users benefit from real-time notifications and tracking to monitor the status of their documents. These features help ensure that your VAT documentation is both effective and organized.

-

How secure is my VAT certificate sample in airSlate SignNow?

airSlate SignNow takes the security of your VAT certificate sample seriously. We implement industry-standard encryption and adhere to strict data protection policies to ensure your documents are safe. You can trust that your sensitive VAT information is protected while using our platform.

Get more for VAT Exemption Form Charity BaKare

Find out other VAT Exemption Form Charity BaKare

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple