Eu372001951 Form

What is the eu372001951?

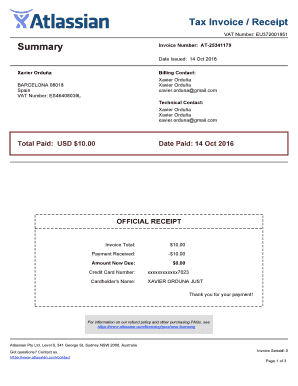

The eu372001951 is a VAT (Value Added Tax) number that is essential for businesses operating within the European Union. It is used for tax identification purposes and is crucial for companies engaged in cross-border trade. Having a valid eu372001951 number allows businesses to charge VAT on sales and reclaim VAT on purchases, ensuring compliance with tax regulations. This number is particularly important for U.S.-based companies that conduct business in Europe, as it facilitates smoother transactions and adherence to local tax laws.

How to obtain the eu372001951

To obtain a eu372001951 VAT number, businesses must first register with the tax authorities in the EU member state where they are established. The registration process typically involves submitting specific documentation, including proof of business activities, identification, and financial records. Depending on the country, this process can vary, so it is advisable to consult local tax regulations or seek assistance from tax professionals who specialize in international trade.

Steps to complete the eu372001951

Completing the eu372001951 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, such as your business identification details and financial records. Next, fill out the form with precise information, including your business name, address, and the nature of your activities. After completing the form, review it for any errors before submission. Finally, submit the form through the designated method, whether online or via mail, ensuring that you keep a copy for your records.

Legal use of the eu372001951

The eu372001951 VAT number is legally binding and must be used in accordance with EU tax regulations. Businesses must ensure that they only issue invoices that include their VAT number when applicable. This number not only serves as a tax identification tool but also helps in maintaining transparency in financial transactions. Failure to use the eu372001951 correctly can lead to penalties, including fines or additional tax liabilities.

Examples of using the eu372001951

Businesses use the eu372001951 in various scenarios, particularly in invoicing and tax reporting. For instance, a U.S. company selling goods to a European customer would include its eu372001951 number on the invoice to ensure proper VAT collection. Additionally, when filing VAT returns, the eu372001951 is necessary to report sales and reclaim any VAT paid on purchases. This number is also essential for compliance during audits or inspections by tax authorities.

Penalties for Non-Compliance

Non-compliance with VAT regulations related to the eu372001951 can result in significant penalties. Businesses may face fines for failing to register for a VAT number, incorrectly charging VAT, or not submitting required documentation. These penalties can vary by country but often include monetary fines and interest on unpaid taxes. It is crucial for businesses to understand their obligations regarding the eu372001951 to avoid these repercussions.

Quick guide on how to complete eu372001951

Effortlessly Prepare Eu372001951 on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without interruptions. Manage Eu372001951 on any platform using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Simplest Way to Modify and Electronically Sign Eu372001951 with Ease

- Find Eu372001951 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal weight as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you choose. Edit and electronically sign Eu372001951 to ensure excellent communication throughout any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eu372001951

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is eu372001951 and how does it relate to airSlate SignNow?

The term eu372001951 refers to a specific identifier for the document signing solution offered by airSlate SignNow. This unique identifier helps users easily access and manage their eSigning needs within the platform. Understanding eu372001951 can enhance your experience in navigating the features of airSlate SignNow.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers several pricing plans that cater to different business needs, starting with a cost-effective solution for small businesses. Each plan includes access to essential features, making it easier to manage documents and eSignatures. If you're considering eu372001951, the pricing is designed to provide flexibility and value.

-

What features does airSlate SignNow provide?

airSlate SignNow includes a robust set of features such as document templates, real-time tracking, and secure eSigning options. These features streamline the signing process and improve workflow efficiency. By utilizing eu372001951, users can maximize their experience with these powerful tools.

-

How can airSlate SignNow benefit my business?

airSlate SignNow can signNowly benefit your business by simplifying the eSigning process and reducing paperwork. By adopting this solution, you can enhance productivity, save time and resources, and ensure compliance with legal standards. The advantages of implementing eu372001951 can be transformative for your operations.

-

Is airSlate SignNow secure for document signing?

Yes, airSlate SignNow prioritizes security by implementing advanced encryption and compliance with industry standards. All documents signed through the platform, including those associated with eu372001951, are securely stored and handled to protect sensitive information. This commitment to security ensures peace of mind for all users.

-

What integrations are available with airSlate SignNow?

airSlate SignNow offers a variety of integrations with popular business tools such as Google Drive, Salesforce, and Microsoft Office. These integrations allow for a seamless workflow, making it easier to manage documents and eSigning processes. Utilizing eu372001951, you can connect your favorite apps to enhance productivity further.

-

Can I manage multiple users with airSlate SignNow?

Yes, airSlate SignNow allows businesses to manage multiple users effectively, providing administrative controls and user-role settings. This feature is especially useful for teams that frequently handle documents requiring signatures, such as those associated with eu372001951. It ensures that everyone has appropriate access to necessary tools.

Get more for Eu372001951

Find out other Eu372001951

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF