T400a Form Cra

What is the T400a Form Cra

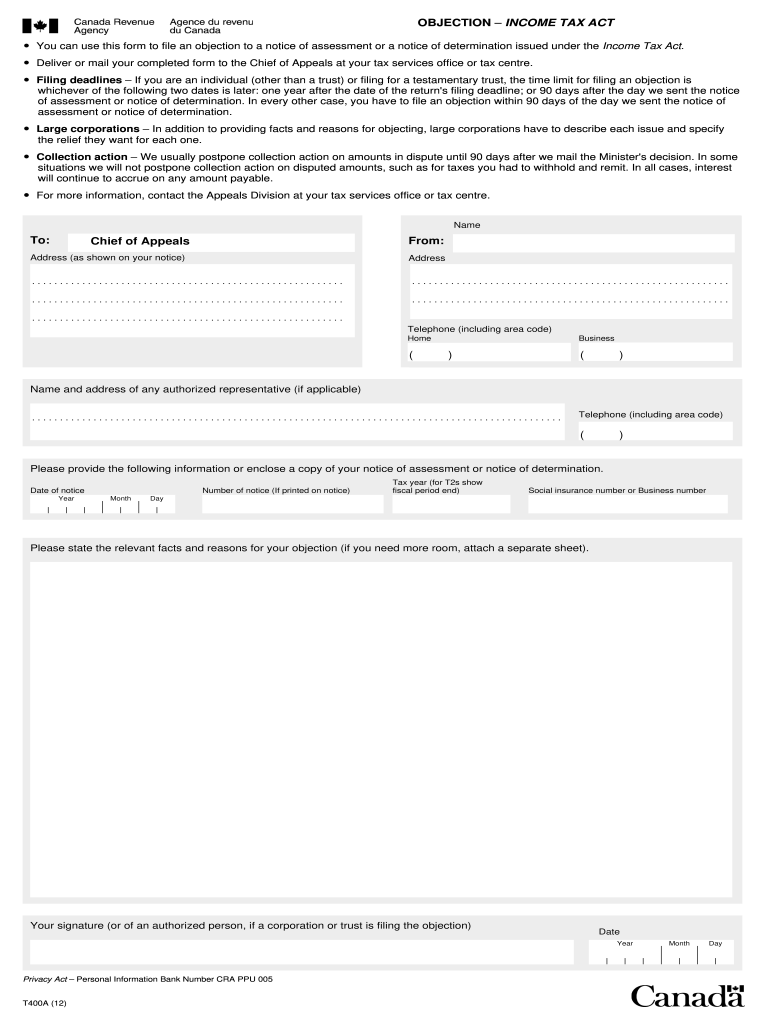

The T400a form, also known as the CRA form T400a objection, is a critical document utilized in the context of tax disputes in Canada. Specifically, it is designed for taxpayers who wish to file an objection against a decision made by the Canada Revenue Agency (CRA) regarding their income tax assessment. This form allows individuals to formally contest the CRA's findings and seek a review of their tax situation. Understanding the purpose and function of the T400a form is essential for taxpayers who believe that their tax assessments are incorrect or unjust.

Steps to complete the T400a Form Cra

Completing the T400a form involves several important steps to ensure that the objection is filed correctly. First, gather all relevant documentation, including the notice of assessment or reassessment from the CRA. Next, fill out the T400a form accurately, providing necessary details such as your personal information, the tax year in question, and the specific reasons for your objection. It is crucial to articulate your arguments clearly and support them with evidence. Once completed, review the form for any errors before submitting it to the CRA. Ensure that you keep a copy for your records.

Legal use of the T400a Form Cra

The legal use of the T400a form is governed by specific regulations set forth by the CRA. To be considered valid, the objection must be filed within the prescribed time limits following the issuance of the notice of assessment. The form must be completed in accordance with the CRA's guidelines, ensuring that all required information is provided. Additionally, the submission of the T400a form must comply with the legal standards for eSignatures if filed electronically, thus ensuring its acceptance in legal proceedings. Proper adherence to these legal requirements is essential for the objection to be recognized by the CRA.

How to obtain the T400a Form Cra

Obtaining the T400a form is a straightforward process. Taxpayers can access the form directly from the Canada Revenue Agency's official website, where it is available for download in PDF format. Alternatively, individuals may request a physical copy of the form by contacting the CRA directly. It is advisable to ensure that you are using the most current version of the T400a form, as updates may occur that could affect the filing process.

Form Submission Methods (Online / Mail / In-Person)

The T400a form can be submitted through various methods, providing flexibility for taxpayers. For those who prefer electronic submission, the form can be filed online through the CRA's secure portal, ensuring a quick and efficient process. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate CRA office. In some cases, in-person submissions may be accepted at local CRA offices, although it is advisable to check in advance regarding availability. Each submission method has its own requirements, so it is important to follow the specified guidelines for the chosen method.

Required Documents

When filing a T400a objection, certain documents are required to support your case. These typically include a copy of the notice of assessment or reassessment from the CRA, which outlines the details of the tax decision being contested. Additionally, any supporting documentation that substantiates your claims should be included. This may consist of receipts, financial statements, or other relevant records that demonstrate why the assessment is incorrect. Ensuring that all required documents are submitted with the T400a form is essential for a successful objection process.

Quick guide on how to complete t400a fillable form

Prepare T400a Form Cra seamlessly on any device

Online document management has gained traction among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly without delays. Manage T400a Form Cra on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and electronically sign T400a Form Cra effortlessly

- Locate T400a Form Cra and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Decide how you'd like to send your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Alter and electronically sign T400a Form Cra while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do I transfer data from Google Sheets cells to a PDF fillable form?

I refer you a amazing pdf editor, her name is Puspita, She work in fiverr, She is just amazing, Several time I am use her services. You can contact with her.puspitasaha : I will create fillable pdf form or edit pdf file for $5 on www.fiverr.com

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

-

How do I send a fillable form by email?

Well, contrary to the belief of some people, you CAN send a fillable form by email, the platform just has to support the Interactive Email feature(which is basically a micro site).

-

How can I edit a PDF or fillable PDF form?

You can try out Fill which has a free forever plan and requires no download.This works best if you just want to complete or fill in an fillable PDF.You simply upload your PDF and then fill it in within the browser:If the fields are live, as in the example above, simple fill them in. If the fields are not live you can drag on the fields to complete it quickly.Upload your PDF to get started here

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

Create this form in 5 minutes!

How to create an eSignature for the t400a fillable form

How to create an electronic signature for your T400a Fillable Form online

How to create an electronic signature for your T400a Fillable Form in Google Chrome

How to create an electronic signature for signing the T400a Fillable Form in Gmail

How to make an electronic signature for the T400a Fillable Form straight from your smart phone

How to create an eSignature for the T400a Fillable Form on iOS

How to generate an electronic signature for the T400a Fillable Form on Android

People also ask

-

What is the T400a Form Cra and how do I use it?

The T400a Form Cra is a crucial document for businesses in Canada, primarily used for reporting various types of income. With airSlate SignNow, you can easily eSign and send your T400a Form Cra to ensure timely submission and compliance. Our platform simplifies the process, allowing you to handle your documentation efficiently.

-

How much does airSlate SignNow cost for handling T400a Form Cra?

airSlate SignNow offers flexible pricing plans tailored to your business needs, even for processing the T400a Form Cra. Our cost-effective solution ensures you get the best value while efficiently managing your document signing needs. You can choose from monthly or annual subscriptions, depending on your usage.

-

Can I integrate airSlate SignNow with other tools for T400a Form Cra management?

Yes, airSlate SignNow supports seamless integrations with various tools and platforms, enhancing your ability to manage the T400a Form Cra. Whether you're using CRM software or accounting tools, our integrations allow you to streamline your workflow and keep all your documents in sync.

-

What are the key features of airSlate SignNow for the T400a Form Cra?

airSlate SignNow provides a range of features ideal for managing the T400a Form Cra, including eSigning, document templates, and real-time tracking. These features not only save time but also enhance security and compliance, ensuring that your forms are handled efficiently and accurately.

-

Is airSlate SignNow secure for sending sensitive T400a Form Cra documents?

Absolutely! airSlate SignNow prioritizes security, using advanced encryption methods to protect your T400a Form Cra and other sensitive documents. Our platform complies with industry standards, ensuring that your information remains confidential and secure throughout the signing process.

-

Can I send the T400a Form Cra for multiple signatures with airSlate SignNow?

Yes, airSlate SignNow allows you to send the T400a Form Cra for multiple signatures easily. You can add recipients, customize signing order, and track the status of each signature, making collaboration simple and efficient.

-

How does airSlate SignNow improve the process of completing T400a Form Cra?

By using airSlate SignNow, the process of completing the T400a Form Cra becomes faster and more efficient. Our user-friendly interface allows you to fill out and eSign documents quickly, reducing the time spent on paperwork and helping you focus on your core business activities.

Get more for T400a Form Cra

Find out other T400a Form Cra

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document