Tai Sacco Loans Form

What is the Tai Sacco Loans

The Tai Sacco loans are financial products offered by the Tai Sacco society, designed to provide members with accessible funding for various personal and business needs. These loans are tailored to meet the specific requirements of members, allowing them to borrow money with favorable terms. The loans can be used for purposes such as education, home improvement, and starting or expanding a business. Understanding the features and benefits of Tai Sacco loans can help members make informed financial decisions.

Eligibility Criteria

To qualify for Tai Sacco loans, applicants must meet specific eligibility requirements. Generally, these criteria include:

- Membership in the Tai Sacco society, which may involve a registration process.

- A demonstrated ability to repay the loan, often assessed through income verification.

- Compliance with any additional requirements set by the Tai Sacco, such as a minimum duration of membership.

Understanding these criteria is essential for a smooth application process and to ensure that potential borrowers are well-prepared.

Steps to complete the Tai Sacco Loans

Completing the Tai Sacco loan application involves several key steps. These steps typically include:

- Gathering necessary documentation, such as proof of income and identification.

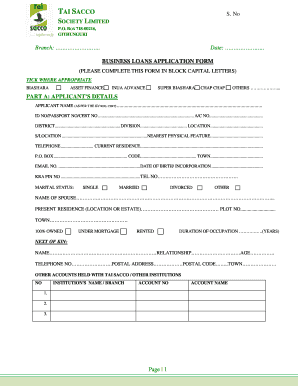

- Filling out the Tai Sacco loan application form accurately.

- Submitting the application through the designated method, which may include online submission via the Tai Sacco app or in-person at a local branch.

- Awaiting approval, which may take several days, depending on the loan type and the Tai Sacco's processing times.

Following these steps can help ensure that applicants complete their loan requests efficiently and effectively.

Required Documents

When applying for Tai Sacco loans, applicants must prepare specific documents to support their application. Commonly required documents include:

- Proof of identity, such as a government-issued ID or passport.

- Proof of income, which may include recent pay stubs, tax returns, or bank statements.

- Membership verification documents, confirming active membership in the Tai Sacco.

Having these documents ready can expedite the application process and increase the likelihood of approval.

Legal use of the Tai Sacco Loans

The legal use of Tai Sacco loans is governed by specific regulations and guidelines. Members must ensure that they utilize the funds for the intended purposes outlined in their loan agreements. Misuse of loan funds can lead to penalties or legal consequences. Additionally, borrowers should be aware of their rights and responsibilities under the loan agreement, including repayment terms and conditions.

How to obtain the Tai Sacco Loans

Obtaining a Tai Sacco loan involves a straightforward process that begins with understanding the available loan types and their respective terms. Members can access the Tai Sacco mobile banking app to explore loan options, check eligibility, and submit applications. It is advisable to review the terms carefully, including interest rates and repayment schedules, before proceeding with the application.

Application Process & Approval Time

The application process for Tai Sacco loans is designed to be user-friendly. Applicants typically fill out an online form or submit a paper application. After submission, the approval time can vary based on several factors, including the loan type and the completeness of the application. Generally, applicants can expect to receive feedback within a few days to a week, allowing them to plan accordingly.

Quick guide on how to complete tai sacco loans

Effortlessly Prepare Tai Sacco Loans on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to find the necessary template and keep it securely online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents swiftly and without hindrances. Manage Tai Sacco Loans across any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Tai Sacco Loans effortlessly

- Find Tai Sacco Loans and click Get Form to commence.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically available from airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose your preferred method of sending your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you select. Edit and eSign Tai Sacco Loans and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tai sacco loans

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic tai sacco loan requirements for eligibility?

The tai sacco loan requirements typically include proof of identity, a stable source of income, and information regarding your credit history. Additional documentation may also be necessary, such as bank statements and employment verification. Meeting these criteria can greatly enhance your chances of loan approval.

-

How can I apply for a loan based on tai sacco loan requirements?

To apply for a loan under the tai sacco loan requirements, you can start by gathering the necessary documentation outlined by the lending institution. Most banks and credit unions provide an online application portal where you can submit your information. It's essential to review all requirements carefully to ensure a smooth application process.

-

What options are available for overcoming tai sacco loan requirements?

If you find that you may not meet the tai sacco loan requirements, consider exploring options such as a co-signer or applying for a different loan type that has more lenient qualifications. Some lenders offer tailored loans that focus on specific borrower needs. Always communicate with the lender to understand potential alternatives.

-

Are there specific income thresholds for tai sacco loan requirements?

Yes, many lenders set specific income thresholds as part of their tai sacco loan requirements to ensure borrowers have the means to repay the loan. These thresholds can vary widely based on the lender, loan amount, and other factors. Always check with your lender for their specific income verification criteria.

-

What are the benefits of understanding tai sacco loan requirements?

Understanding the tai sacco loan requirements helps you prepare effectively for the loan application process, reducing the chances of delays or rejections. Additionally, it can empower you to identify the best lending options suited to your financial situation. Knowledge of these requirements can ultimately lead to securing favorable terms.

-

How do tai sacco loan requirements vary between lenders?

Tai sacco loan requirements can vary signNowly from lender to lender, with some placing greater emphasis on credit scores while others may focus more on income stability. It's crucial to compare different lenders to find one that aligns with your financial standing and goals. Always read the fine print to understand specific terms.

-

What features should I look for when considering loans based on tai sacco loan requirements?

When evaluating loans based on tai sacco loan requirements, consider looking for features such as competitive interest rates, flexible repayment options, and customer service support. Additionally, some lenders offer online tools that simplify the application process. Each feature can enhance your overall borrowing experience.

Get more for Tai Sacco Loans

Find out other Tai Sacco Loans

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe