Filing Enforcement Section Ms F180 Form

What is the Filing Enforcement Section Ms F180

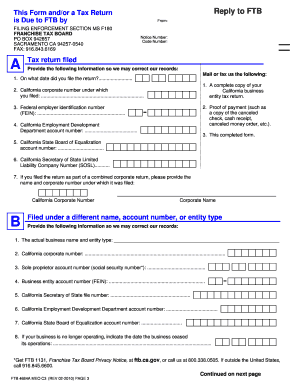

The Filing Enforcement Section Ms F180 is a specific component of the California Franchise Tax Board (FTB) that deals with the enforcement of tax filing requirements. This section is responsible for ensuring compliance with state tax laws, particularly for individuals and businesses that may have failed to file their tax returns or pay due taxes. The FTB utilizes this section to address non-compliance issues, which can lead to penalties or additional legal actions if not resolved. Understanding the role of the Filing Enforcement Section is crucial for taxpayers to navigate their obligations effectively.

How to use the Filing Enforcement Section Ms F180

Using the Filing Enforcement Section Ms F180 involves understanding the specific requirements and processes set by the California FTB. Taxpayers who receive correspondence from this section should carefully review the information provided, which typically outlines any outstanding tax obligations or filing requirements. It is essential to respond promptly to any notices and to provide the necessary documentation to resolve issues. Utilizing electronic filing tools can streamline the process, ensuring that all forms are submitted accurately and efficiently.

Steps to complete the Filing Enforcement Section Ms F180

Completing the Filing Enforcement Section Ms F180 involves several key steps:

- Review the notice received from the FTB for details on the specific requirements.

- Gather all necessary documentation, including previous tax returns and supporting financial records.

- Complete the required forms accurately, ensuring all information is up to date.

- Submit the completed forms electronically or via mail, depending on the instructions provided.

- Retain copies of all submitted documents for personal records.

Legal use of the Filing Enforcement Section Ms F180

The legal use of the Filing Enforcement Section Ms F180 is governed by California tax laws and regulations. This section is authorized to enforce compliance with tax filings and can impose penalties for non-compliance. Taxpayers must ensure that they adhere to the guidelines provided by the FTB to avoid legal repercussions. Utilizing electronic platforms for filing can enhance compliance by ensuring that submissions meet legal standards and are timestamped for verification.

Required Documents

When dealing with the Filing Enforcement Section Ms F180, taxpayers may need to provide various documents, including:

- Previous tax returns for the years in question.

- W-2 forms, 1099s, or other income statements.

- Supporting documentation for any deductions or credits claimed.

- Proof of payment for any taxes owed.

Gathering these documents in advance can facilitate a smoother resolution process with the FTB.

Penalties for Non-Compliance

Failure to comply with the requirements of the Filing Enforcement Section Ms F180 can result in significant penalties. These may include:

- Monetary fines for late filings or unpaid taxes.

- Increased interest on outstanding tax balances.

- Potential legal action, including liens or levies against assets.

It is important for taxpayers to address any notices from this section promptly to mitigate potential penalties.

Quick guide on how to complete filing enforcement section ms f180

Easily prepare Filing Enforcement Section Ms F180 on any device

The management of online documents has gained traction among companies and individuals. It offers an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Handle Filing Enforcement Section Ms F180 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to edit and eSign Filing Enforcement Section Ms F180 effortlessly

- Find Filing Enforcement Section Ms F180 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal authority as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of sending your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign Filing Enforcement Section Ms F180 and ensure outstanding communication throughout every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the filing enforcement section ms f180

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is filing enforcement section ms f180?

Filing enforcement section ms f180 refers to the specific procedures and requirements for enforcing legal filings. It ensures that all necessary documents are in compliance with regulatory standards. Understanding these requirements can lead to more efficient document management.

-

How does airSlate SignNow assist with filing enforcement section ms f180?

AirSlate SignNow simplifies the process of managing documents related to filing enforcement section ms f180 by providing easy-to-use templates and eSigning capabilities. This helps businesses stay compliant while saving time and reducing errors in document submission. Efficient document tracking further streamlines the enforcement process.

-

What are the pricing options for airSlate SignNow when dealing with filing enforcement section ms f180?

AirSlate SignNow offers flexible pricing plans that cater to businesses focusing on filing enforcement section ms f180. These plans are designed to accommodate various business sizes, ensuring that you only pay for the features you need. Each plan enhances your document workflow efficiency.

-

What features does airSlate SignNow provide for filing enforcement section ms f180?

The features of airSlate SignNow include customizable templates, automated workflows, and secure eSigning, all crucial for managing filing enforcement section ms f180. These tools ensure that your documents are handled efficiently and securely, reducing the risk of non-compliance. Additionally, real-time tracking helps you monitor progress seamlessly.

-

Are there integrations available for airSlate SignNow to support filing enforcement section ms f180?

Yes, airSlate SignNow integrates with various third-party applications to enhance workflows related to filing enforcement section ms f180. These integrations facilitate seamless document sharing and collaboration among different platforms, making your processes even more efficient. Popular integrations include CRM and cloud storage solutions.

-

How can airSlate SignNow improve compliance for filing enforcement section ms f180?

AirSlate SignNow enhances compliance for filing enforcement section ms f180 by providing a clear audit trail and secure storage for all your documents. This eliminates the risk of lost paperwork and provides legal protection in the event of disputes. The platform's automated reminders help ensure you meet all filing deadlines.

-

What benefits does using airSlate SignNow offer for filing enforcement section ms f180?

Using airSlate SignNow for filing enforcement section ms f180 offers benefits like reduced turnaround times and enhanced accuracy in document management. The platform's user-friendly interface allows team members of any skill level to navigate easily, ensuring a smooth adoption. Additionally, cost savings can be signNow by minimizing paper and administrative costs.

Get more for Filing Enforcement Section Ms F180

Find out other Filing Enforcement Section Ms F180

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe