8891 Form

What is the 8891 Form

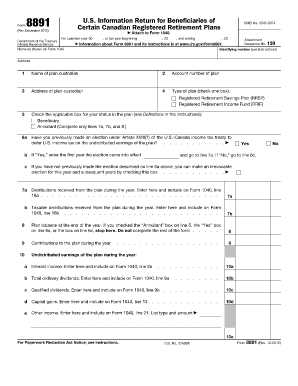

The 8891 form, officially known as the "U.S. Information Return for Beneficiaries of Certain Canadian Retirement Plans," is a tax document used by U.S. citizens and residents who are beneficiaries of certain Canadian retirement plans. This form is essential for reporting income from these plans to the Internal Revenue Service (IRS). It ensures that individuals comply with U.S. tax laws while benefiting from their Canadian retirement accounts. Understanding the purpose and requirements of the 8891 form is crucial for accurate tax reporting and avoidance of penalties.

How to obtain the 8891 Form

Obtaining the 8891 form is straightforward. It is available directly from the IRS website, where individuals can download and print the form. Additionally, tax professionals and accountants often have access to the latest version of the form, which can be provided upon request. It is important to ensure that you are using the most current version of the 8891 form to avoid any issues with filing.

Steps to complete the 8891 Form

Completing the 8891 form involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect details about your Canadian retirement plan, including account numbers and the amount of income received.

- Fill out personal information: Provide your name, address, and Social Security number at the top of the form.

- Report income: Accurately report the income received from the Canadian retirement plan in the appropriate sections of the form.

- Sign and date: Ensure that you sign and date the form before submission to validate it.

Legal use of the 8891 Form

The 8891 form is legally binding when completed accurately and submitted on time. It serves as a declaration of income received from Canadian retirement plans and must be filed with the IRS as part of your annual tax return. Failing to file this form can lead to penalties and interest on unpaid taxes. It is essential to understand the legal implications of the information provided on this form and to maintain compliance with IRS regulations.

Filing Deadlines / Important Dates

Filing the 8891 form is subject to specific deadlines. Generally, it must be submitted by the tax return due date, which is typically April 15 for most taxpayers. If you are unable to meet this deadline, you may file for an extension, but it is crucial to ensure that the form is submitted by the extended deadline to avoid penalties. Keeping track of these important dates is essential for maintaining compliance with tax regulations.

Penalties for Non-Compliance

Failure to file the 8891 form or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late submissions, and interest may accrue on any unpaid taxes related to the income reported on the form. Additionally, non-compliance can lead to increased scrutiny of your tax returns in future years. Being aware of these potential consequences underscores the importance of completing and submitting the 8891 form correctly and on time.

Quick guide on how to complete 8891 form

Effortlessly Prepare 8891 Form on Any Device

Digital document management has seen a surge in popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle 8891 Form on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

The easiest method to modify and eSign 8891 Form hassle-free

- Obtain 8891 Form and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign 8891 Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8891 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8891 and how is it used?

Form 8891 is used by U.S. taxpayers to report certain foreign financial accounts and is crucial for compliance with tax regulations. With airSlate SignNow, completing and eSigning form 8891 is streamlined, allowing you to manage your documents securely and efficiently.

-

How can airSlate SignNow help with the completion of form 8891?

airSlate SignNow provides intuitive templates and tools to assist in filling out form 8891 accurately. Our platform simplifies the process with features like document editing, cloud storage, and easy eSigning, ensuring that your form is completed promptly.

-

What are the pricing options for using airSlate SignNow for form 8891?

airSlate SignNow offers various pricing plans tailored to fit your business needs when managing documents like form 8891. We provide a cost-effective solution that scales as your requirements grow, ensuring you only pay for the features you use.

-

Is airSlate SignNow secure for sending form 8891?

Absolutely! airSlate SignNow employs advanced security protocols to protect sensitive information contained in form 8891. Our platform ensures end-to-end encryption and secure document storage, maintaining the confidentiality of your financial data.

-

Can I integrate airSlate SignNow with other tools for managing form 8891?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your ability to work with form 8891. You can connect our platform with CRM systems, accounting software, and other productivity tools to streamline your workflow.

-

What are the benefits of using airSlate SignNow for form 8891?

Using airSlate SignNow for form 8891 provides numerous benefits, including faster processing times, improved accuracy, and reduced paper usage. Our platform not only simplifies document management but also ensures compliance with tax regulations effortlessly.

-

Can I eSign form 8891 using airSlate SignNow?

Yes, you can easily eSign form 8891 with airSlate SignNow. Our electronic signature feature is legally binding and complies with government regulations, ensuring your form 8891 is valid and accepted.

Get more for 8891 Form

Find out other 8891 Form

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement