Mary Kay Income Tax Preparation Sheet Form

What is the Mary Kay Income Tax Preparation Sheet

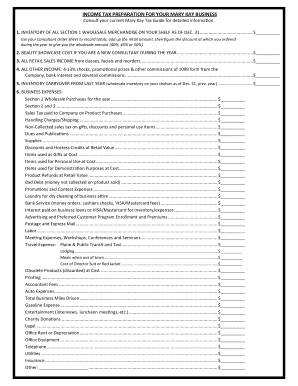

The Mary Kay Income Tax Preparation Sheet is a specialized document designed for Mary Kay consultants to accurately report their income and expenses for tax purposes. This form helps individuals organize their financial information, ensuring they capture all necessary details related to their Mary Kay business activities. It is essential for maintaining compliance with IRS regulations and for maximizing potential deductions.

How to use the Mary Kay Income Tax Preparation Sheet

Using the Mary Kay Income Tax Preparation Sheet involves several straightforward steps. First, gather all relevant financial documents, including sales records, receipts for expenses, and any other income statements. Next, fill out the preparation sheet by entering your total income from sales and any applicable expenses. This sheet serves as a summary of your financial activity and should be used to prepare your tax return accurately. It's advisable to keep a copy for your records, as it may be useful for future reference or audits.

Key elements of the Mary Kay Income Tax Preparation Sheet

Several key elements should be included in the Mary Kay Income Tax Preparation Sheet to ensure comprehensive reporting. These include:

- Total Sales Income: The total revenue generated from selling Mary Kay products.

- Expenses: A detailed list of business-related expenses, such as inventory costs, marketing expenses, and travel costs.

- Net Income: The calculation of total income minus total expenses, which determines your taxable income.

- Consultant ID: Your unique Mary Kay consultant identification number for accurate tracking.

Steps to complete the Mary Kay Income Tax Preparation Sheet

Completing the Mary Kay Income Tax Preparation Sheet involves a systematic approach:

- Collect Documentation: Gather all sales receipts, expense invoices, and any other financial records.

- Fill in Income: Enter your total sales income from your Mary Kay business.

- List Expenses: Document all business-related expenses, ensuring to categorize them appropriately.

- Calculate Net Income: Subtract total expenses from total income to arrive at your net income.

- Review for Accuracy: Double-check all entries for accuracy and completeness.

Legal use of the Mary Kay Income Tax Preparation Sheet

The Mary Kay Income Tax Preparation Sheet is legally recognized as a valid document for tax reporting purposes when completed accurately. It is essential to adhere to IRS guidelines regarding income reporting and deductions. Proper use of this form can help ensure compliance with tax laws and avoid potential penalties. Always retain a copy of the completed sheet for your records, as it may be required for future audits or inquiries.

IRS Guidelines

When using the Mary Kay Income Tax Preparation Sheet, it is important to follow IRS guidelines for self-employment income reporting. This includes accurately reporting all income earned and maintaining records of expenses that can be deducted. The IRS requires that all income be reported, even if it is below the threshold for taxation. Familiarizing yourself with IRS publications related to self-employment can provide additional clarity on compliance and reporting requirements.

Quick guide on how to complete mary kay income tax preparation sheet

Complete Mary Kay Income Tax Preparation Sheet effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Mary Kay Income Tax Preparation Sheet on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Mary Kay Income Tax Preparation Sheet with ease

- Find Mary Kay Income Tax Preparation Sheet and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or blackout private information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or missing files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow manages all your document organization needs in just a few clicks from your chosen device. Modify and eSign Mary Kay Income Tax Preparation Sheet to ensure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mary kay income tax preparation sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mary Kay income advisory statement?

The Mary Kay income advisory statement is a detailed document that summarizes the earnings potential and performance metrics of Mary Kay consultants. It provides valuable insights into sales figures, commission structures, and product performance. Understanding this statement is crucial for consultants to maximize their earnings.

-

How can airSlate SignNow assist with the Mary Kay income advisory statement?

airSlate SignNow simplifies the process of signing and managing your Mary Kay income advisory statement. With its easy-to-use eSigning features, you can quickly obtain necessary signatures and keep documents organized. This ensures you stay compliant and have easy access to your advisory statements at all times.

-

What are the pricing options for using airSlate SignNow for handling Mary Kay income advisory statements?

airSlate SignNow offers various pricing plans to meet your business needs, including plans tailored for individual consultants or larger teams. Each plan provides access to essential features for managing Mary Kay income advisory statements effectively. You can explore budget-friendly options that still offer a robust set of tools.

-

Are there any specific features for managing Mary Kay income advisory statements in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for managing Mary Kay income advisory statements. These include secure eSigning, templates for recurring documents, and document tracking. These functionalities help you streamline the administrative aspects of your consultancy business.

-

What benefits does airSlate SignNow offer for Mary Kay consultants?

Using airSlate SignNow offers numerous benefits for Mary Kay consultants, including time-saving document management and the ability to eSign from anywhere. This enables consultants to focus more on sales and less on administrative tasks. Additionally, the platform enhances professionalism when dealing with clients.

-

Can I integrate airSlate SignNow with other tools to manage Mary Kay income advisory statements?

Yes, airSlate SignNow easily integrates with a variety of tools that can help manage your Mary Kay income advisory statements. Whether you're using CRM software or other document management systems, these integrations streamline your workflow. This makes it easier to keep track of your earnings and performance metrics.

-

How does airSlate SignNow ensure the security of my Mary Kay income advisory statements?

airSlate SignNow employs advanced security measures to protect your Mary Kay income advisory statements. The platform utilizes encryption, secure sign-in options, and compliance with industry standards to ensure your sensitive documents are safe. You can rest assured that your earnings and personal data are protected through the eSigning process.

Get more for Mary Kay Income Tax Preparation Sheet

Find out other Mary Kay Income Tax Preparation Sheet

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast