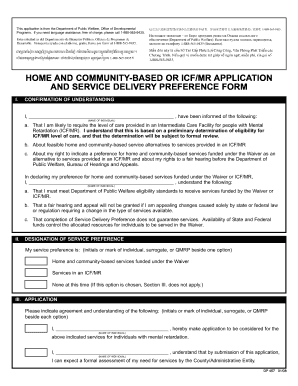

Dp 457 Form

What is the DP 457?

The DP 457 form is a specific document used in various administrative processes, often related to tax or legal matters. It serves as a formal request or declaration that requires accurate information and signatures to be deemed valid. Understanding the purpose and requirements of the DP 457 is essential for individuals and businesses to ensure compliance with relevant regulations.

How to Use the DP 457

Using the DP 457 effectively involves several steps. First, gather all necessary information, including personal details and any supporting documents required for submission. Next, complete the form accurately, ensuring that all fields are filled out as per the guidelines. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements of the issuing authority.

Steps to Complete the DP 457

Completing the DP 457 involves a systematic approach:

- Review the form for any specific instructions provided.

- Gather all required documents and information.

- Fill out the form carefully, ensuring accuracy in all entries.

- Sign the form, either digitally or with a handwritten signature, as required.

- Submit the form through the designated method, ensuring it is sent to the correct address or platform.

Legal Use of the DP 457

The legal validity of the DP 457 hinges on compliance with applicable laws and regulations. When filled out correctly, the form can serve as a binding document in legal contexts. It is crucial to ensure that all signatures are authentic and that the form adheres to the requirements set forth by governing bodies, such as the ESIGN Act and UETA, which govern electronic signatures.

Key Elements of the DP 457

Understanding the key elements of the DP 457 is vital for proper completion. These elements typically include:

- Identification information of the individual or entity submitting the form.

- Details regarding the purpose of the form and any relevant dates.

- Signature lines for all parties involved, ensuring compliance with legal requirements.

- Any necessary attachments or supporting documents that must accompany the form.

Form Submission Methods

The DP 457 can be submitted through various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online submission via a secure portal, which often allows for quicker processing.

- Mailing a physical copy to the designated address, ensuring it is sent with adequate postage.

- In-person submission at specified locations, which may provide immediate confirmation of receipt.

Quick guide on how to complete dp 457

Prepare Dp 457 smoothly on any device

Digital document management has become favored by companies and individuals alike. It offers a superb environmentally friendly substitute to traditional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without any holdups. Manage Dp 457 across any platform with airSlate SignNow Android or iOS applications and streamline your document-based tasks today.

How to modify and eSign Dp 457 effortlessly

- Obtain Dp 457 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign function, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Dp 457 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dp 457

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dp 457 feature in airSlate SignNow?

The dp 457 feature in airSlate SignNow allows users to efficiently manage document workflows and eSignatures. This functionality is designed to streamline the signing process, ensuring that your documents are signed quickly and securely. Businesses benefit from increased productivity and reduced turnaround times with the dp 457 feature.

-

How much does airSlate SignNow with dp 457 cost?

Pricing for airSlate SignNow that includes the dp 457 feature is competitive and tailored to fit different business needs. It offers a subscription model with flexible plans based on the number of users and features required. Customers can choose from monthly or annual billing options to find the best fit for their budget.

-

What are the primary benefits of using dp 457 with airSlate SignNow?

Using dp 457 with airSlate SignNow brings multiple benefits, including enhanced document security, faster signing processes, and improved collaboration among team members. This feature ensures that all signatures are legally binding and compliant with regulations, making it a reliable choice for businesses. Additionally, it reduces the need for physical paperwork, leading to cost savings.

-

Can dp 457 integrate with other software applications?

Yes, the dp 457 feature in airSlate SignNow supports integration with various software applications, enhancing its functionality. It can be seamlessly connected with CRMs, project management tools, and other business solutions to create a cohesive workflow. This interoperability helps businesses to streamline operations and improve efficiency.

-

Is there a mobile app for accessing dp 457 features?

Absolutely! airSlate SignNow offers a mobile app that allows users to access dp 457 features on the go. This means that you can send and sign documents from anywhere, straight from your smartphone or tablet. The mobile app provides a user-friendly experience, enabling businesses to maintain productivity outside of traditional office settings.

-

How does dp 457 ensure the security of signed documents?

The dp 457 feature in airSlate SignNow employs advanced encryption and security protocols to protect your signed documents. This includes secure storage and access controls to ensure that only authorized individuals can view or edit sensitive information. With robust security measures in place, businesses can trust that their documents are safe and compliant with industry standards.

-

Who can benefit from using airSlate SignNow's dp 457?

Businesses of all sizes can benefit from using the dp 457 feature in airSlate SignNow. Whether you're a startup, a small business, or a large enterprise, the ability to send and eSign documents efficiently is crucial. This functionality is particularly beneficial for industries such as real estate, legal, and healthcare, where timely document handling is essential.

Get more for Dp 457

- Aama recertification form

- Thedacare caring hearts application form

- Status analyzer form

- Obgyn lewis gale salem va patient registration forms

- Orthopedic surgery forms

- Motorcycle insurance card template form

- Banner health login release forms

- Financial assistance policy prohealth care prohealthcare form

Find out other Dp 457

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure