F8843 Form

What is the F8843 Form

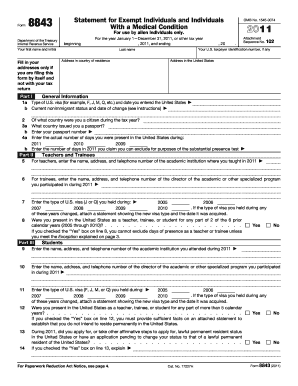

The F8843 Form is a tax document used by certain non-resident aliens in the United States. This form is specifically designed to report the days of presence in the U.S. and to claim an exemption from the substantial presence test. It is often utilized by students, teachers, and trainees who are in the U.S. on specific visa types, allowing them to maintain their non-resident status for tax purposes.

How to use the F8843 Form

To effectively use the F8843 Form, individuals must accurately fill out the required information regarding their stay in the U.S. This includes personal details, visa type, and the number of days spent in the country. After completing the form, it should be attached to the individual’s income tax return, even if no tax is owed. This ensures that the IRS has a complete record of the individual's non-resident status.

Steps to complete the F8843 Form

Completing the F8843 Form involves several key steps:

- Gather necessary personal information, including your name, address, and visa details.

- Determine the number of days you were present in the U.S. during the tax year.

- Fill out the form accurately, ensuring all sections are completed.

- Review the completed form for any errors or omissions.

- Attach the F8843 Form to your tax return before submission.

Legal use of the F8843 Form

The F8843 Form is legally recognized by the IRS as a valid document for non-resident aliens to report their presence in the U.S. and claim exemptions. It is essential for maintaining compliance with U.S. tax laws. Failing to submit this form when required can lead to complications regarding tax status and potential penalties.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the F8843 Form. Typically, the form must be submitted by the tax return deadline, which is usually April 15 for most individuals. However, if you are a non-resident alien, you may have until June 15 to file your return, but the F8843 must still be included with your submission.

Required Documents

When completing the F8843 Form, certain documents are necessary to ensure accuracy. These may include:

- Your passport and visa information.

- Records of your days spent in the U.S., such as travel itineraries or calendars.

- Any previous tax returns, if applicable.

Form Submission Methods

The F8843 Form can be submitted through various methods. Individuals can file it electronically by attaching it to their e-filed tax return or submit a paper version by mailing it to the appropriate IRS address. It is important to check the IRS guidelines for the correct submission method based on your specific situation.

Quick guide on how to complete f8843 form 1649604

Complete F8843 Form effortlessly on any device

Digital document management has become increasingly favored by both organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documentation, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to generate, modify, and eSign your documents promptly without delays. Manage F8843 Form on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and eSign F8843 Form effortlessly

- Find F8843 Form and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to finalize your edits.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate generating new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign F8843 Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f8843 form 1649604

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the F8843 Form, and who needs to complete it?

The F8843 Form is a tax document required by certain individuals in the United States to claim exempt status for tax purposes. Typically, non-resident aliens and foreign students need to complete this form to ensure compliance with IRS regulations. Ensuring accurate completion of the F8843 Form is crucial to avoid potential tax issues.

-

How can airSlate SignNow help with the F8843 Form?

airSlate SignNow provides an efficient platform for completing and eSigning the F8843 Form digitally. With advanced features, users can easily fill out the necessary fields and send the form securely, streamlining the submission process. This eliminates delays often associated with paper forms.

-

What are the pricing options for using airSlate SignNow for the F8843 Form?

airSlate SignNow offers flexible pricing plans to accommodate different needs when completing the F8843 Form. Users can choose from monthly or annual subscriptions, providing options for both individuals and businesses. The cost-effective plans ensure that users can manage their document signing needs without overspending.

-

Are there any notable features of airSlate SignNow that assist with the F8843 Form?

Yes, airSlate SignNow includes features such as templates, custom workflows, and real-time tracking specifically designed for forms like the F8843 Form. These features enhance efficiency and ensure accuracy, making the process of filling out and submitting the form much easier. Users can also utilize automated reminders to avoid missing deadlines.

-

Is it safe to store the F8843 Form in airSlate SignNow?

Absolutely, airSlate SignNow prioritizes security, safeguarding all documents, including the F8843 Form, with robust encryption and secure cloud storage. Users can be confident that their sensitive information is protected from unauthorized access. Additionally, airSlate SignNow complies with various data protection regulations to ensure user trust.

-

Can I integrate airSlate SignNow with other applications for managing the F8843 Form?

Yes, airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and CRM systems, enhancing the management of the F8843 Form. These integrations streamline workflows, allowing users to access and manage their documents more efficiently. Such compatibility ensures that users can work within their preferred tools.

-

What are the benefits of using airSlate SignNow for the F8843 Form over traditional methods?

Using airSlate SignNow for the F8843 Form offers numerous benefits over traditional methods, including faster processing times, reduced paper usage, and enhanced accessibility. The digital platform allows users to complete and sign the form from anywhere, mitigating logistical challenges. This modern approach signNowly increases efficiency and productivity.

Get more for F8843 Form

Find out other F8843 Form

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online