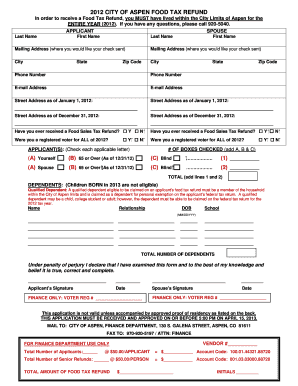

City of Aspen Food Tax Refund Form

What is the City of Aspen Food Tax Refund

The City of Aspen Food Tax Refund is a financial reimbursement program designed to alleviate the burden of food taxes on residents. This initiative allows eligible individuals and families to claim a refund for the food tax paid on qualifying purchases. The program aims to support local residents by providing relief in the form of a tax refund, making essential food items more affordable.

How to Obtain the City of Aspen Food Tax Refund

To obtain the City of Aspen Food Tax Refund, residents must first ensure they meet the eligibility criteria. This typically includes being a resident of Aspen and having paid food taxes within the designated timeframe. Residents can apply for the refund by completing the city of Aspen food tax refund form, which can be accessed online or obtained from local government offices. After filling out the form, applicants can submit it through the designated channels, such as online submission or by mail.

Steps to Complete the City of Aspen Food Tax Refund

Completing the City of Aspen Food Tax Refund involves several steps:

- Gather necessary documentation, including proof of residency and receipts for food purchases.

- Access the city of Aspen food tax refund form online or in person.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the completed form through the chosen method, either online or by mail.

Required Documents

When applying for the City of Aspen Food Tax Refund, applicants must provide specific documents to support their claim. Required documents typically include:

- Proof of residency in Aspen, such as a utility bill or lease agreement.

- Receipts or records of food purchases that demonstrate the amount of food tax paid.

- Completed city of Aspen food tax refund form.

Eligibility Criteria

Eligibility for the City of Aspen Food Tax Refund is determined by several factors, including:

- Residency: Applicants must be residents of Aspen.

- Income limits: There may be income thresholds that applicants need to meet to qualify for the refund.

- Timeframe: The food tax must have been paid within the specified period for the refund to be applicable.

Form Submission Methods

Residents can submit the city of Aspen food tax refund form through various methods to ensure convenience:

- Online submission via the official city website.

- Mailing the completed form to the designated city office.

- In-person submission at local government offices during business hours.

Quick guide on how to complete city of aspen food tax refund

Complete City Of Aspen Food Tax Refund effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and without interruptions. Handle City Of Aspen Food Tax Refund on any system with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign City Of Aspen Food Tax Refund effortlessly

- Locate City Of Aspen Food Tax Refund and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign City Of Aspen Food Tax Refund and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of aspen food tax refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the aspen food tax refund?

The aspen food tax refund is a financial benefit designed for residents who qualify based on their annual income and food purchases. This refund helps alleviate costs associated with essential food items, making it easier for families to manage their budgets.

-

How can I apply for the aspen food tax refund?

To apply for the aspen food tax refund, you must complete an application form available on the official website. Make sure to provide necessary documentation, such as proof of income and residency, to facilitate the processing of your application.

-

What eligibility criteria must be met for the aspen food tax refund?

Eligibility for the aspen food tax refund typically includes meeting specific income requirements and being a resident of the Aspen area. It's important to check the guidelines on the official state or city website to ensure you meet all the necessary criteria.

-

What are the benefits of the aspen food tax refund?

The aspen food tax refund provides financial relief to eligible residents, allowing them to save money on their essential food purchases. This refund can help improve the overall quality of life for families and individuals by reducing food expenses.

-

When can I expect to receive my aspen food tax refund?

After your application for the aspen food tax refund is submitted, processing times can vary. Generally, you should expect to receive the refund within a few weeks, depending on the volume of applications being processed.

-

Can the airSlate SignNow platform assist with aspen food tax refund documentation?

Yes, the airSlate SignNow platform can streamline the process of preparing and signing necessary documentation for the aspen food tax refund. Our easy-to-use eSigning features ensure that all your documents are securely signed and ready for submission.

-

Are there any costs associated with filing for the aspen food tax refund?

While applying for the aspen food tax refund itself is typically free, there may be costs associated with gathering and submitting required documentation. Using tools like airSlate SignNow can signNowly reduce paperwork hassle and associated costs.

Get more for City Of Aspen Food Tax Refund

- Hospital discharge summary arizona department of health services azdhs form

- Form sv 730

- Application for license and certificate of marriage form

- Site bcdc information

- Homeowner preventing ca get form

- How do i change my site addresswebs support form

- California lottery scratchers 2012 form

- Statement of truth form

Find out other City Of Aspen Food Tax Refund

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure