Tax Exempt Illinois Form

What is the Tax Exempt Illinois

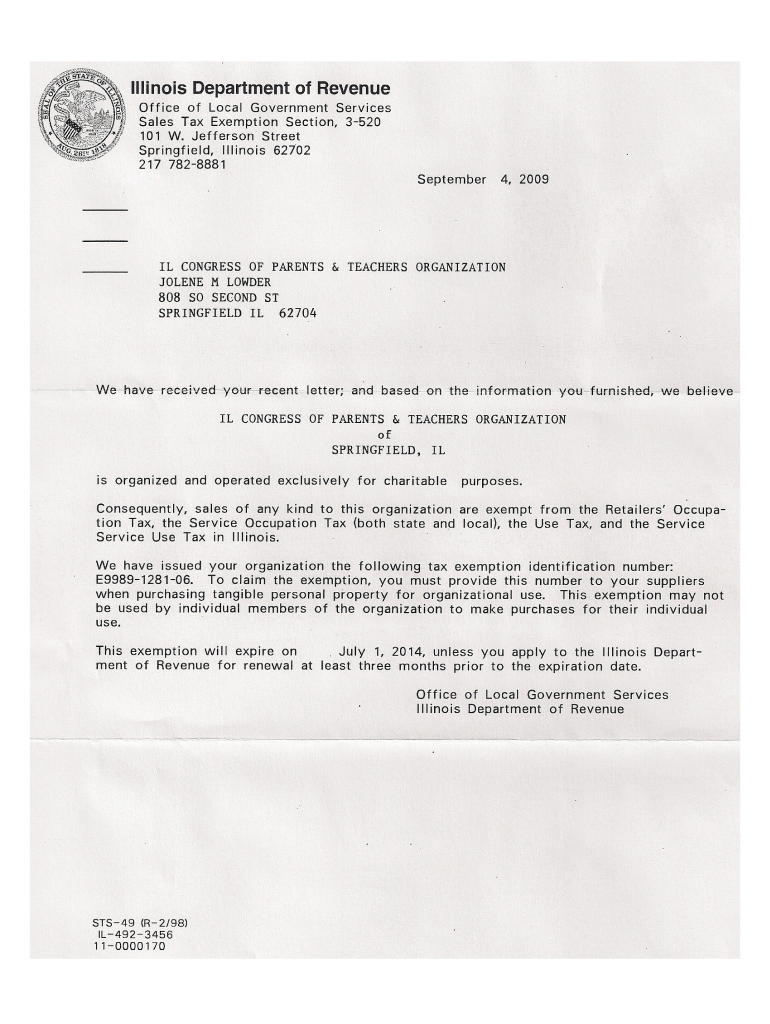

The Tax Exempt Illinois form is a crucial document that allows qualifying organizations to apply for tax-exempt status under Illinois law. This form is primarily used by non-profit organizations, charities, and certain educational institutions that meet specific criteria set forth by the state. By obtaining tax-exempt status, these organizations can avoid paying sales tax on purchases and may also be exempt from property taxes. Understanding the definition and purpose of this form is essential for any organization seeking to operate without the burden of certain taxes.

How to obtain the Tax Exempt Illinois

To obtain the Tax Exempt Illinois form, organizations must first ensure they meet the eligibility criteria established by the state. This typically includes being a non-profit entity organized for charitable, educational, or religious purposes. Organizations can download the form from the Illinois Department of Revenue's website or request a physical copy through their office. It is important to gather all necessary documentation, such as proof of non-profit status and a detailed description of the organization's activities, before submitting the form.

Steps to complete the Tax Exempt Illinois

Completing the Tax Exempt Illinois form involves several key steps:

- Gather required documentation, including proof of non-profit status and financial statements.

- Download the form from the Illinois Department of Revenue's website or request a hard copy.

- Fill out the form accurately, ensuring all information is complete and truthful.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with any required attachments to the appropriate state office.

Legal use of the Tax Exempt Illinois

The legal use of the Tax Exempt Illinois form is governed by state laws that outline the qualifications for tax exemption. Organizations must adhere to these laws to maintain their status. Misuse of the form or failure to comply with the regulations can lead to penalties, including the revocation of tax-exempt status. It is essential for organizations to understand their obligations and ensure they operate within the legal framework established by the state.

Key elements of the Tax Exempt Illinois

Key elements of the Tax Exempt Illinois form include:

- Organization Information: Name, address, and type of organization.

- Purpose Statement: A clear description of the organization’s mission and activities.

- Financial Information: Details regarding the organization's funding sources and budget.

- Signature: An authorized representative must sign the form to validate the application.

Eligibility Criteria

Eligibility for the Tax Exempt Illinois form generally requires that the organization be non-profit and operate for charitable, educational, or religious purposes. The organization must demonstrate that its activities serve the public good and that it does not operate for profit. Additionally, the organization must comply with any specific requirements set forth by the Illinois Department of Revenue, such as maintaining proper records and filing annual reports.

Quick guide on how to complete tax exempt illinois

Effortlessly Prepare Tax Exempt Illinois on Any Device

Managing documents online has gained significance among businesses and individuals. It offers a superb environmentally friendly substitute for traditional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Tax Exempt Illinois on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Tax Exempt Illinois with minimal effort

- Locate Tax Exempt Illinois and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Put aside concerns about lost or misplaced files, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Exempt Illinois and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exempt illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for obtaining a tax exempt status in Illinois?

To obtain a tax exempt status in Illinois, businesses need to apply through the Illinois Department of Revenue. It's essential to provide all necessary documentation that proves your eligibility for the tax exempt status. Once approved, you can utilize tax exempt benefits for qualifying purchases.

-

How can airSlate SignNow assist in managing tax exempt documents?

airSlate SignNow provides an efficient way to manage tax exempt documents by allowing businesses to send and eSign necessary forms electronically. This simplifies the documentation process and ensures that all relevant tax exempt Illinois documents are securely stored and easily accessible. The platform enhances efficiency and compliance for your tax exempt needs.

-

Is airSlate SignNow affordable for small businesses seeking tax exempt Illinois options?

Yes, airSlate SignNow offers a cost-effective solution that is especially beneficial for small businesses. With flexible pricing plans, companies can find options that fit their budget while effectively managing their tax exempt Illinois documentation. Investing in this platform can lead to signNow time and cost savings.

-

What features does airSlate SignNow provide for handling tax exempt Illinois transactions?

airSlate SignNow includes multiple features that simplify handling tax exempt Illinois transactions, such as customizable templates, secure eSigning, and cloud storage. These tools help streamline the entire process, ensuring all transactions involving tax exempt statuses are handled efficiently and securely. The user-friendly interface makes it easy to manage documents overall.

-

Can airSlate SignNow integrate with other software for tax exempt Illinois purposes?

Yes, airSlate SignNow offers integrations with various software applications that can assist in managing tax exempt Illinois documentation. Popular integrations include CRM systems, accounting software, and cloud storage solutions. This connectivity ensures a seamless experience when handling tax exempt transactions and record-keeping.

-

What benefits do businesses gain from using airSlate SignNow for tax exempt Illinois documentation?

Businesses benefit from using airSlate SignNow for tax exempt Illinois documentation through improved efficiency and reduced paperwork. The platform speeds up the signing process, minimizes errors, and enhances compliance with tax laws. This ultimately allows businesses to focus on growth while maintaining their tax exempt status effectively.

-

Is it easy to set up airSlate SignNow for tax exempt Illinois needs?

Setting up airSlate SignNow for tax exempt Illinois needs is straightforward and user-friendly. The platform provides guided instructions and resources to help businesses get started quickly. Whether you're a seasoned user or new to eSigning, you'll find that integrating airSlate SignNow into your tax exempt processes is simple and efficient.

Get more for Tax Exempt Illinois

- Waiver university of lethbridge uleth form

- Verified by synergy gateway informationdurham college

- Kindness gram form

- Red cross training partner application form

- Research finance form

- Transcript request form lakehead university

- What is psychological first aid form

- 3215 fr06 purchasing card request formits your yale

Find out other Tax Exempt Illinois

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document