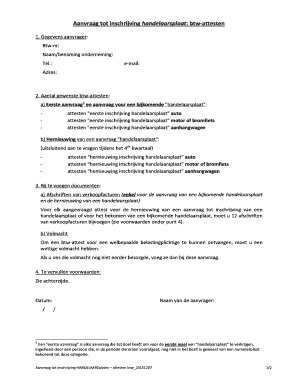

Btw Attest Form

What is the Btw Attest

The Btw Attest is a document that serves as proof of value-added tax (VAT) registration for businesses operating in the Netherlands. It is essential for companies that need to demonstrate their VAT compliance to clients, suppliers, or tax authorities. This document confirms that a business is registered for VAT and is authorized to charge and reclaim VAT on eligible transactions. The Btw Attest is particularly relevant for businesses engaged in cross-border transactions or those that require VAT verification for invoicing purposes.

How to Obtain the Btw Attest

To obtain the Btw Attest, businesses must first ensure that they are registered for VAT with the Dutch tax authorities. The process typically involves submitting an application form along with necessary documentation, such as proof of business registration and identification. Once the application is approved, the tax authorities will issue the Btw Attest, which can be requested online or through official channels. It is advisable for businesses to keep their registration details updated to avoid delays in obtaining the attest.

Steps to Complete the Btw Attest

Completing the Btw Attest involves several key steps:

- Ensure your business is registered for VAT with the Dutch tax authorities.

- Gather required documentation, including proof of business identity and registration.

- Fill out the application form accurately, providing all necessary information.

- Submit the application either online or via the designated postal address.

- Wait for confirmation from the tax authorities regarding the status of your application.

Legal Use of the Btw Attest

The Btw Attest is legally recognized as proof of VAT registration, which can be crucial for businesses engaging in transactions that require VAT compliance. It is important to present this document when requested by clients or tax authorities to avoid potential issues related to VAT obligations. The legal framework surrounding the Btw Attest ensures that it holds weight in both domestic and international transactions, reinforcing the credibility of the business's VAT status.

Required Documents for the Btw Attest

When applying for the Btw Attest, businesses must provide several key documents to support their application. These typically include:

- Proof of business registration, such as a business license or registration certificate.

- Identification documents for the business owner or authorized representative.

- Any previous tax documents that may be relevant to the application.

Penalties for Non-Compliance

Failure to comply with VAT regulations, including not obtaining or presenting the Btw Attest when required, can lead to significant penalties. Businesses may face fines, interest on unpaid taxes, or even legal action from tax authorities. It is crucial for businesses to maintain their VAT registration and ensure they have the Btw Attest readily available to avoid these risks.

Quick guide on how to complete btw attest

Complete Btw Attest seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely save it online. airSlate SignNow equips you with all the functionalities required to create, alter, and eSign your documents rapidly without delays. Manage Btw Attest on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Btw Attest effortlessly

- Locate Btw Attest and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that task.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Change and eSign Btw Attest and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the btw attest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'btw attest' and how does it work with airSlate SignNow?

The term 'btw attest' refers to the process of verifying and confirming actions or signatures within documents. Using airSlate SignNow, businesses can easily implement 'btw attest' to ensure that all electronic signatures are valid and legally binding, providing an added layer of trust and security in document transactions.

-

How much does airSlate SignNow cost for users needing 'btw attest' features?

airSlate SignNow offers a variety of pricing plans tailored to different business needs, including those requiring 'btw attest' functionalities. You can choose from monthly or annual subscriptions, with enterprise options available designed to scale with your organization's demands.

-

What key features does airSlate SignNow provide to support 'btw attest'?

AirSlate SignNow includes several features to support 'btw attest,' such as secure eSigning, advanced document tracking, and authentication options. These features ensure that your documents are not only signed but also verified to meet compliance standards for various industries.

-

Can I integrate airSlate SignNow with other software for 'btw attest' usage?

Yes, airSlate SignNow seamlessly integrates with numerous third-party applications, providing enhanced functionality for 'btw attest.' This allows users to incorporate eSigning and document workflows into existing systems, streamlining operations and enhancing productivity.

-

What are the benefits of using airSlate SignNow for 'btw attest'?

Using airSlate SignNow for 'btw attest' offers several benefits, including increased efficiency and reduced time spent on paperwork. By digitizing the signing process, businesses can accelerate transaction times and improve accuracy while maintaining legal compliance.

-

Is airSlate SignNow compliant with regulations when using 'btw attest'?

Absolutely! airSlate SignNow is designed to comply with various industry regulations, including eSign laws. This compliance ensures that your 'btw attest' processes are legally sound, providing confidence that your signed documents are upheld in any legal context.

-

How do I get started with 'btw attest' on airSlate SignNow?

To get started with 'btw attest' on airSlate SignNow, simply sign up for an account and explore the user-friendly interface. You can create templates, send documents for signature, and utilize the 'btw attest' features with just a few clicks, making it easy for any user.

Get more for Btw Attest

- S lo para informaci n no entregue a la corte california courts courts ca 6968049

- California jv 590 s form

- Tr 500 s instruction to defendant for remote california courts courts ca form

- Fillable court forms california

- California time form

- Adopt 200 fillable form 2010

- Dv 500 form

- Dv 520 info s get ready for the court hearing spanish judicial council forms courts ca

Find out other Btw Attest

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF