Form 12256

What is the Form 12256

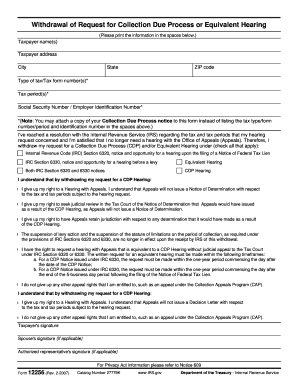

The Form 12256 is an IRS document used primarily for tax purposes, specifically related to the reporting of certain financial transactions. This form is essential for individuals and businesses that need to provide detailed information regarding their financial activities to the Internal Revenue Service. Understanding the purpose and requirements of Form 12256 is crucial for compliance with tax regulations.

How to use the Form 12256

Using the Form 12256 involves several steps to ensure accurate reporting. Initially, gather all necessary financial documentation, including income statements and transaction records. Fill out the form with precise information, ensuring that all fields are completed as required. Once completed, the form can be submitted electronically through an approved e-filing service or mailed directly to the IRS, depending on your preference and the specific instructions provided by the IRS.

Steps to complete the Form 12256

Completing Form 12256 requires careful attention to detail. Start by entering your personal information, such as your name, address, and taxpayer identification number. Next, provide the financial details required, including the nature of the transactions being reported. Ensure that all amounts are accurately calculated and double-check for any errors. After reviewing the form for completeness, sign and date it before submission. Following these steps will help ensure that your form is processed without delays.

Legal use of the Form 12256

The legal use of Form 12256 is governed by IRS regulations. It is important to ensure that the information provided is truthful and accurate, as submitting false information can lead to penalties. The form must be filed within the designated time frame to maintain compliance with tax laws. Utilizing electronic signing solutions, like those offered by signNow, can enhance the legitimacy of your submission while ensuring that you meet all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for Form 12256 are critical to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, if you are filing for a business or under specific circumstances, the deadlines may vary. It is advisable to check the IRS website or consult with a tax professional to confirm the exact dates relevant to your situation.

Required Documents

To complete Form 12256, certain documents are necessary. These may include your previous tax returns, income statements, and any supporting documentation related to the transactions being reported. Having these documents ready will facilitate a smoother completion process and ensure that all information is accurate and verifiable.

Form Submission Methods (Online / Mail / In-Person)

Form 12256 can be submitted through various methods to accommodate different preferences. You can file the form online using an IRS-approved e-filing service, which is often the quickest option. Alternatively, you may choose to mail the completed form directly to the IRS. In some cases, in-person submissions may be available at designated IRS offices. Each method has its own processing times, so consider your needs when selecting a submission method.

Quick guide on how to complete form 12256

Complete Form 12256 easily on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly without issues. Handle Form 12256 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related activity today.

How to modify and eSign Form 12256 effortlessly

- Find Form 12256 and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Select important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere moments and carries the same legal significance as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Move past concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Modify and eSign Form 12256 while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 12256

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 12256 and how is it used?

Form 12256 is a document used for specific filing purposes within various business processes. By utilizing form 12256, users can ensure that their submissions meet regulatory requirements efficiently. With airSlate SignNow, you can easily create, customize, and eSign form 12256 to streamline your workflows.

-

How does airSlate SignNow simplify the signing process for form 12256?

airSlate SignNow provides a user-friendly interface that allows you to send and eSign form 12256 in just a few clicks. Its intuitive design ensures that all parties can easily navigate the signing process, reducing delays. Additionally, the platform enables real-time tracking, so you can stay updated on the status of your form 12256.

-

Is there a pricing plan for using airSlate SignNow with form 12256?

Yes, airSlate SignNow offers affordable pricing plans that cater to various business needs when handling form 12256. Whether you are a small business or a larger organization, our pricing is transparent and designed to be cost-effective. Visit our pricing page to find a plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other apps for managing form 12256?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, allowing you to manage form 12256 alongside your existing workflows. Whether you're using CRM systems, document management tools, or cloud storage solutions, our integrations help you keep everything organized and efficient.

-

What are the main benefits of using airSlate SignNow for form 12256?

Using airSlate SignNow for form 12256 enhances your document management experience through automation and efficiency. Key benefits include reduced turnaround time, improved accuracy, and the convenience of eSigning from anywhere. These features allow businesses to focus on their core activities while ensuring compliance.

-

Can I customize form 12256 in airSlate SignNow?

Yes, airSlate SignNow allows for comprehensive customization of form 12256 to meet your specific needs. You can add fields, change layouts, and include branding elements to make it fit your company's identity. This flexibility ensures that the form 12256 aligns perfectly with your workflow requirements.

-

Is it secure to eSign form 12256 with airSlate SignNow?

Security is a top priority at airSlate SignNow, and eSigning form 12256 is as secure as it gets. We implement robust encryption and comply with industry standards to protect your data during transmission and storage. This means you can eSign with confidence, knowing your form 12256 is handled securely.

Get more for Form 12256

Find out other Form 12256

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure