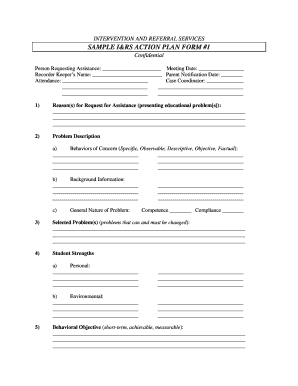

Sample I Rs Action Plan Form

What is the Sample IRS Action Plan

The Sample IRS Action Plan is a structured document designed to help individuals and businesses outline their strategies for addressing specific tax obligations or compliance issues with the Internal Revenue Service (IRS). This plan typically includes detailed steps, timelines, and responsibilities to ensure that all necessary actions are taken to meet IRS requirements. It serves as a roadmap for managing tax-related tasks, such as filing returns, making payments, or responding to IRS inquiries.

How to Use the Sample IRS Action Plan

To effectively use the Sample IRS Action Plan, begin by identifying the specific tax issue or obligation you need to address. Next, customize the template to reflect your unique circumstances, including relevant dates, amounts, and any supporting documentation required. Assign tasks to responsible parties and set deadlines to ensure timely completion. Regularly review and update the plan as needed to stay on track with your tax obligations.

Steps to Complete the Sample IRS Action Plan

Completing the Sample IRS Action Plan involves several key steps:

- Identify the tax issue: Determine the specific IRS requirement or compliance issue you are addressing.

- Gather necessary information: Collect all relevant documents, such as prior tax returns, notices from the IRS, and financial statements.

- Customize the template: Fill in the Sample IRS Action Plan with your specific details, including timelines and responsible parties.

- Implement the plan: Follow the outlined steps, ensuring that tasks are completed by their deadlines.

- Monitor progress: Regularly check the status of each task and update the plan as necessary.

Legal Use of the Sample IRS Action Plan

The Sample IRS Action Plan is legally valid when it is completed accurately and in compliance with IRS regulations. It is important to ensure that all information provided is truthful and complete, as inaccuracies can lead to penalties or audits. Utilizing this plan demonstrates a proactive approach to tax compliance and can be beneficial in mitigating potential issues with the IRS.

Key Elements of the Sample IRS Action Plan

Key elements of the Sample IRS Action Plan include:

- Objective: A clear statement of the tax issue being addressed.

- Timeline: Specific dates for each action item.

- Responsibilities: Identification of individuals or teams responsible for each task.

- Supporting documents: A list of required documents needed to support the actions taken.

- Review process: A method for regularly assessing progress and making necessary adjustments.

IRS Guidelines

Understanding IRS guidelines is crucial when creating your Sample IRS Action Plan. The IRS provides extensive resources and instructions on various tax matters, including filing requirements, payment options, and compliance procedures. Familiarizing yourself with these guidelines ensures that your action plan aligns with current regulations and helps avoid potential pitfalls.

Quick guide on how to complete sample i rs action plan

Complete Sample I Rs Action Plan effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Sample I Rs Action Plan on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Sample I Rs Action Plan with ease

- Find Sample I Rs Action Plan and select Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and eSign Sample I Rs Action Plan and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample i rs action plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS action plan template and how does it work?

An IRS action plan template is a structured document that helps businesses outline steps required to comply with IRS regulations. By utilizing this template, organizations can ensure they effectively manage tax compliance and reporting duties efficiently.

-

How can the airSlate SignNow platform help with the IRS action plan template?

The airSlate SignNow platform simplifies the process of using an IRS action plan template by providing extensive eSigning and document management features. Businesses can easily create, edit, and securely share their templates, ensuring compliance with IRS requirements.

-

Are there costs associated with using the IRS action plan template on airSlate SignNow?

Using the IRS action plan template on airSlate SignNow is part of our cost-effective subscription plans, which vary based on features and team size. The platform aims to provide value by automating workflows and reducing the cost of document handling.

-

What features are included with the IRS action plan template in airSlate SignNow?

The IRS action plan template in airSlate SignNow includes features like customizable fields, electronic signatures, and document tracking. These features enhance efficiency and ensure all necessary steps are documented and completed accurately.

-

How does using an IRS action plan template improve compliance?

Implementing an IRS action plan template helps businesses stay organized and ensures critical tasks are completed accurately and on time. This structured approach minimizes the risk of errors and improves overall compliance with IRS regulations.

-

Can the IRS action plan template be integrated with other applications?

Yes, the airSlate SignNow platform allows seamless integration with various applications, enhancing the functionality of the IRS action plan template. This feature enables teams to work more collaboratively and ensures documentation flows smoothly across systems.

-

Is it easy to customize the IRS action plan template?

Absolutely! airSlate SignNow makes it easy to customize the IRS action plan template according to specific business needs, allowing for added fields and specifications. This flexibility ensures that each organization can tailor the template to address its unique compliance requirements.

Get more for Sample I Rs Action Plan

- Inow shelby form

- Uab applicant declaration form into partnerportal

- Hinds community college appeal form

- Lp service learning sheet form

- Literal equations worksheet algebra 1 answers form

- Behavior tracking form momentary time sampling name grade age date person completing

- Teacher recommendation form for cheerleaders bishop kelly

- Omb no 1845 0074 expiration date 09302015 form

Find out other Sample I Rs Action Plan

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document