Form 16aa

What is the Form 16aa

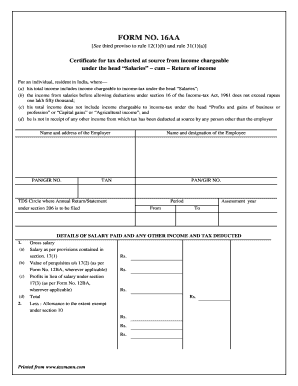

The Form 16aa is a tax document used primarily in the United States for reporting income and tax deductions. It serves as a certificate of tax deducted at source (TDS) on income, allowing taxpayers to claim credit for the tax that has already been paid on their behalf. This form is particularly relevant for individuals who receive income from various sources, including salaries, interest, or dividends. Understanding the purpose and function of the Form 16aa is essential for accurate tax filing and compliance.

How to use the Form 16aa

Using the Form 16aa involves several key steps to ensure that the information is accurately reported. Taxpayers should first gather all necessary documents, including income statements and any other relevant financial records. Next, the form must be filled out with precise details such as income amounts, TDS deducted, and personal identification information. Once completed, the Form 16aa can be submitted along with the taxpayer's annual income tax return. Proper use of this form can help in maximizing tax benefits and ensuring compliance with IRS regulations.

Steps to complete the Form 16aa

Completing the Form 16aa requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Fill in your personal information, including name, address, and Social Security number.

- Report all sources of income accurately, ensuring that amounts match your records.

- Indicate the total amount of tax deducted at source, as shown in your income statements.

- Review the form for accuracy before submission to avoid any discrepancies.

Legal use of the Form 16aa

The Form 16aa is legally recognized as a valid document for tax reporting in the United States. Its legal standing is reinforced by compliance with IRS guidelines, ensuring that the information provided is accurate and truthful. Taxpayers must ensure that they use the form correctly and submit it within the designated filing deadlines to avoid penalties. Proper legal use of the Form 16aa not only facilitates tax compliance but also protects taxpayers against potential audits or disputes regarding their reported income.

Filing Deadlines / Important Dates

Filing deadlines for the Form 16aa are crucial for compliance with tax regulations. Typically, the form must be submitted alongside your annual income tax return by April fifteenth of the following tax year. It is important to keep track of any changes in deadlines, as extensions may be available under certain circumstances. Being aware of these important dates helps ensure that taxpayers avoid late fees and penalties associated with non-compliance.

Required Documents

To complete the Form 16aa accurately, several documents are required. These include:

- Income statements from employers or financial institutions.

- Previous tax returns for reference.

- Any relevant documentation supporting deductions or credits claimed.

- Identification documents, such as a Social Security card or taxpayer identification number.

Having these documents ready can streamline the process of filling out the form and ensure that all information is accurate and complete.

Quick guide on how to complete form 16aa

Effortlessly prepare Form 16aa on any device

Online document management has become favored among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 16aa on any device using the airSlate SignNow Android or iOS applications and enhance your document processes today.

The easiest way to edit and eSign Form 16aa without hassle

- Find Form 16aa and click on Get Form to begin.

- Use the tools we provide to fill in your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form: via email, SMS, invitation link, or download it to your computer.

No more worries about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 16aa and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 16aa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 16aa?

Form 16aa is a crucial document often required for tax purposes in various regions. It provides necessary details about income, deductions, and tax payments. Understanding how to properly fill out and submit form 16aa is essential for compliance and smooth tax processing.

-

How does airSlate SignNow simplify the process of handling form 16aa?

airSlate SignNow streamlines the process of creating, signing, and managing form 16aa electronically. With its user-friendly interface and efficient e-signature capabilities, users can quickly finalize and send their documents, enhancing productivity while ensuring compliance with legal standards.

-

What are the pricing options for using airSlate SignNow for form 16aa management?

airSlate SignNow offers competitive pricing plans tailored to different business needs, making managing form 16aa affordable for all. Each plan includes essential features that facilitate document signing, storage, and integration functions. Check our pricing page for specific details and options.

-

Can I integrate airSlate SignNow with other tools to manage form 16aa?

Yes, airSlate SignNow provides seamless integration with various tools and platforms to enhance your form 16aa management. By connecting with popular applications, businesses can automate workflows and ensure documents are processed efficiently. Explore our integration options for more details.

-

What features does airSlate SignNow offer for creating form 16aa?

airSlate SignNow includes robust features for drafting and managing form 16aa. Users can customize templates, add conditional logic, and collaborate with others in real-time. These features make it easier to create accurate and compliant documents efficiently.

-

Are there any benefits to using airSlate SignNow for form 16aa over traditional methods?

Using airSlate SignNow for form 16aa provides numerous benefits over traditional paper methods. It signNowly reduces turnaround times, minimizes paperwork, and enhances security of sensitive information. This results in a more efficient process that saves time and reduces costs for organizations.

-

Is airSlate SignNow legally compliant for handling form 16aa?

Absolutely! airSlate SignNow complies with various legal standards for e-signatures, ensuring that form 16aa is handled appropriately. This adherence to legal requirements means you can confidently manage your documents and trust in the integrity of the signing process.

Get more for Form 16aa

Find out other Form 16aa

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History