Employee's Withholding Certificate Form

What is the Employee's Withholding Certificate

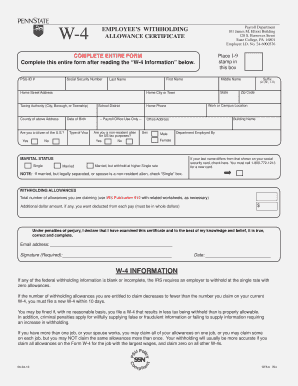

The Employee's Withholding Certificate, commonly referred to as Form W-4, is a document that employees in the United States complete to inform their employer of the amount of federal income tax to withhold from their paychecks. This form is essential for ensuring that the correct amount of tax is deducted, helping employees avoid underpayment or overpayment of taxes throughout the year. The information provided on the certificate includes personal details, filing status, and the number of withholding allowances claimed, which directly influences the withholding amount.

Steps to Complete the Employee's Withholding Certificate

Completing the Employee's Withholding Certificate involves several straightforward steps:

- Begin by entering your personal information, including your name, address, Social Security number, and filing status.

- Determine the number of withholding allowances you wish to claim. This number affects how much tax is withheld from your paycheck.

- If applicable, indicate any additional amount you want withheld from each paycheck.

- Sign and date the form to validate it. This step is crucial for the form to be considered legally binding.

After completing the form, submit it to your employer for processing.

Legal Use of the Employee's Withholding Certificate

The Employee's Withholding Certificate is legally recognized as a valid document for determining tax withholding in the United States. To ensure its legal use, it must be completed accurately and submitted to the employer. Employers are required to honor the information provided on the certificate, as it dictates the amount of federal income tax withheld from an employee's wages. Compliance with IRS regulations is essential, and both employees and employers should retain copies of the completed form for their records.

Key Elements of the Employee's Withholding Certificate

Several key elements make up the Employee's Withholding Certificate:

- Personal Information: This includes the employee's name, address, and Social Security number.

- Filing Status: Employees must select their filing status, which can be single, married filing jointly, married filing separately, or head of household.

- Withholding Allowances: Employees can claim allowances based on their personal situation, which will reduce the amount of tax withheld.

- Additional Withholding: Employees may choose to specify an additional amount to be withheld from each paycheck.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the completion and submission of the Employee's Withholding Certificate. Employees should refer to the latest IRS publications for updates on withholding allowances and tax rates. It is important to review these guidelines annually or whenever there are significant changes in personal circumstances, such as marriage, divorce, or the birth of a child, as these factors can affect tax withholding needs.

Form Submission Methods

Employees can submit the Employee's Withholding Certificate to their employer through various methods:

- Online Submission: Many employers offer electronic submission options, allowing employees to fill out and submit the form digitally.

- Mail: Employees can print the completed form and mail it directly to their employer's HR or payroll department.

- In-Person: Submitting the form in person is also an option, especially for new employees during the onboarding process.

Quick guide on how to complete employees withholding certificate

Accomplish Employee's Withholding Certificate effortlessly on any device

Web-based document administration has become widely embraced by enterprises and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Employee's Withholding Certificate on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Employee's Withholding Certificate with ease

- Find Employee's Withholding Certificate and click on Obtain Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Completed button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Purge the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Revise and eSign Employee's Withholding Certificate while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employees withholding certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are withholding allowances and how do they affect my taxes?

Withholding allowances determine the amount of federal income tax withheld from your paycheck. The more allowances you claim, the less tax is withheld, which can impact your overall tax refund. It's important to understand your withholding allowances to ensure you're not over- or under-paying your taxes throughout the year.

-

How does airSlate SignNow help with managing withholding allowances?

airSlate SignNow streamlines the process of completing and signing forms related to withholding allowances. Our platform provides templates that make it easy to fill out W-4 forms accurately. This ensures that you can efficiently manage your tax withholding while staying compliant.

-

Can I integrate airSlate SignNow with payroll software to handle withholding allowances?

Yes, airSlate SignNow offers integrations with various payroll software solutions. This allows you to automate the transfer of withholding allowances and other tax-related documents seamlessly, reducing the risk of errors and ensuring timely updates on employee withholding statuses.

-

What features does airSlate SignNow offer for handling withholding allowances?

airSlate SignNow provides easy document uploads, customizable templates, and secure eSigning features that specifically cater to handling withholding allowances. Our user-friendly interface also allows for real-time collaboration, making it simpler to manage and document any changes related to your withholding allowances.

-

Is there a cost associated with using airSlate SignNow for managing withholding allowances?

AirSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes, making it a cost-effective solution for managing withholding allowances. With our subscription model, you can select a plan that suits your budget while gaining access to all the necessary features for effective document management.

-

How can I ensure compliance when using airSlate SignNow for withholding allowances?

To ensure compliance, airSlate SignNow provides up-to-date templates and resources for all forms related to withholding allowances, such as W-4s. Our platform also secures data with encryption and provides audit trails, ensuring that all your documentation meets regulatory standards.

-

Can I track changes made to withholding allowances documents in airSlate SignNow?

Absolutely! AirSlate SignNow includes a comprehensive tracking feature that logs all changes made to documents related to withholding allowances. This feature allows you to review the editing history and ensure that all updates are accurate and properly recorded.

Get more for Employee's Withholding Certificate

Find out other Employee's Withholding Certificate

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form