Irs Form 668 D

What is the IRS Form 668 D?

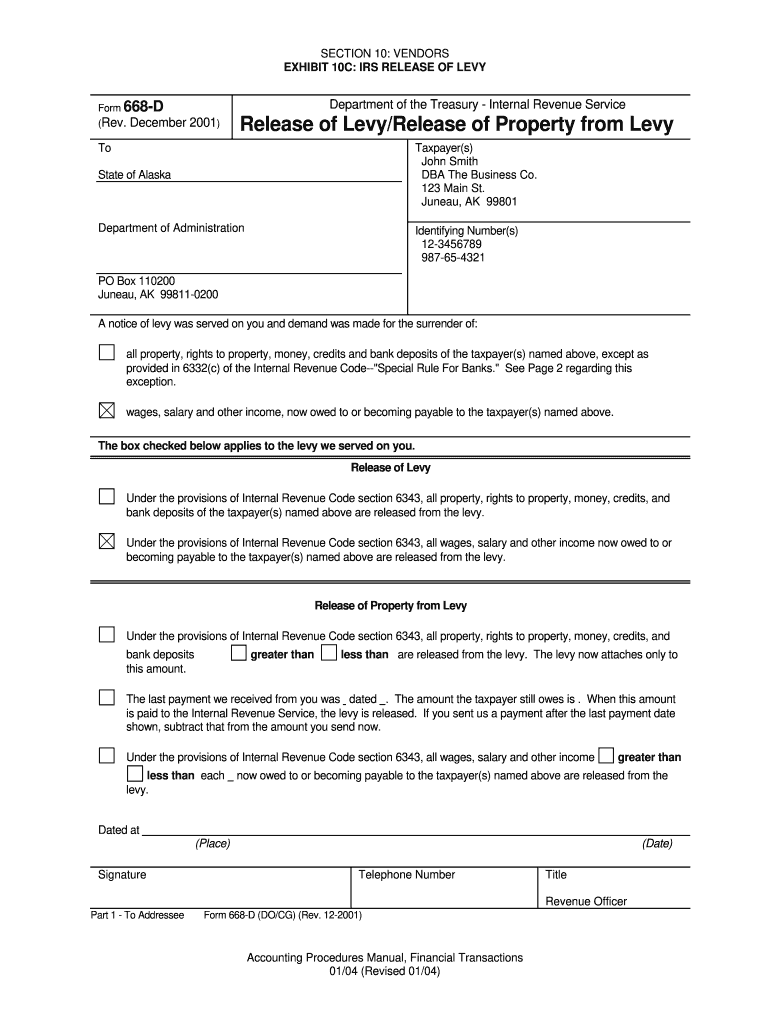

The IRS Form 668 D, also known as the release of levy, is a crucial document used to formally release a levy placed on a taxpayer's property or assets. A levy is a legal seizure of assets to satisfy a tax debt, and the Form 668 D serves as proof that the IRS has lifted this levy. This form is essential for individuals or businesses who have had their assets frozen or seized due to unpaid taxes, allowing them to regain access to their property.

How to use the IRS Form 668 D

Using the IRS Form 668 D involves a few key steps. First, ensure that the levy has been released by the IRS, which is typically indicated by the issuance of this form. Once you receive the form, review it carefully to confirm that all information is accurate. It is important to retain a copy of the Form 668 D for your records, as it serves as official documentation of the levy release. If you need to present this form to financial institutions or other entities, it is advisable to keep multiple copies on hand.

Steps to complete the IRS Form 668 D

Completing the IRS Form 668 D requires attention to detail. Follow these steps to ensure accuracy:

- Obtain the form from the IRS or your tax professional.

- Fill in the taxpayer's name, address, and identification number accurately.

- Provide details regarding the levy, including the date it was issued and the specific assets affected.

- Sign and date the form to certify its accuracy.

- Submit the form to the IRS as instructed, ensuring you keep a copy for your records.

Legal use of the IRS Form 668 D

The IRS Form 668 D is legally binding once it is completed and submitted. It acts as a formal acknowledgment from the IRS that the levy has been released. This means that the taxpayer is no longer subject to the seizure of their assets for the specified tax debt. It is essential to use this form correctly to avoid any future legal complications regarding the status of the levy.

Key elements of the IRS Form 668 D

Several key elements must be included in the IRS Form 668 D to ensure its validity:

- The taxpayer's full name and address.

- The IRS's identification number for the levy.

- The date the levy was released.

- A clear statement indicating that the levy is no longer in effect.

- The signature of an authorized IRS official.

Filing Deadlines / Important Dates

While there are no specific deadlines for submitting the IRS Form 668 D, it is important to act promptly once the levy is released. Keeping track of important dates related to your tax obligations is crucial to avoid future levies. Always consult the IRS guidelines or a tax professional for any time-sensitive matters related to your tax situation.

Quick guide on how to complete irs form 668 d release of levy

Accomplish Irs Form 668 D seamlessly on any device

Digital document management has gained traction with both businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing users to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Irs Form 668 D on any device with airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

Steps to modify and eSign Irs Form 668 D effortlessly

- Find Irs Form 668 D and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device. Modify and eSign Irs Form 668 D to ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Does the IRS require unused sheets of a form to be submitted? Can I just leave out the section of a form whose lines are not filled out?

This is what a schedule C I submitted earlier looks like :http://onemoredime.com/wp-conten... So I did not submit page 2 of the schedule C - all the lines on page 2 (33 through 48) were blank.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the irs form 668 d release of levy

How to generate an electronic signature for the Irs Form 668 D Release Of Levy in the online mode

How to create an eSignature for your Irs Form 668 D Release Of Levy in Google Chrome

How to generate an electronic signature for signing the Irs Form 668 D Release Of Levy in Gmail

How to create an eSignature for the Irs Form 668 D Release Of Levy right from your mobile device

How to create an eSignature for the Irs Form 668 D Release Of Levy on iOS devices

How to create an electronic signature for the Irs Form 668 D Release Of Levy on Android devices

People also ask

-

What is the IRS Form 668 D Release of Levy?

The IRS Form 668 D Release of Levy is a document that officially releases a levy placed on a taxpayer's property or wages by the IRS. This form provides evidence that the taxpayer has satisfied their debt or that the levy is no longer necessary. Businesses using airSlate SignNow can easily generate and sign this form electronically, streamlining compliance processes.

-

How can airSlate SignNow help with IRS Form 668 D Release of Levy?

airSlate SignNow simplifies the process of creating, signing, and managing the IRS Form 668 D Release of Levy. Our platform allows you to input necessary information, collect e-signatures, and securely store documents all in one place. This ensures a fast and efficient way to handle your tax-related document needs.

-

Is there a cost associated with using airSlate SignNow for tax documents like the IRS Form 668 D Release of Levy?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our pricing is designed to be affordable while providing robust features for creating and managing documents, including the IRS Form 668 D Release of Levy. You can choose a plan that best fits your organization's requirements.

-

Are there any features specific to document security for IRS Form 668 D Release of Levy in airSlate SignNow?

Absolutely, airSlate SignNow prioritizes document security, particularly for sensitive forms like the IRS Form 668 D Release of Levy. Our platform includes features such as encryption, secure access controls, and audit trails to protect your documents and ensure compliance with legal standards.

-

Can I integrate airSlate SignNow with other software for handling IRS Form 668 D Release of Levy?

Yes, airSlate SignNow supports integrations with various third-party applications. This flexibility allows you to seamlessly incorporate the automated handling of the IRS Form 668 D Release of Levy into your existing workflows, enhancing productivity and collaboration within your team.

-

What are the benefits of using airSlate SignNow for IRS Form 668 D Release of Levy?

Using airSlate SignNow for the IRS Form 668 D Release of Levy offers numerous benefits including time savings, reduced paperwork, and enhanced accuracy. The electronic signature feature expedites the signing process, while our customizable templates ensure you have everything needed for compliance at your fingertips.

-

How user-friendly is airSlate SignNow for creating the IRS Form 668 D Release of Levy?

airSlate SignNow is designed with user experience in mind, making it easy for individuals to create the IRS Form 668 D Release of Levy without technical expertise. Our intuitive interface, combined with step-by-step guidance, ensures that users can quickly navigate the document creation process.

Get more for Irs Form 668 D

- Ch3cf3 form

- 252e form 100067407

- Registration form in a bank

- Family information guide jatoft foti insurance agency

- Pioneer american life insurance form

- Madison surgery center apparently drops late term abortion form

- Lab toxicology clinical documentation form

- 219th level 3 civil docket control order form

Find out other Irs Form 668 D

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors