Privately Owned Atm Questionnaire Form

What is the Privately Owned ATM Questionnaire

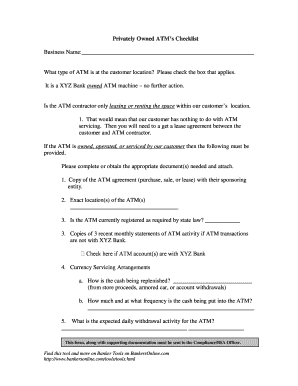

The privately owned ATM questionnaire is a specialized document designed to gather essential information about privately owned automated teller machines (ATMs). This form is crucial for business owners who wish to operate ATMs on their premises. It typically includes questions regarding the location, ownership, and operational details of the ATM, ensuring compliance with local regulations and financial institution requirements.

How to Use the Privately Owned ATM Questionnaire

Using the privately owned ATM questionnaire involves several steps to ensure accurate completion. First, gather all necessary information related to the ATM, including its location, ownership details, and operational specifics. Next, fill out the questionnaire carefully, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions before submission to the relevant authority or financial institution.

Steps to Complete the Privately Owned ATM Questionnaire

Completing the privately owned ATM questionnaire requires careful attention to detail. Follow these steps:

- Collect necessary documentation, such as ownership proof and location details.

- Fill in the questionnaire with accurate information, ensuring clarity in each response.

- Review the completed form for accuracy, checking for any missing information.

- Submit the questionnaire electronically or via mail, depending on the requirements of the receiving entity.

Key Elements of the Privately Owned ATM Questionnaire

Several key elements are essential to the privately owned ATM questionnaire. These include:

- Owner's name and contact information.

- ATM location details, including address and accessibility.

- Operational hours and any fees associated with ATM usage.

- Compliance with local regulations and financial institution policies.

Legal Use of the Privately Owned ATM Questionnaire

The legal use of the privately owned ATM questionnaire is vital for ensuring compliance with federal and state regulations. This form serves as a formal declaration of the ATM's operational status and ownership. Proper completion and submission can protect business owners from potential legal issues related to ATM operations, such as unauthorized use or liability claims.

State-Specific Rules for the Privately Owned ATM Questionnaire

Each state may have specific rules governing the operation of privately owned ATMs. It is important to familiarize yourself with these regulations, as they can affect the information required on the questionnaire. Some states may have additional licensing requirements or operational guidelines that must be adhered to, making it crucial for business owners to stay informed about local laws.

Quick guide on how to complete privately owned atm questionnaire

Effortlessly Prepare Privately Owned Atm Questionnaire on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the right template and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Privately Owned Atm Questionnaire on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest way to modify and eSign Privately Owned Atm Questionnaire effortlessly

- Find Privately Owned Atm Questionnaire and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all information and click on the Done button to save your modifications.

- Select how you wish to deliver your form: via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Privately Owned Atm Questionnaire and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the privately owned atm questionnaire

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a privately owned ATM questionnaire?

A privately owned ATM questionnaire is a document designed to gather essential information about an ATM that a business wishes to place at its location. This questionnaire helps assess the feasibility and setup process of the ATM, ensuring all requirements are met before installation.

-

How does airSlate SignNow facilitate the completion of a privately owned ATM questionnaire?

With airSlate SignNow, businesses can easily create and send electronically signed copies of their privately owned ATM questionnaire. This streamlines the process and allows for faster completion, reducing the time and effort traditionally required for paperwork.

-

Is there any cost associated with using airSlate SignNow for the privately owned ATM questionnaire?

AirSlate SignNow offers a cost-effective solution for managing documents, including the privately owned ATM questionnaire. Pricing depends on the plan chosen, which provides various features suitable for different business needs.

-

What features does airSlate SignNow offer for handling the privately owned ATM questionnaire?

AirSlate SignNow includes features such as document templates, electronic signatures, and encrypted data protection. These functionalities enhance the efficiency and security of processing the privately owned ATM questionnaire to meet compliance standards.

-

Can the privately owned ATM questionnaire be customized using airSlate SignNow?

Yes, the privately owned ATM questionnaire can be easily customized in airSlate SignNow to suit your business's specific needs. Users can add their branding and modify any required fields to ensure the form captures all necessary information.

-

Are there any integrations available to streamline the privately owned ATM questionnaire process?

AirSlate SignNow supports various integrations with popular applications, such as CRMs and project management tools. This makes it easier to streamline the workflow associated with the privately owned ATM questionnaire, allowing for seamless data transfer and management.

-

What are the key benefits of using airSlate SignNow for a privately owned ATM questionnaire?

Using airSlate SignNow for a privately owned ATM questionnaire provides businesses with a fast, secure, and compliant way to handle documentation. It minimizes errors and ensures a smooth process from questionnaire completion to final signature.

Get more for Privately Owned Atm Questionnaire

- What does dd22 form look like 2010

- Vba 22 1990 arepdf 2012 form

- Va form 40 1330 online form 2009

- 21 534ez ipad 1998 form

- Direct deposit enrollment veterans benefits administration form

- 29 0309 direct deposit enrollmentchange form

- Certifying body for your health occupation 1998 form

- Va application for familly memberpdffillercom 2011 form

Find out other Privately Owned Atm Questionnaire

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online