Form St105

What is the Form St105

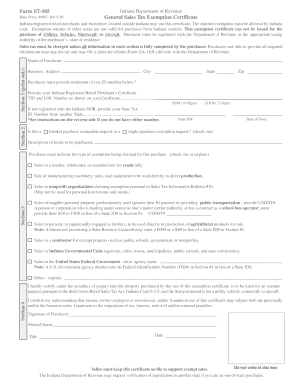

The Form St105 is a crucial document used in the United States for sales tax exemption purposes. It is primarily utilized by purchasers to claim exemption from sales tax on certain purchases, particularly in the context of business transactions. This form is essential for entities that qualify for tax-exempt status, allowing them to avoid paying sales tax on eligible purchases, thereby reducing overall costs.

How to Use the Form St105

Using the Form St105 involves several straightforward steps. First, ensure that you meet the eligibility criteria for tax exemption. Next, download the form from an official source or obtain a physical copy. Fill out the necessary fields, including your name, address, and the reason for claiming exemption. Finally, submit the completed form to the seller from whom you are purchasing goods or services. It's important to retain a copy for your records.

Steps to Complete the Form St105

Completing the Form St105 requires attention to detail. Start by providing your business information, including the name and address. Specify the type of exemption you are claiming, such as for resale or for use in manufacturing. Ensure that all sections are filled out accurately. After completing the form, sign and date it. This signature certifies that the information provided is true and that you are entitled to the exemption claimed.

Legal Use of the Form St105

The legal use of the Form St105 is governed by state laws regarding sales tax exemptions. To be valid, the form must be completed correctly and submitted to the seller at the time of purchase. Misuse of the form, such as claiming exemptions without proper eligibility, can lead to penalties. It is essential to understand the specific legal requirements in your state to ensure compliance.

Key Elements of the Form St105

Key elements of the Form St105 include the purchaser's name, address, and the type of exemption being claimed. Additionally, the form requires a signature and date to validate the claim. The form may also include sections for the seller's information, ensuring that both parties have a clear understanding of the transaction. Accurate completion of these elements is vital for the form's acceptance.

Form Submission Methods

The Form St105 can be submitted in various ways. Typically, it is presented directly to the seller at the point of sale. Some businesses may allow for electronic submission, depending on their policies. In certain cases, it may also be necessary to submit the form to a state tax authority for record-keeping purposes. Always check with the seller for their preferred submission method to ensure compliance.

Examples of Using the Form St105

Examples of using the Form St105 include situations where a retailer sells products to a reseller who will not pay sales tax because they intend to sell the items again. Another example is a manufacturer purchasing raw materials for production, which are exempt from sales tax under specific conditions. These scenarios illustrate the practical applications of the form in various business contexts.

Quick guide on how to complete form st105

Complete Form St105 effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents rapidly without delays. Handle Form St105 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The simplest way to modify and eSign Form St105 without hassle

- Obtain Form St105 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form St105 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st105

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form st105 and how is it used?

The form st105 is a critical document used for sales tax exemption in several jurisdictions. Businesses utilize the form st105 to establish their status as exempt from sales tax when purchasing goods for resale. Using this form properly can help companies save money and streamline their tax processes.

-

How can I fill out the form st105 using airSlate SignNow?

Filling out the form st105 with airSlate SignNow is simple and efficient. Our platform allows you to upload the form, fill in the necessary fields, and eSign it digitally. This ensures that your document is completed accurately and securely, saving time for both you and your recipient.

-

Is there a cost associated with using airSlate SignNow to manage the form st105?

airSlate SignNow offers various pricing plans that cater to different business needs, making it cost-effective. While the exact cost may vary based on the features you choose, using airSlate SignNow to manage the form st105 can lead to signNow savings in time and resources. Check our pricing page for specific details.

-

What are the benefits of using airSlate SignNow for the form st105?

Using airSlate SignNow for the form st105 provides numerous benefits including faster processing times and enhanced security. Our platform facilitates easy eSignature capabilities, which ensures documents are signed promptly and tracked efficiently. This not only speeds up your workflow but also provides peace of mind regarding document safety.

-

Can airSlate SignNow integrate with other software for managing the form st105?

Yes, airSlate SignNow offers integrations with several popular business software applications, enhancing your ability to manage the form st105 effectively. Our platform can connect with tools like CRM and accounting systems, allowing for seamless data transfer and improved workflow. This ensures that you can handle the form st105 within your existing processes.

-

Is the form st105 legally binding when signed using airSlate SignNow?

Yes, signatures provided through airSlate SignNow on the form st105 are legally binding. The platform complies with applicable eSignature laws, ensuring that documents signed digitally hold the same legal weight as traditional handwritten signatures. This provides assurance for businesses and individuals using the form st105.

-

What security measures does airSlate SignNow employ for the form st105?

airSlate SignNow takes security seriously, implementing advanced measures to protect your information when handling the form st105. Our platform uses encryption, two-factor authentication, and rigorous access controls to ensure your sensitive data remains safe. You can have confidence in the security of your digitally signed documents.

Get more for Form St105

- Motion to waive divorce education requirements utah state courts utcourts form

- Application for change of name adult courts state va form

- Virginia certificate release form

- Dc 326 form

- Dc 582 form

- Resident agent form for living and or family trusts fairfax county

- Motions day form

- Virginia small claims court form

Find out other Form St105

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself