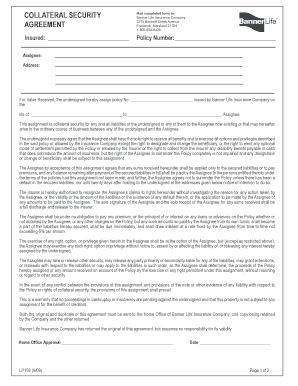

COLLATERAL SECURITY AGREEMENT Term Life Insurance Form

What is the collateral security agreement term life insurance?

The collateral security agreement term life insurance is a legal document that establishes a connection between a life insurance policy and a loan or financial obligation. This agreement allows a lender to use the life insurance policy as collateral, ensuring that the loan is secured against the policy's value. In the event of the borrower's death, the lender can claim the insurance payout to settle the outstanding debt. This arrangement provides a safety net for lenders while allowing borrowers to access funds without liquidating their assets.

Key elements of the collateral security agreement term life insurance

Several key elements define a collateral security agreement term life insurance. These include:

- Identification of Parties: The agreement must clearly identify the borrower and the lender, including their legal names and contact information.

- Policy Details: It should specify the life insurance policy number, the insurer's name, and the face value of the policy.

- Loan Amount: The document must state the loan amount secured by the life insurance policy.

- Terms and Conditions: It outlines the terms under which the collateral can be claimed, including any conditions for default.

- Signatures: Both parties must sign the agreement to validate it legally.

Steps to complete the collateral security agreement term life insurance

Completing the collateral security agreement term life insurance involves several steps to ensure its validity and compliance with legal standards:

- Gather necessary information about the life insurance policy, including the policy number and insurer details.

- Consult with a financial advisor or attorney to understand the implications of using life insurance as collateral.

- Draft the agreement, including all key elements such as party identification, policy details, and loan amount.

- Review the document for accuracy and completeness.

- Both parties should sign the agreement in the presence of a witness or notary, if required.

- Keep copies of the signed agreement for both parties and notify the insurance company about the collateral arrangement.

Legal use of the collateral security agreement term life insurance

The legal use of the collateral security agreement term life insurance is governed by state laws and regulations. It is essential to ensure that the agreement complies with the relevant legal framework to be enforceable. This includes adhering to laws regarding the use of life insurance as collateral, as well as any specific requirements set forth by the insurance company. Legal counsel can provide guidance on ensuring compliance with applicable laws and regulations.

How to obtain the collateral security agreement term life insurance

Obtaining a collateral security agreement term life insurance typically involves a few straightforward steps:

- Contact your life insurance provider to request the necessary documentation and information about your policy.

- Consult with a legal professional to draft the collateral security agreement tailored to your specific situation.

- Ensure that all parties involved understand the terms outlined in the agreement before signing.

- File the signed agreement with the appropriate parties, including the lender and insurance company, to formalize the arrangement.

Examples of using the collateral security agreement term life insurance

There are various scenarios in which a collateral security agreement term life insurance can be beneficial:

- A small business owner seeking a loan to expand operations may use their life insurance policy as collateral to secure favorable loan terms.

- An individual needing funds for medical expenses can leverage their life insurance policy to obtain a loan without liquidating other assets.

- Parents looking to finance their child's education may use their life insurance as collateral to secure a low-interest student loan.

Quick guide on how to complete collateral security agreement term life insurance

Effortlessly prepare COLLATERAL SECURITY AGREEMENT Term Life Insurance on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can obtain the proper format and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage COLLATERAL SECURITY AGREEMENT Term Life Insurance on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign COLLATERAL SECURITY AGREEMENT Term Life Insurance with ease

- Obtain COLLATERAL SECURITY AGREEMENT Term Life Insurance and select Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools provided specifically for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form via email, text message (SMS), an invitation link, or download it to your computer.

Put an end to lost or misplaced documents, time-consuming form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign COLLATERAL SECURITY AGREEMENT Term Life Insurance and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the collateral security agreement term life insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a COLLATERAL SECURITY AGREEMENT Term Life Insurance?

A COLLATERAL SECURITY AGREEMENT Term Life Insurance is a type of policy that provides coverage for a specified term while allowing the insurance to serve as collateral for loans. This ensures that lenders have a security interest in the policy, which can provide financial stability. It's an excellent option for individuals seeking both coverage and an investment that secures loans.

-

How does a COLLATERAL SECURITY AGREEMENT Term Life Insurance work?

With a COLLATERAL SECURITY AGREEMENT Term Life Insurance, the policyholder pays regular premiums to keep the coverage active for the term specified. In the event of the policyholder's untimely death, the benefits are paid to the beneficiary or can be utilized to settle any outstanding loans secured by the agreement. This dual function makes it essential for both personal and financial planning.

-

What are the benefits of a COLLATERAL SECURITY AGREEMENT Term Life Insurance?

The key benefits of a COLLATERAL SECURITY AGREEMENT Term Life Insurance include financial security for your family and ease of access to funds in case of emergencies. It also helps lower borrowing costs, as lenders view it as an added layer of security. This policy ultimately provides peace of mind knowing that your loved ones are protected.

-

What should I consider when choosing a COLLATERAL SECURITY AGREEMENT Term Life Insurance policy?

When selecting a COLLATERAL SECURITY AGREEMENT Term Life Insurance policy, consider factors like the term length, coverage amount, and premium costs. It's essential to assess your financial obligations and future needs to choose a policy that fits your circumstances. Always compare multiple providers to find the best coverage at competitive rates.

-

Are there any costs associated with a COLLATERAL SECURITY AGREEMENT Term Life Insurance?

Yes, there are costs associated with a COLLATERAL SECURITY AGREEMENT Term Life Insurance, primarily in the form of monthly or annual premiums. Additionally, some policies might have administrative fees or costs related to securing the collateral with a lender. Understanding these costs upfront can help you budget effectively.

-

Can I make changes to my COLLATERAL SECURITY AGREEMENT Term Life Insurance policy?

Yes, you can typically make changes to your COLLATERAL SECURITY AGREEMENT Term Life Insurance policy, such as adjusting the coverage amount or changing beneficiaries. However, any changes might affect the premiums, so it's important to consult with your insurance provider. Regular reviews of your policy ensure it continues to meet your needs.

-

How do I integrate COLLATERAL SECURITY AGREEMENT Term Life Insurance with financial planning?

Integrating a COLLATERAL SECURITY AGREEMENT Term Life Insurance into your financial planning involves assessing it as both a protective measure and an asset. By seeing it as collateral, you can leverage its value for loans while ensuring coverage for your loved ones. It's advisable to work with a financial advisor to maximize its benefits in your overall strategy.

Get more for COLLATERAL SECURITY AGREEMENT Term Life Insurance

Find out other COLLATERAL SECURITY AGREEMENT Term Life Insurance

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template