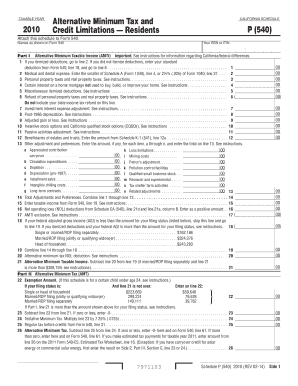

Ca Schedule P 540 Instructions Form

What is the California Schedule P 540 Instructions?

The California Schedule P 540 is a supplemental form used by individuals to report income from pass-through entities, such as partnerships, S corporations, and limited liability companies (LLCs). This form is essential for taxpayers who receive income from these entities, as it allows them to accurately report their share of income, deductions, and credits. The Schedule P 540 instructions provide detailed guidance on how to complete the form, ensuring compliance with California tax regulations.

Steps to Complete the California Schedule P 540 Instructions

Completing the California Schedule P 540 requires careful attention to detail. Here are the main steps to follow:

- Gather all necessary documents, including K-1 forms from partnerships or S corporations.

- Review the instructions to understand the specific requirements for reporting income and deductions.

- Fill out the form by entering your share of income, deductions, and credits as reported on your K-1 forms.

- Double-check your entries for accuracy and completeness.

- Sign and date the form before submission.

Key Elements of the California Schedule P 540 Instructions

The California Schedule P 540 instructions highlight several key elements that taxpayers must consider:

- Income Reporting: Clearly outline how to report income from various sources, including partnerships and S corporations.

- Deductions: Provide information on allowable deductions that can be claimed on the form.

- Credits: Detail any tax credits that may be applicable, which can reduce the overall tax liability.

- Filing Requirements: Specify who is required to file the Schedule P 540 based on their income sources.

Legal Use of the California Schedule P 540 Instructions

The legal use of the California Schedule P 540 instructions ensures that taxpayers comply with state tax laws. By following the guidelines provided, individuals can avoid potential penalties for incorrect reporting. The instructions clarify the legal obligations of taxpayers regarding income from pass-through entities, helping to maintain transparency and accuracy in tax filings.

Form Submission Methods

Taxpayers have several options for submitting the California Schedule P 540:

- Online Submission: Many taxpayers choose to file electronically through approved tax software, which often streamlines the process.

- Mail: Completed forms can be mailed to the appropriate California tax authority address, as specified in the instructions.

- In-Person: Some taxpayers may opt to deliver their forms in person at local tax offices, ensuring immediate receipt.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the California Schedule P 540 is crucial for compliance. Typically, the deadline aligns with the standard tax return filing date, which is generally April 15 for individual taxpayers. However, extensions may be available, and it is important to refer to the latest instructions for any updates or changes to deadlines.

Quick guide on how to complete ca schedule p 540 instructions

Complete Ca Schedule P 540 Instructions effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools needed to create, adjust, and eSign your documents swiftly without any delays. Handle Ca Schedule P 540 Instructions on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Ca Schedule P 540 Instructions seamlessly

- Find Ca Schedule P 540 Instructions and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Ca Schedule P 540 Instructions and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca schedule p 540 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California Schedule P?

California Schedule P is a tax form used by corporations and partnerships in California to report their income and deductions. It includes detailed information on various adjustments that may affect taxable income. Understanding California Schedule P is essential for accurate tax reporting.

-

How can airSlate SignNow assist with California Schedule P?

airSlate SignNow simplifies the process of preparing and signing documents related to California Schedule P. Our platform allows businesses to easily complete and eSign necessary tax forms, ensuring compliance and efficiency in handling sensitive information.

-

What features does airSlate SignNow offer for document signing?

With airSlate SignNow, you can access features such as customizable templates, real-time collaboration, and secure eSigning, specifically beneficial for documents like California Schedule P. These features streamline the document workflow, saving time and reducing errors.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers cost-effective pricing plans to suit various business needs, including options for individuals and larger teams. Our plans provide access to features that enhance workflow efficiency, including those necessary for handling forms like California Schedule P.

-

Is airSlate SignNow compliant with California law?

Yes, airSlate SignNow is fully compliant with California law, ensuring that all electronically signed documents, including those related to California Schedule P, are legally valid and secure. Our platform adheres to the highest standards of security and compliance.

-

Can I integrate airSlate SignNow with other software for managing California Schedule P?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, making it easy to manage documents like California Schedule P. These integrations help streamline your financial workflows and maintain accurate records.

-

What benefits does airSlate SignNow provide for eSigning California Schedule P?

The primary benefits of using airSlate SignNow for eSigning California Schedule P include speed, efficiency, and improved accuracy. By digitizing the signing process, you can complete your tax forms quickly and ensure that all necessary signatures are obtained without hassle.

Get more for Ca Schedule P 540 Instructions

- Chapter iv investigating foodborne illnesses and massgov form

- On approval by the league association form

- Request letter for late fee payment by parents form

- Submission form rood riddle equine hospital

- Practitioner advisor information

- Ambit energy enrollment form

- Mvss membership application society for vascular surgery form

- Sagu christian character reference form

Find out other Ca Schedule P 540 Instructions

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document