Cp080 Am12 Form

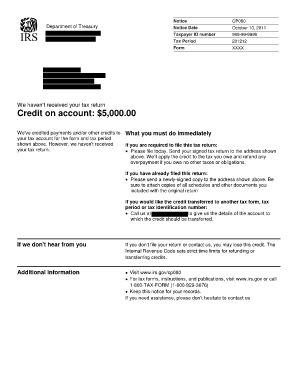

What is the CP080 AM12?

The CP080 AM12 is an IRS notice that informs taxpayers about a specific issue related to their tax filings. This notice typically addresses discrepancies or missing information that may require the taxpayer's attention. Understanding the details of the CP080 AM12 is crucial for ensuring compliance with IRS regulations and avoiding potential penalties. The notice serves as a formal communication from the IRS, outlining necessary actions that the taxpayer must take to rectify any issues identified in their tax return.

How to Use the CP080 AM12

Using the CP080 AM12 effectively involves carefully reviewing the notice and following the instructions provided. Taxpayers should first identify the specific issue mentioned in the notice, which may relate to underreported income, missing documentation, or other discrepancies. After understanding the context, the next step is to gather any required documents or information that the IRS might need. This could include previous tax returns, W-2 forms, or other relevant financial records. Once all necessary information is compiled, taxpayers should respond to the notice in the manner specified, ensuring that all communications are clear and accurate.

Steps to Complete the CP080 AM12

Completing the CP080 AM12 involves several important steps:

- Carefully read the notice to understand the issue at hand.

- Gather all relevant documentation that supports your case.

- Prepare a response that addresses the concerns raised in the notice.

- Submit your response to the IRS by the deadline indicated in the notice.

- Keep a copy of all correspondence for your records.

Following these steps helps ensure that your response is thorough and meets IRS requirements.

Legal Use of the CP080 AM12

The CP080 AM12 is legally binding, meaning that taxpayers must adhere to the instructions and requirements outlined in the notice. Failure to comply can result in penalties or further action from the IRS. It is essential for taxpayers to recognize that this notice is part of the legal framework governing tax compliance in the United States. Therefore, understanding how to respond appropriately is critical to maintaining good standing with the IRS.

IRS Guidelines for the CP080 AM12

The IRS provides specific guidelines regarding the CP080 AM12, which are designed to assist taxpayers in resolving any issues effectively. These guidelines include:

- Timelines for responding to the notice.

- Documentation requirements for supporting your case.

- Instructions on how to communicate with the IRS regarding the notice.

Taxpayers should familiarize themselves with these guidelines to ensure they are following the correct procedures.

Penalties for Non-Compliance with the CP080 AM12

Non-compliance with the CP080 AM12 can lead to various penalties imposed by the IRS. These penalties may include additional taxes owed, interest on unpaid amounts, or even legal action in severe cases. It is crucial for taxpayers to take the notice seriously and respond promptly to avoid these potential consequences. Understanding the implications of non-compliance reinforces the importance of addressing the issues raised in the notice.

Quick guide on how to complete cp080 am12

Complete Cp080 Am12 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents promptly without delays. Manage Cp080 Am12 on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to adjust and eSign Cp080 Am12 effortlessly

- Find Cp080 Am12 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that function.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Cp080 Am12 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp080 am12

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cp080 feature in airSlate SignNow?

The cp080 feature in airSlate SignNow allows users to efficiently manage and track electronic signatures on important documents. This feature streamlines the signing process, making it faster and more reliable for businesses of all sizes.

-

How does pricing for cp080 work?

Pricing for cp080 in airSlate SignNow is designed to be competitive and cost-effective. Various plans are available to suit different business needs, ensuring that you pay only for the features you require while benefiting from seamless document management.

-

What are the primary benefits of using cp080?

The cp080 functionality enhances your document workflow by providing quick and secure eSigning capabilities. Businesses benefit from increased efficiency, reduced turnaround times for approvals, and enhanced compliance with regulatory requirements.

-

Can cp080 integrate with other tools?

Yes, cp080 integrates seamlessly with various business tools and applications. This integration capability allows users to enhance their workflow by connecting airSlate SignNow to popular platforms like CRM systems, project management tools, and more.

-

Is cp080 suitable for small businesses?

Absolutely! The cp080 feature in airSlate SignNow is tailored to meet the needs of small businesses. Its user-friendly interface and cost-effective pricing make it an ideal choice for startups looking to manage their documents efficiently.

-

What types of documents can be signed using cp080?

With cp080, users can sign a wide variety of documents, including contracts, agreements, and forms. This versatility ensures that businesses can manage all their signing needs within a single platform.

-

How secure is the cp080 signing process?

The signing process with cp080 is highly secure, utilizing advanced encryption and authentication measures. airSlate SignNow ensures that all documents are protected, keeping sensitive information safe during the eSigning process.

Get more for Cp080 Am12

Find out other Cp080 Am12

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation