1040a Facts Form

What is the 1040A Facts Form

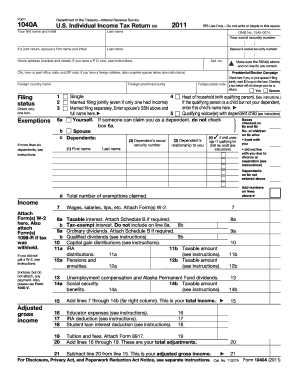

The 1040A Facts Form is a simplified version of the standard IRS Form 1040, designed for taxpayers with straightforward financial situations. This form allows individuals to report their income, claim certain tax credits, and determine their tax liability. It is particularly beneficial for those who do not itemize deductions and have a taxable income below a specified threshold. The 1040A can be used by individuals, couples, and heads of household, making it an accessible option for many taxpayers.

How to Use the 1040A Facts Form

Using the 1040A Facts Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and applicable deductions or credits. After completing the form, review it for accuracy before submitting it to the IRS. The 1040A can be filed electronically or by mail, depending on your preference and filing method.

Steps to Complete the 1040A Facts Form

Completing the 1040A Facts Form requires careful attention to detail. Follow these steps:

- Gather all necessary documents, such as W-2 forms and 1099s.

- Enter your personal information, including your name, address, and Social Security number.

- Report your income by entering amounts from your income statements.

- Claim any eligible tax credits or deductions, such as the Earned Income Tax Credit.

- Calculate your total tax liability based on the provided instructions.

- Sign and date the form before submission.

Legal Use of the 1040A Facts Form

The 1040A Facts Form is legally recognized by the IRS as a valid method for reporting income and calculating taxes. To ensure compliance, taxpayers must adhere to IRS guidelines and provide accurate information. Electronic submissions are accepted, provided they meet the requirements set forth by the IRS. It is essential to keep a copy of the completed form for your records, as it may be needed for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the 1040A Facts Form typically align with the standard tax filing dates set by the IRS. Generally, individual taxpayers must submit their forms by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines and to file on time to avoid penalties.

Required Documents

To complete the 1040A Facts Form, certain documents are required. These include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Documentation for tax credits or deductions claimed.

Having these documents ready will facilitate a smoother filing process.

Quick guide on how to complete 1040a facts form

Manage 1040a Facts Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle 1040a Facts Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign 1040a Facts Form with ease

- Locate 1040a Facts Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to finalize your changes.

- Choose how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign 1040a Facts Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040a facts form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040a Facts Form and how is it used?

The 1040a Facts Form is a simplified income tax form used by individuals with straightforward tax situations. This form serves to report income, deductions, and taxes owed. Using airSlate SignNow, you can easily fill, sign, and send your 1040a Facts Form securely online.

-

How can airSlate SignNow help me with the 1040a Facts Form?

airSlate SignNow provides a user-friendly platform for electronically signing and storing your 1040a Facts Form. The ability to access documents from any device makes it easy to manage your tax documents without hassle. Additionally, advanced security features ensure your sensitive information remains protected.

-

Are there any costs associated with using airSlate SignNow for the 1040a Facts Form?

airSlate SignNow offers various pricing plans to accommodate different user needs, including options for individuals and businesses. These plans are cost-effective, especially for those who frequently need to manage documents like the 1040a Facts Form. Check the airSlate website for detailed pricing information.

-

Can I integrate airSlate SignNow with other applications while handling the 1040a Facts Form?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to streamline your workflow when dealing with the 1040a Facts Form. Whether it's accounting software or customer relationship management tools, our integrations facilitate easy access and management of your documents.

-

What are the benefits of using airSlate SignNow for tax forms like the 1040a Facts Form?

Using airSlate SignNow for your 1040a Facts Form saves time and reduces the risk of errors. The electronic signing feature eliminates the need for printing and mailing, making your tax preparation process efficient. Additionally, cloud storage ensures that your documents are safe and easily retrievable.

-

Is airSlate SignNow secure for handling sensitive documents like the 1040a Facts Form?

Yes, airSlate SignNow prioritizes security, utilizing advanced encryption protocols to protect your 1040a Facts Form and other sensitive documents. We comply with industry standards to safeguard your information. You can trust our platform to keep your data secure.

-

Is customer support available if I encounter issues with my 1040a Facts Form?

Absolutely! airSlate SignNow offers comprehensive customer support to assist you with any issues regarding your 1040a Facts Form. Our support team is available via chat, email, or phone to ensure you have a smooth experience while using our platform.

Get more for 1040a Facts Form

- Delawre form sl 1923 word document

- Pc 24 background check authorization form delaware deldot

- Uniform traffic citation

- Garage sale permit application city of gulfport florida form

- Larggo enviromental services form

- St johns county notice of commencement form

- Charlotte county florida notice of commencement form

- Alarm cutler bay form

Find out other 1040a Facts Form

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent